Money Stories

12:24, 29-Apr-2019

Get the facts: Chinese youth and consumption

CGTN

In China, youths constitute a huge consumer group in light of both its population size and vast consumption demands.

According to estimates by the Chinese Academy of Social Sciences, the country's population aged 18 to 44 settled at 548 million as of end-2017, constituting about 39 percent of the country's total.

The younger generation of Chinese consumers is on the rise. Their economic strength and purchasing power are now driving the consumer market. /VCG Photo

The younger generation of Chinese consumers is on the rise. Their economic strength and purchasing power are now driving the consumer market. /VCG Photo

Winning the hearts of young people equals winning the future. Amid cutthroat market competition, whoever seizes this consumer demographic may grab the upper hand.

Consumption keywords: E-commerce, excessive consumption and sense of gain

A report conducted by CBNData showed that online shopping now constitutes a salient feature of the behavior of youth consumers, with the post-80s being the nucleus and the post-90s catching up in being the primary drivers of this transition.

During last year's Singles Day shopping bonanza on November 11, Chinese e-commerce tycoon Alibaba secured 213.5 billion yuan (31.9 billion U.S. dollars) worth of sales across all of its platforms, surging 27 percent compared with that of the previous year.

The assorted shopping channels from the likes of e-commerce platforms have in turn beefed up young consumers' willingness to consume, while the presence of new payment methods possible due to online lending platforms and credit payments (such as WeBank and Ant Credit Pay) have allayed their concerns about prices as they can afford more pricey products by taking small loans.

Since 2012, the average growth rate of online financial transactions has exceeded 200 percent annually.

Chinese e-commerce giant Alibaba smashes the 2017 record for its Singles' Day sales event, shooting up by 27 percent to 213.5 billion yuan (31.9 billion U.S. dollars), November 11, 2018. /VCG Photo

Chinese e-commerce giant Alibaba smashes the 2017 record for its Singles' Day sales event, shooting up by 27 percent to 213.5 billion yuan (31.9 billion U.S. dollars), November 11, 2018. /VCG Photo

Data from Ant Financial, Alibaba's financial affiliate, showcased that 45 million out of China's 170 million post-90s had opened Ant Credit Pay services as of the end of 2017, which means that one in four post-90s were credit consumers.

Also stressed in the CBNData report are the role of young consumers' interests and sense of gain in determining their shopping behavior, which to a large extent sets the consumption trend in China.

They feel no compunction about paying for knowledge and content appealing to them, ranging from music and videos to language courses and answers to questions.

Wages up, savings down

In China, mounting per capita income serves as one of the most potent contributing factors in youth consumption behavior, which has also led to dwindling national savings rates in the past few years.

