Politics

19:56, 09-Mar-2017

Views on Two Sessions: A look at Premier Li’s report

Updated

11:00, 28-Jun-2018

Guest commentary by Benjamin Chiao

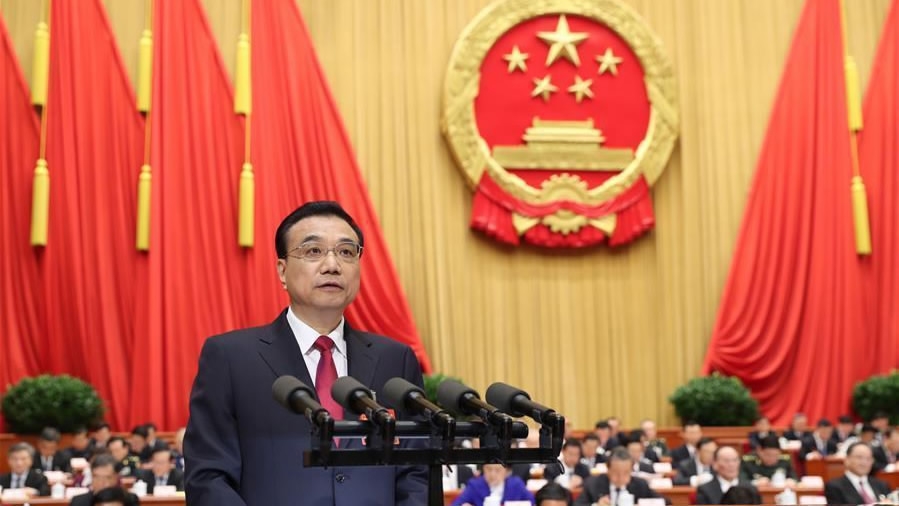

Chinese Premier Li Keqiang delivered the government's work report on Sunday. The report laid out plans to pull the country out of the slowest growth of 6.7 percent in 26 years. An already impressive rate compared to Western standards, but a rebound is not coming anytime soon. The report sets the target to 6.5 percent in 2017. Some argue that China is now being dragged down by the world’s economy. Others say that China is facing internal structural problems as they are moving away from manufacturing-led-growth, protecting its environment, and facing the problems associated with a rapidly aging population. While one can argue about the causes of the slowdown, cures are clearly pointing to at least one key direction: supply-side reforms.

This is a set of reforms to unleash the power of the private sector by reducing the burden on firms and restricting the reach of the government.

The second plenary meeting of the Fifth Session of the 12th National Committee of the Chinese People's Political Consultative Conference is held at the Great Hall of the People in Beijing, March 9, 2017. /Xinhua Photo

The second plenary meeting of the Fifth Session of the 12th National Committee of the Chinese People's Political Consultative Conference is held at the Great Hall of the People in Beijing, March 9, 2017. /Xinhua Photo

It is but a logical consequence of the anti-corruption campaign. China's citizens are generally satisfied with how much more restrained the officials have become, especially in lower-tier cities. One major side effect is the time needed to rebuild a clean and effective incentive scheme for the officials. In the meantime, firms started to complain about getting projects approved because of the inactions of the officials. Officials are still just human beings, who respond to weaker incentives, believing little can go wrong if they do not approve any projects. The government reacted by phasing out control over areas that should be run more effectively by private firms.

What would be interesting to watch is the tug-of-war between the central government and the monster-sized state-owned enterprises. Premier Li again pointed out the importance of trimming down state-owned enterprises, especially in the petroleum and electricity industries, setting a deadline of this year to largely complete basic reform.

The truth is, China is somewhat consistent with state capitalism, with ‘upstream’ industries largely owned by the government, while there are more privately owned industries ‘downstream’. Oftentimes. the upstream gets a larger share of the profits, as the SOEs there charge nearly monopoly prices. If you contrast this with one single industry with little SOEs, namely the Internet industry, you will see impressive growth, an average of around 40% growth in online merchandise volume in the last three years, according to iResearch. The Internet industry remains a powerhouse that plays a bigger and bigger role. Private firms operate without the unfair competition from the SOEs. Another desirable side effect is the breakdown of the traditional upstream and downstream relationships of existing industries as new networks and new supply chains are being built.

Meanwhile, the government is trying to keep “irrational” market behavior and other market risks in check.

Members of the 12th National Committee of the Chinese People's Political Consultative Conference (CPPCC) attend the second plenary meeting of the Fifth Session of the 12th CPPCC National Committee at the Great Hall of the People in Beijing, March 9, 2017. /Xinhua Photo

Members of the 12th National Committee of the Chinese People's Political Consultative Conference (CPPCC) attend the second plenary meeting of the Fifth Session of the 12th CPPCC National Committee at the Great Hall of the People in Beijing, March 9, 2017. /Xinhua Photo

In the finance sectors, China promises to be more vigilant against risks from debt defaults, non-performing assets, shadow banking and Internet finance. In the non-financial sectors, the government will push for more reduction in over-capacity, especially in the coal and steel industries, and for real estate inventories accumulated in third and fourth-tier cities.

What remains to be seen, perhaps, is how much determination there is to overcome difficulties ahead that will block the ambitions Li Keqiang laid out.

(Benjamin Chiao, Paris School of Business Professor and China Center Director. The article reflects the author's opinion, not necessarily the view of CGTN.)

30km

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3