Business

15:31, 09-May-2018

Argentina reaches out to IMF as peso slide continues

Nicholas Moore

Argentina has appealed to the International Monetary Fund (IMF) to help pull it away from the brink of financial crisis, after its currency continued to collapse despite interest rates being raised to 40 percent.

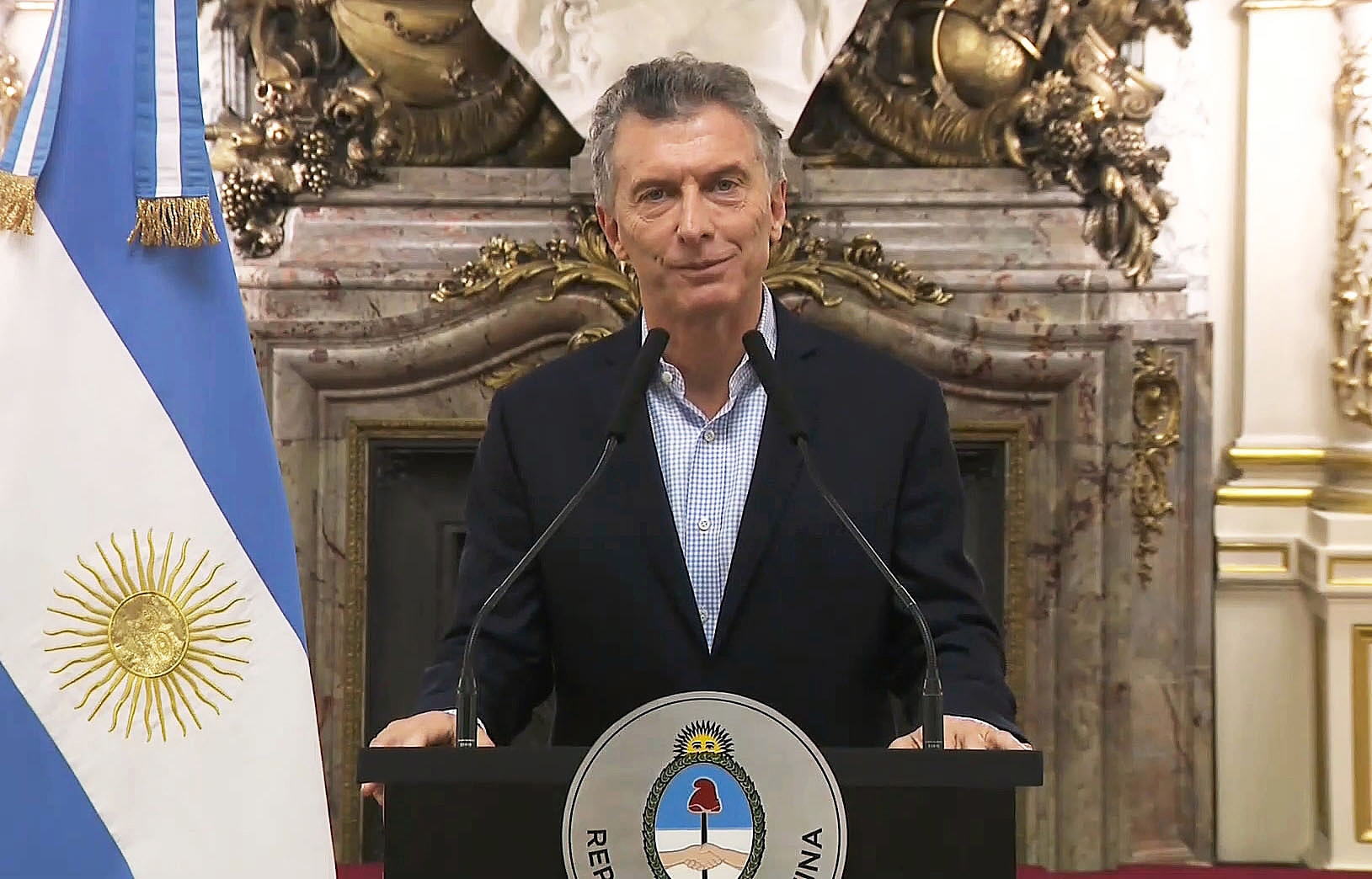

In a televised address, Argentinian President Mauricio Macri told the nation he had agreed to start working on a deal with IMF chief Christine Lagarde, saying “this will allow us to strengthen our program of growth and development, giving us greater support to face this new global scenario and avoid crises like the ones we have had in our history.”

Argentinian President Mauricio Macri announces the beginning of negotiations with the IMF in a televised address from Buenos Aires, May 8, 2018. /VCG Photo

Argentinian President Mauricio Macri announces the beginning of negotiations with the IMF in a televised address from Buenos Aires, May 8, 2018. /VCG Photo

The government has not yet confirmed what kind of deal it is looking for with the IMF, but Bloomberg reports that Buenos Aires is seeking a financing deal worth 30 billion US dollars.

The peso has plummeted in value in recent weeks, with Macri blaming rising oil prices and US interest rate rises for knocking confidence in Argentina’s economy and other emerging markets.

Argentinian authorities raised interest rates three times in the space of eight days at the end of April and beginning of this month, from 27.5 to 40 percent. The rate rises failed to arrest the peso’s downturn, which hit a record low of 23.25 US dollars on Tuesday.

Macri has vowed to reform his country’s finances and address issues that saw Argentina plunged into financial crises in the 1990s and early 2000s.

Currency exchange values displayed in an exchange bureau in Buenos Aires, Argentina, May 8, 2018. /VCG Photo

Currency exchange values displayed in an exchange bureau in Buenos Aires, Argentina, May 8, 2018. /VCG Photo

In a statement, Christine Lagarde said Argentina was “a valued member of the IMF,” adding “discussions have been initiated on how we can work together to strengthen the Argentine economy and these will be pursued in short order.”

Other economies in Latin America have seen their currencies decline in recent weeks, as risk-averse investors pull away from emerging markets against the backdrop of a strengthening US dollar.

Argentina has long struggled with high inflation, with prices increasing by around 40 percent in 2016, after Macri removed energy subsidies in a bid to reform the economy.

The high levels of inflation have been a major factor in low levels of foreign investment in Argentina, while the threat of instability means domestic businesses remain reluctant about borrowing and expanding.

Macri’s announcement that he would look for a deal with the IMF was not well received domestically, with many recalling the last time it offered assistance to Argentina in the early 2000s.

In 2001, Argentina defaulted on 132 billion US dollars’ worth of foreign debt, and the IMF pumped 22 billion US dollars into the economy to maintain the peso’s peg to the US dollar. However, its insistense on tight austerity did not prevent a collapse for the dollar peg, and instead left millions of Argentinians jobless and in poverty.

The Institute of International Finance has underlined weaknesses in Argentina, China, Turkey, South Africa and Ukraine in the face of glowing global risks and a lack of investor appetite for emerging markets.

VCG Photo

VCG Photo

An increasingly strong US dollar, the threat of trade tariffs from Washington and higher oil prices are set to put emerging markets under even more pressure, with the US Federal Reserve’s chief Jay Powell telling a conference in Zurich on Tuesday up-and-coming economies could endure “the normalization of monetary policies in advanced economies.”

However, Macri has recognized how exposed his country is to changes beyond its borders, telling his television audience on Tuesday “the problem that we have today is that we are one of the countries in the world that most depends on external finance, as a result of the enormous public spending that we inherited and are restoring order to.”

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3