In car-crazy China, can gov’t, new players bring order to chaotic auto aftermarket?

2017-05-11 16:32 GMT+8

Editor

Zhao Hong

Auto sales in China amounted to 28 million in 2016 and China’s motor vehicle ownership surpassed 300 million for the first time in March, according to official statistics.

Unsurprisingly, this creates a powerful engine for the auto aftermarket, which Chinese transport authorities expect to grow by an annual average of 30 percent up to 2018, by which point the market scale should have reached one trillion yuan (around 145 billion US dollars).

Yet industry observers fear that the current auto aftermarket is poorly equipped to cater to such demand, being largely comprised of unregulated independent workshops where the quality of service and parts is unreliable.

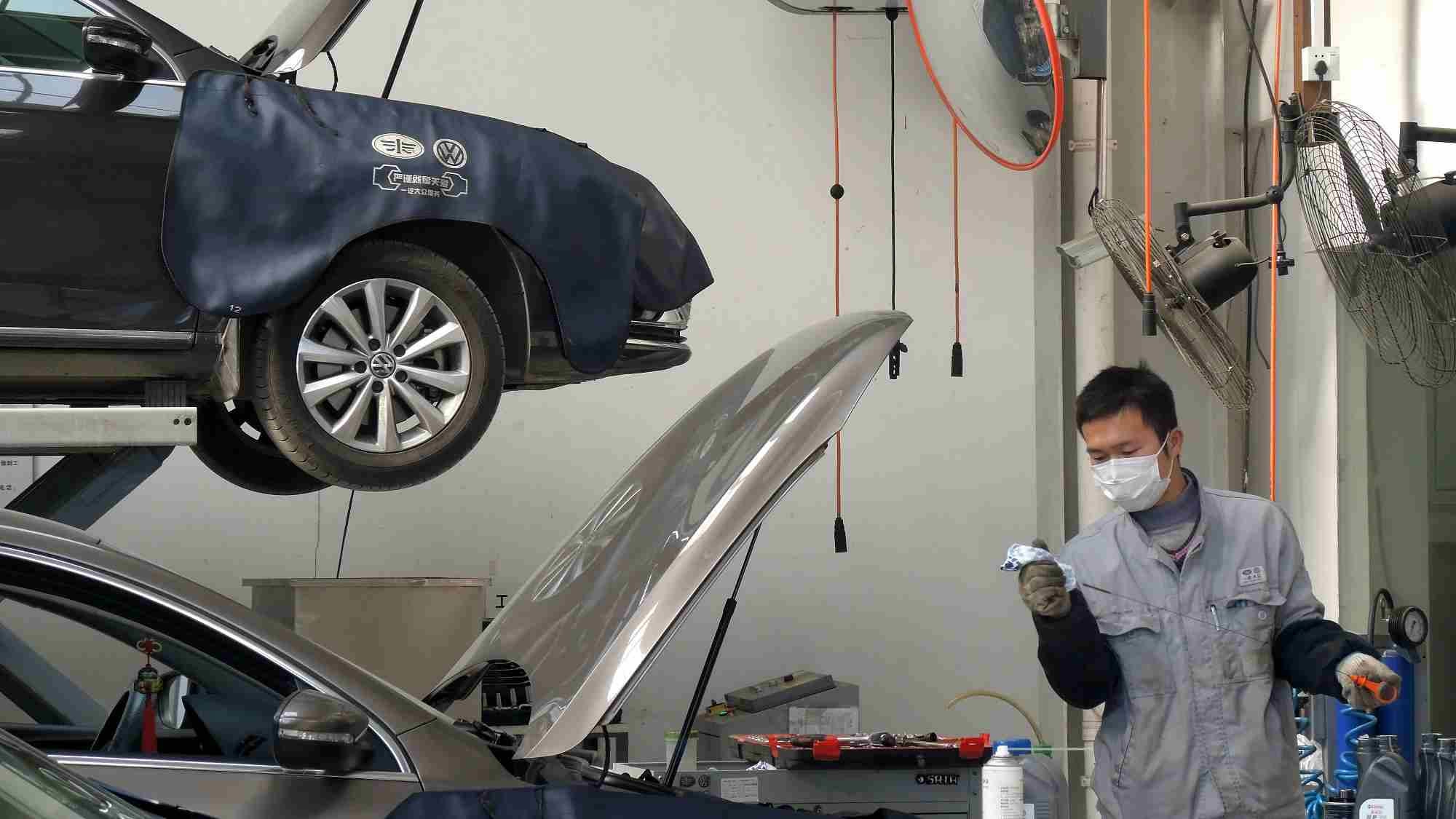

A repairman in a 4S store /VCG Photo

The aftermarket is unbalanced

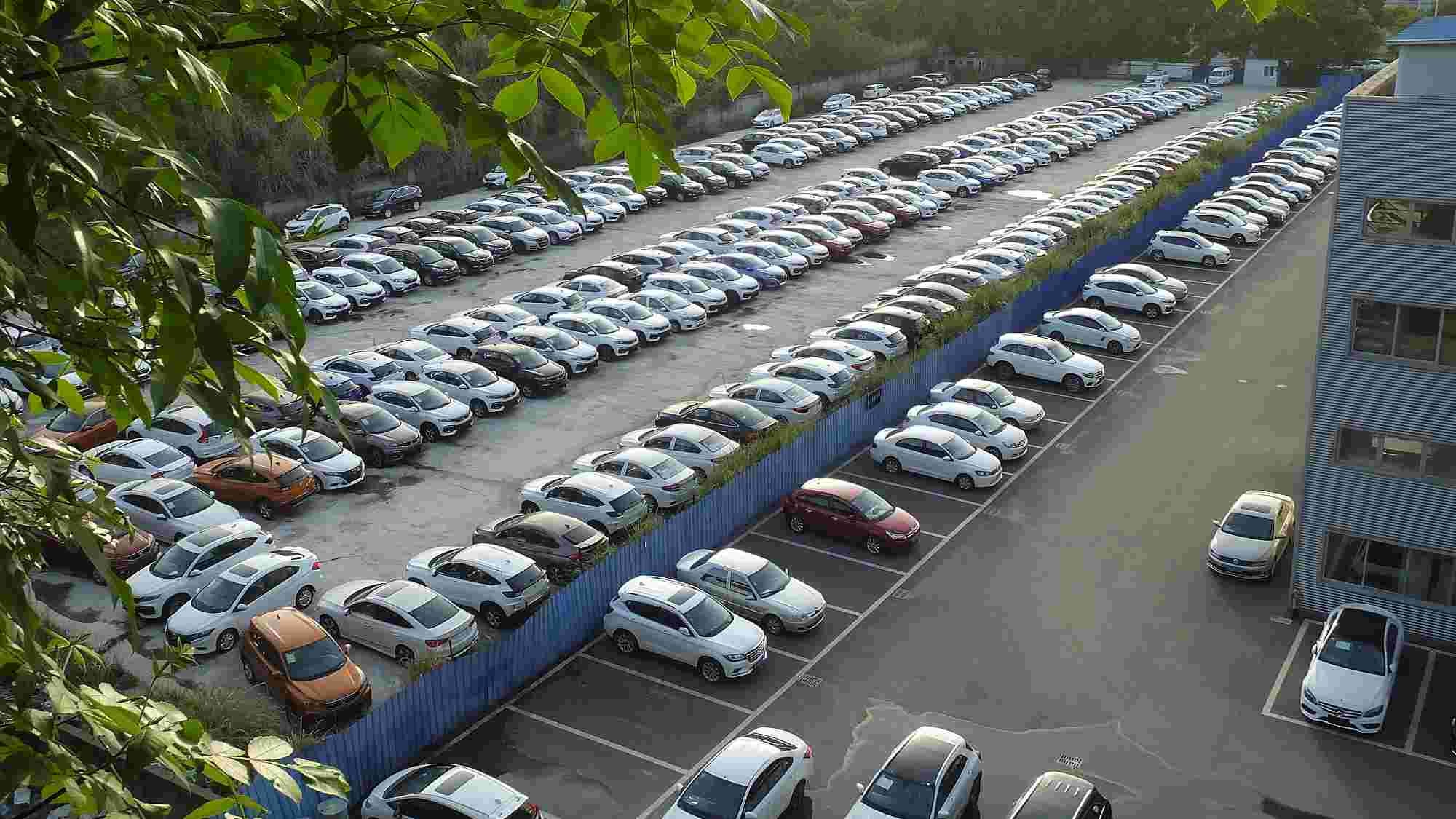

China's auto industry has gradually grown into a pillar of the national economy. And the aftermarket remains the most dazzling gold mine in the automotive industry. The 2013-2017 China Auto Aftermarket Blue Book estimates profit in the aftermarket can reach up to 50 percent.

However, the actual development of the aftermarket is lagging behind. At one end of the scale is an established system of 4S stores, and at the other side are scattered roadside shops. Consumers have to choose between the two.

4S stores have their advantages in technical skills and quality of parts, but they charge high prices for repairs and maintenance, resulting in a steep drop-off when the vehicle owners' insurance policies expire. Those lost customers flow into private repair factories or roadside stores, which offer much cheaper prices but patchy service.

A man works to repair a car /VCG Photo

There are over 400,000 auto repair shops in China, but most of them have fewer than 400 regular customers.

China's auto market has long been a sweet pastry in the eyes of international giants, including America’s Jiffy Lube and Precision Tune Auto Care, Japan's Autobacs, and South Korea's Hankook Tire. But these businesses have failed to crack the China market due to its chaotic conditions.

