China is investigating ways to encourage banks and private capital to invest in green finance projects, a deputy central bank governor said on Friday.

Developing green finance is a global trend and a necessary choice for China's sustainable growth as well as a major move to honor the country's commitment to the Paris Agreement, said Chen Yulu, deputy governor of the People's Bank of China (PBOC).

Development of green finance is gaining traction in China but is still in the early stages, Chen said.

The People's Bank of China will roll out more incentive policies to encourage green finance development. /VCG Photo

The State Council announced on Wednesday its decision to set up pilot zones in Guangdong, Guizhou, Jiangxi and Zhejiang provinces and Xinjiang Uygur Autonomous Region to boost green finance development.

The central bank will roll out more incentive policies in pilot regions, such as including a green credit review in the Macro Prudential Assessment for deposit financial institutions and promoting sustainable business practices among private investors.

The PBOC will also develop more green finance products, expand financing channels, roll out industrial standards and set up green credit mechanism, said Chen.

The cost of green projects will be gradually reduced and profit increased thanks to rising awareness and an improving green finance mechanism, Chen added.

Banks, non-banking financial institutions eye green growth

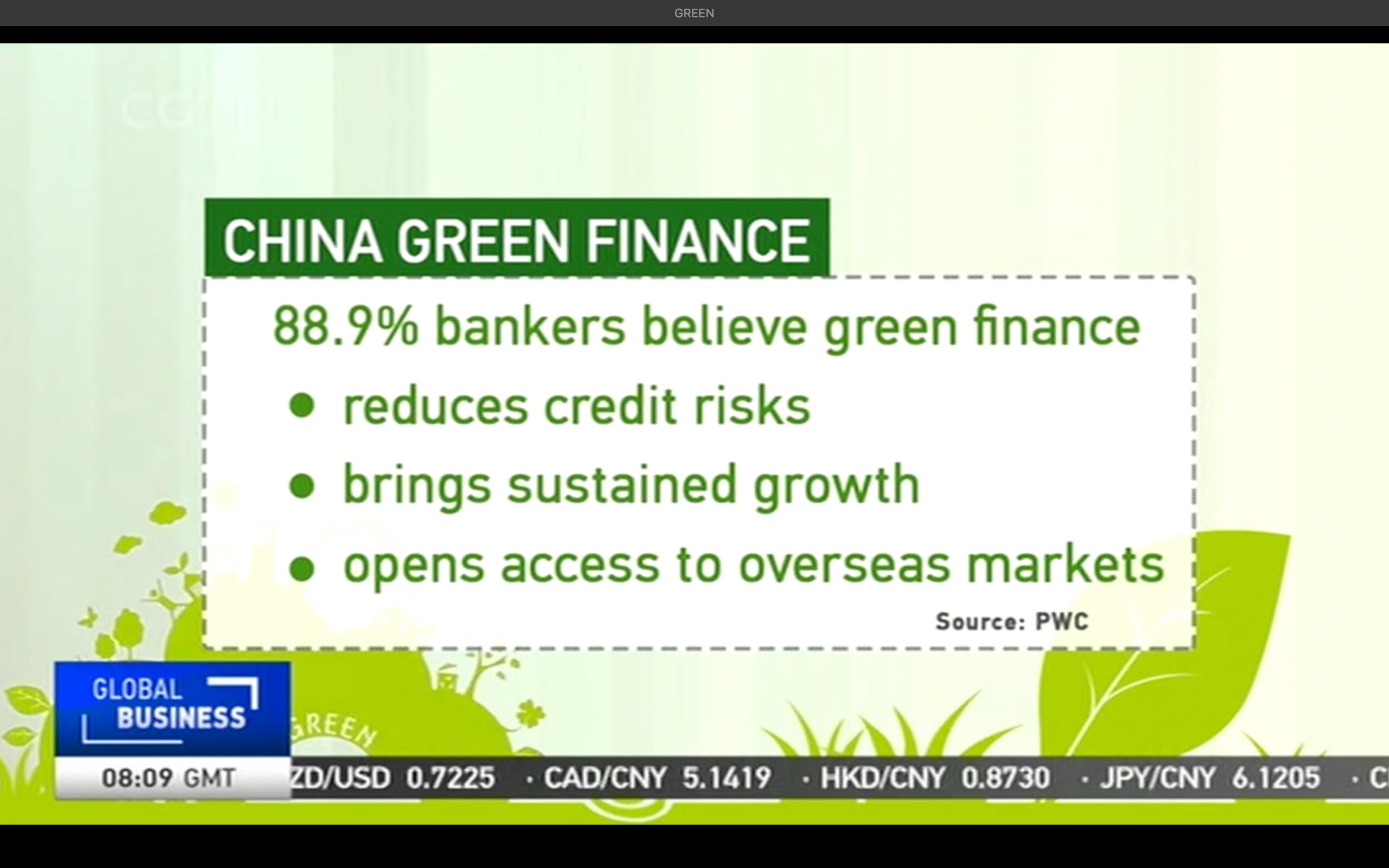

Banks are the major players in the green finance market. In a survey compiled by services firm PWC, about 90 percent of bankers believe the industry will benefit from green finance as it cuts credit risk, brings sustained growth and opens access to foreign markets. Almost all bankers believe green finance will be an important component of Chinese banks' future business.

CGTN Photo

Brokerages are also getting on the green finance bandwagon.

The Shanghai and Shenzhen stock exchanges are experimenting with new rules that mandate environment-related disclosure.

The move will educate investors on green investment. Insurers and trust funds have also tested programs on green finance.

China's green debt issuance surged 30 percent in the first quarter to 17 billion yuan, 11 percent of the global total.

In 2016, more than 80% of green debt was issued by financial institutions. And that means a small share of corporate green debt. Industry insiders say this segment could expand quickly as firms have huge demand for such finance.

In March, the China Securities Regulatory Commission issued guidance on corporate green finance. The document says the regulator will give support in approval and also set disclosure requirements.