17:39, 02-Dec-2017

Win with China: Foreign banks navigate China's financial sector

This year's Fortune Global Forum will be held in south China's Guangzhou next week. The banking sector is a proxy for a country's economy. But it is also a highly regulated one. As China continues to open up, how have foreign banks sought growth opportunities and integration with the Chinese market? Our reporter Wei Lynn Tang has the story.

If time is an indication of persistence, aim, and foresight -- the foothold of foreign banks in China for over a hundred years now could be testament to their stance in the country.

Capitalizing on what they do best -- bridging the gap between China and the Western world. These foreign banks now also count Chinese companies as their clients, beyond just the multinationals.

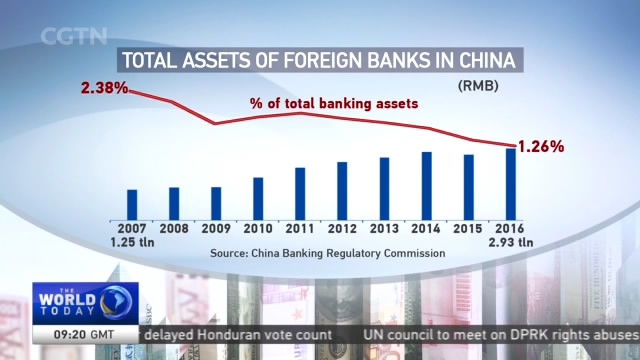

In the past 10 years, total assets of foreign banks -- a crucial metrics for the sector -- have increased from 1.3 trillion to 2.9 trillion yuan. Their share of China's entire banking sector, however, has fallen from 2.4 to 1.3 percent.

Foreign banks urged to look beyond this measure.

GAO FENG CHIEF COUNTRY OFFICER, DEUTSCHE BANK CHINA "We're not here clearly to compete on the same thing. If you look at this from a slightly different angle, risk management expertise, product expertise as well as how do you operate a bank on a global scale. I think that is something we have contributed greatly to this market. So I'd say both foreign banks and Chinese banks are major contributors to this market and I think this market will not be as interesting without either one of them."

ANNE MARION-BOUCHACOURT CHINA'S CHIEF COUNTRY OFFICER, SOCIETE GENERALE "In the Chinese market per se, it's very difficult to compete against Chinese banks because they are very strong and here locally we do not have that much competitive advantage. While if you look at our international footprint; and our area of expertise in natural resources, in mining where we have historical expertise or acquisition financing, hedging risk, all those are areas where we can bring values and try to build on that."

Furthermore, with only 1.1 trillion US dollars or so committed to China's Belt & Road initiative so far by the AIIB, Silk Road Fund and the New Development Bank, against an estimated 1.7 trillion needed per year up until 2030, extra funds are needed.

In June, Deutsche Back cemented its commitment with a 3 billion-US-dollar deal with the China Development Bank to finance infrastructure projects under the Belt & Road initiative.

Meanwhile, Societe Generale says it has set up a Chinese desk in each African country, as commercial activities between China and Africa pick-up pace.

WEI LYNN TANG BEIJING China has been gradually opening up. It first joined the World Trade Organization in 2001. In 2007, foreign banks were allowed to establish locally incorporated operations in China. A decade later, just 3 weeks ago, China further liberalised its financial sector, allowing foreign companies to now hold a majority stake in joint ventures with Chinese securities and insurance firms.

The opening up will also raise single foreign ownership limits in Chinese banks and asset management companies.

While a timeline of this proposal has yet to be disclosed, Societe Generale is gearing up to take advantage of this news.

ANNE MARION-BOUCHACOURT CHINA'S CHIEF COUNTRY OFFICER, SOCIETE GENERALE "I think we would love to be able to have the license to open a security. We have looked at it for many years, but we were blocked by the fact that it's very complicated to share risk appetite. I think the fact that we could be a majority shareholder means we are ready to invest, and to open up a security."

Going forward, Gao Feng expects the Chinese capital market to be much more open to foreign capitals, with the RMB internationalization and Chinese stocks being added to the MSCI global benchmark equity index.

GAO FENG CHIEF COUNTRY OFFICER, DEUTSCHE BANK CHINA "So globally everybody will have a reallocation, they need to look at China much more seriously. And I think we are in a sweet spot, we can facilitate that flow, and if we do that well, hopefully the world will understand China better, and Chinese investors or companies understand outside world much better and in that case it's a win-win situation."

And as such, despite their small share, the message is clear for these Fortune 500 banks. China -- with its 1.3 billion population and 80 trillion yuan economy -- is still one market that cannot be dismissed. Wei Lynn Tang, CGTN, Beijing.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3