By CGTN's Gao Songya

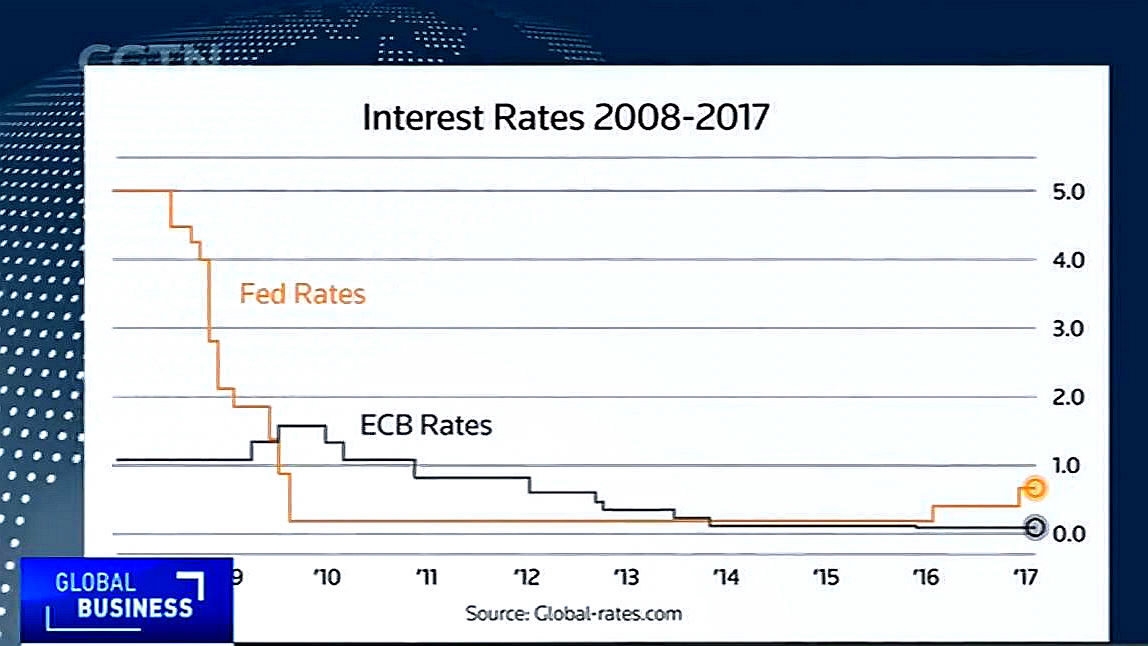

The world’s two largest central banks, the European Central Bank (ECB) and the US Federal Reserve (Fed), are to further split over interest rates.

Even with economic growth and inflation picking up, the ECB is very likely to stay loyal to its ongoing steady policies, instead of tightening them up, as it awaits high-risk elections in the Netherlands and France during an upsurge in populist sentiment.

French presidential candidate Marine Le Pen, in Lyon, France. /CFP Photo

The Fed, however, is looking at a possible rate hike as Chair Janet Yellen signaled.

“At our meeting later this month, the committee will evaluate whether employment and inflation are continuing to evolve in line with our expectations, in which case a further adjustment of the federal funds rate would likely be appropriate," Yellen said last Friday.

The Fed will meet next on March 14-15.

Federal Reserve Chair Janet Yellen addresses the Executives Club of Chicago in Chicago, Illinois, US, March 3, 2017. /CFP Photo

The Fed raised interest rates for only the second time in a decade last December, but has forecast three rate increases this year over rising inflation and low unemployment rates at home.

“We are waiting for the important employment report for the month of February from the US government before we have final evaluations of the state of US labor market,” said John Lonski, Chief Economist from Moody's Capital Markets Research Group.

The next monthly jobs report is scheduled for March 10.

A screenshot showing ECB and Fed’s interest rates from 2008 to 2017. /CGTN Photo

Besides political risks ahead, Justin Urquhart Stewart, director of Seven Investment Management, said the ECB should stick to its stimulating program for now, as the recovery has been coming through and it may well last with current policies.