Biz Analysis

16:58, 07-Jun-2019

Central banks lower interest rates as world awaits the Fed, ECB

CGTN

India's central bank on Thursday lowered its benchmark interest rate for the third time this year, coming just after Prime Minister Narendra Modi's election victory and amid growing speculation that the European Central Bank (ECB) and U.S. Federal Reserve will make similar moves in the coming months.

The rate was lowered by 25 basis points to 5.75 percent, its lowest point in nearly a decade.

The decision, which was reached unanimously by the central bank's monetary policy committee, comes after not only a landslide win for Modi, but also a concerning slowdown in economic growth.

The most recent quarter up to March saw economic growth slow to 5.8 percent, its slowest pace in five years and well down from the 6.6 percent recorded in the previous quarter.

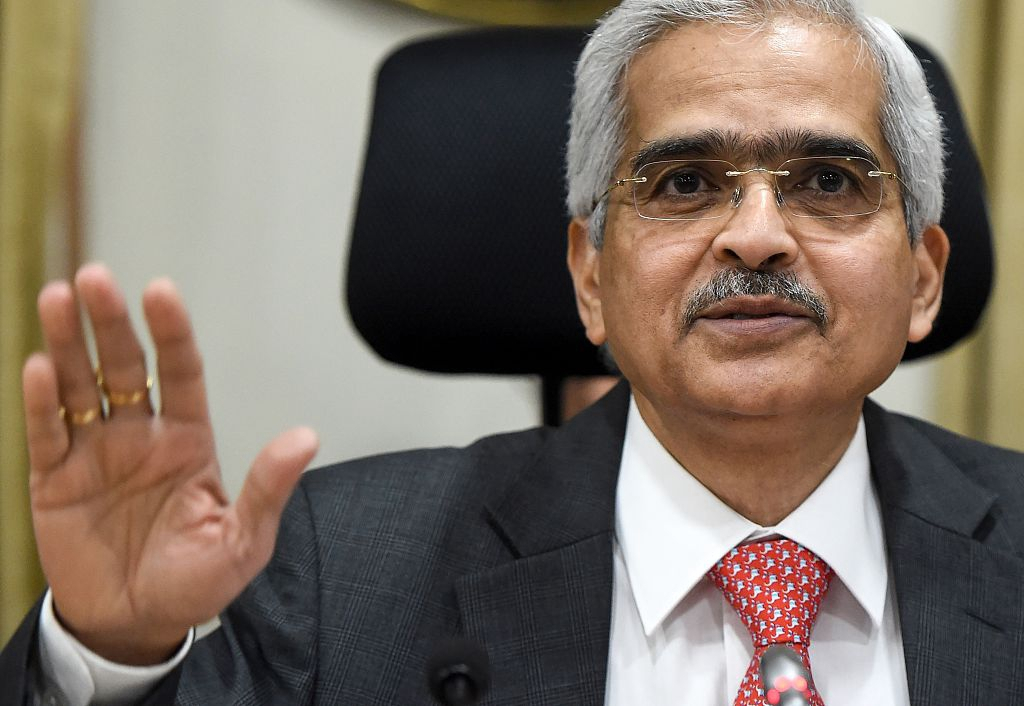

The head of the central bank, Shaktikanta Das, said “growth impulses have significantly weakened,” amid growing concerns over slowing consumption and job creation.

Governor of the Reserve Bank of India Shaktikanta Das. /VCG Photo

Governor of the Reserve Bank of India Shaktikanta Das. /VCG Photo

The move comes just days after the Reserve Bank of Australia (RBA) reduced the cost of borrowing to a historic low, cutting its rates to 1.25 percent amid slowing economic growth hitting levels not seen since the financial crisis.

RBA Governor Philip Lowe blamed an increase in “downside risks stemming from the trade disputes,” as concerns over global growth ripple towards the U.S. Federal Reserve and, on Thursday, the European Central Bank – two institutions that have now signaled rate cuts could be on the horizon.

Japan meanwhile has maintained rates at current levels, but minutes from the Bank of Japan's March meeting showed the nine board members debated the pros and cons of cutting borrowing costs.

U.S. markets rallied earlier this week after Fed Chief Jerome Powell said current economic developments were being closely watched, with plans to “act as appropriate to sustain the expansion.”

This was seen by investors as a sign that cutting interest rates was a possibility, particularly given the inverted yield curve – a precursor to every U.S. recession since World War Two.

On Thursday, ECB President Mario Draghi, who will leave his post in September, made similar comments to Powell, saying the bank was ready to “use all the instruments that are in the toolbox,” amid weak inflation and ongoing anemic growth in the Eurozone.

VCG Photo

VCG Photo

Draghi highlighted both rate cuts and further quantitative easing as possible policy moves, and while such an accommodative approach could boost consumption and investment, such a move carries its own set of risks.

If major central banks cut rates but the economy continues to lurch downwards and towards a recession, regulators would find themselves struggling to find effective solutions to pull their economies out of a slump.

For Europe, the financial crisis led to years of austerity and quantitative easing, a program that was meant to end in 2018.

A return to such policies would suggest that authorities have failed to come up with any new answers to the conundrum of stagnant inflation and wage growth despite low unemployment. Rate cuts and a premature return to easing send out the message that the global economy never fully recovered from 2008.

(Top image: Federal Reserve Chair Jerome Powell. /VCG Photo)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3