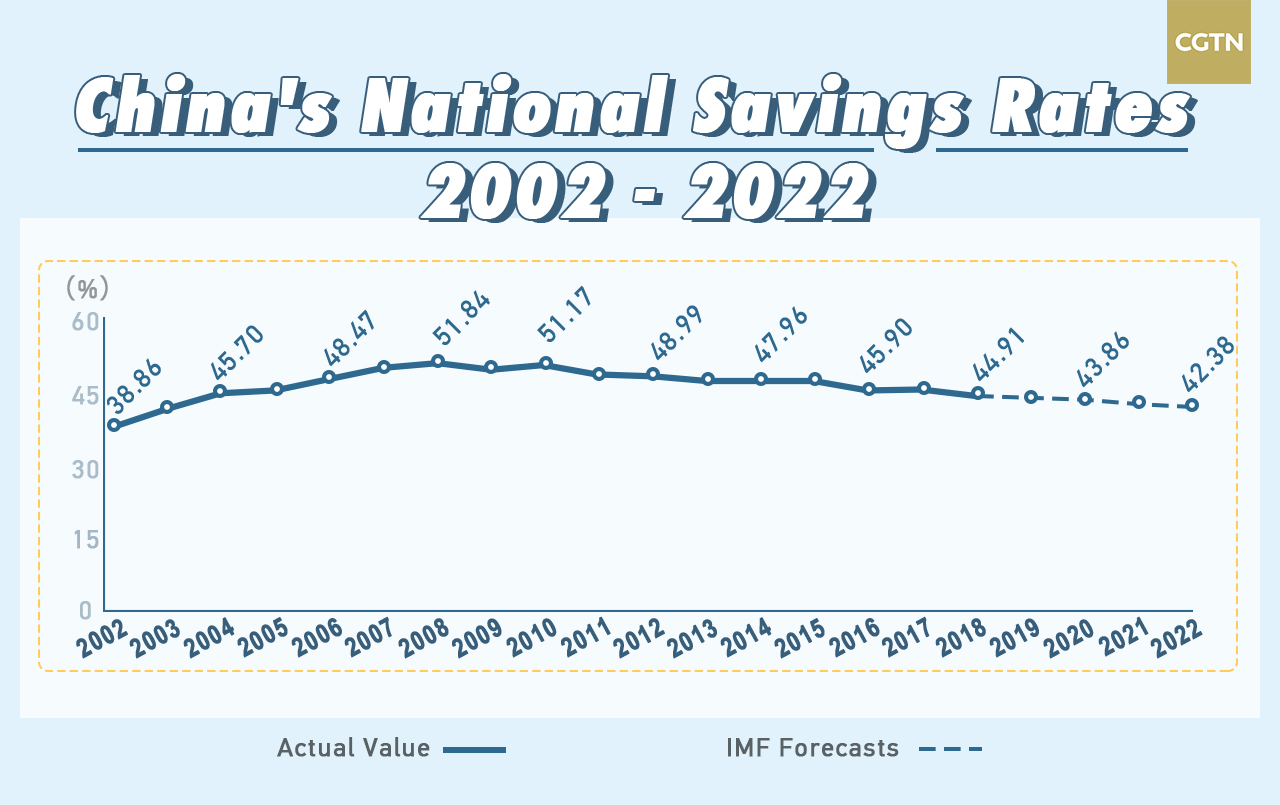

Official data showed the country's national savings rate settled at 38.86 percent in 2002 and maintained its upward momentum before peaking at 51.84 percent in 2018, after which the reading had been trending down continuously to 44.91 percent in 2018 and was even projected by IMF to fall further to settle at 42.38 percent in 2022.

During the first three decades since the introduction of the reform and opening-up policy, driven by enduring poverty and favorable demographic dividend, China boasted ample young labor force at low demand for consumption and accustomed to setting aside money for the future.

But that's not the case anymore on account of a drastic gain in GDP and a robust social security system. Chinese consumers, the youth in particular, have become regular fixtures of e-commerce platforms and brick-and-mortar stores.

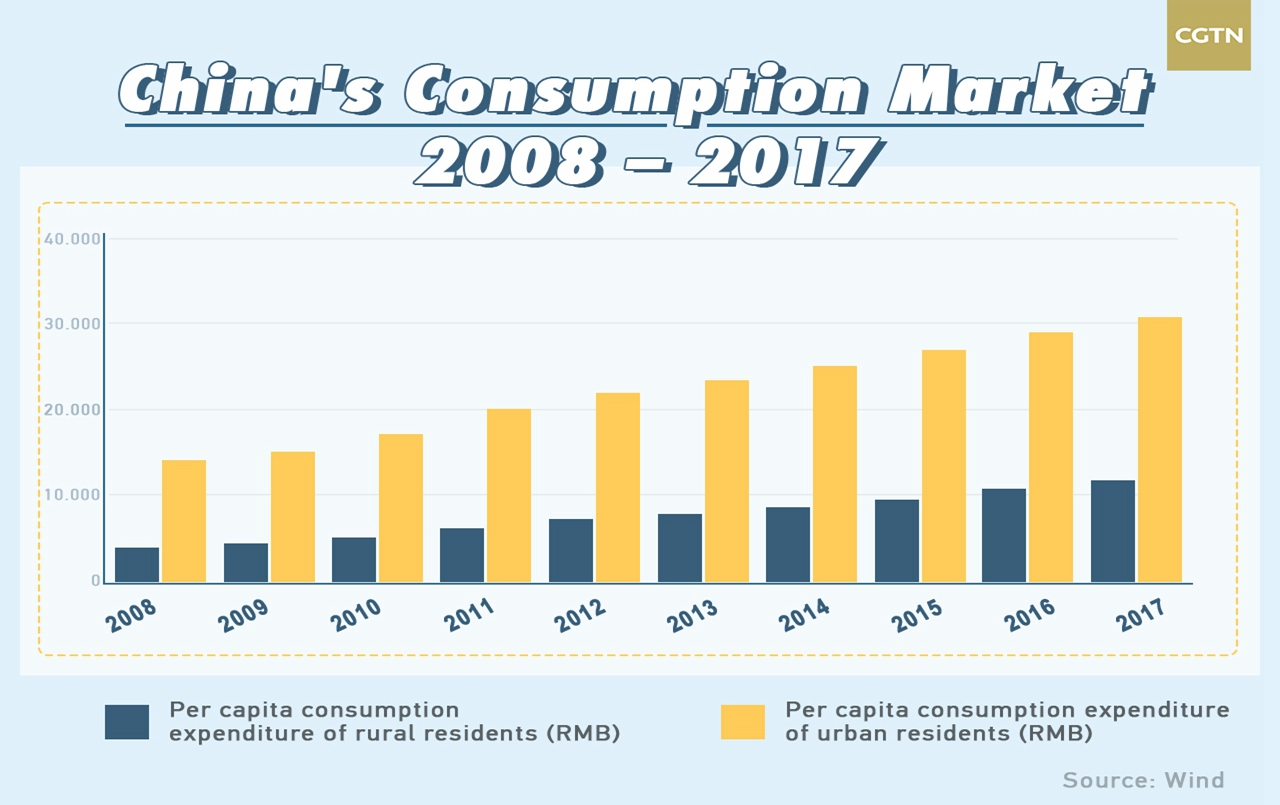

According to China's National Bureau of Statistics, the per capita consumption expenditure of rural and urban residents came at 4,065 yuan and 14,061 yuan in 2008, but with a mere gap of nine years, the figures shot up to 11,691 yuan and 31,098 yuan, respectively.

In the second largest economy, one person in every six is of the post-90s generation. When millennials jump forcefully onto the consumption wagon, it is unquestionable that the young generation will become the mainstay of China's vast consumer market, who generally have a higher propensity to consume.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3