Incredibly high parts-to-whole price ratio

The Insurance Association of China, along with the China Automotive Maintenance and Repair Trades Association did an analysis where they picked 100 cars and compared the cost of the car new to the cost of replacing all its parts. In the most extreme case, the owners of one of the models could have bought 8.3 new versions for the same cost as replacing all its parts.

The inflated ratio indicates profiteering in the aftermarket.

The parking lot of a 4S store /VCG Photo

Aftermarket switching to e-commerce model

The Ministry of Transport, National Development and Reform Commission and other ministries have been encouraging original parts manufacturers to sell their high-quality products far and wide, and cancelled restrictions on who authorized repair companies could provide products to in 2014, breaking the monopoly control of original auto parts manufacturers and ensuring customers have the right to choose parts of matching brands.

In April, the National Development and Reform Commission and the Ministry of Industry and Information Technology issued new regulations on auto sales management, in an attempt to make the aftermarket more open and transparent.

Aside from greater regulation, the biggest hope on the horizon may be the Internet. Driven by government policy, a large number of Internet enterprises and many independent after-sales maintenance businesses have emerged in the aftermarket.

A worker repairs a car /VCG Photo

In 2015, Alibaba announced is establishment of an auto business department and started the auto e-commerce service O2O, taking full advantage of its big data marketing, auto financial business and a platform with 60 million car owners.

Some Internet-based auto maintenance companies like Tuhu have gradually found their way to success by combining both online and offline operation, beginning to pay attention to heavy asset investment, and combining the advantages of both Internet and traditional enterprises.

Copyright © 2017