By Shweta Bajaj

India has introduced a new system of taxation known as the Goods and Services Tax (GST).

It has been touted as the most ambitious tax reform India has ever seen. But many small and medium scale traders are concerned they have not been given enough time to transition.

The introduction of the GST, which is considered a crucial step to unite the economic federal system, has been dubbed “One Nation One Tax.”

There are four main tax rates - five percent, 12 percent, 18 percent and 28 percent, assigned to a variety of goods and services.

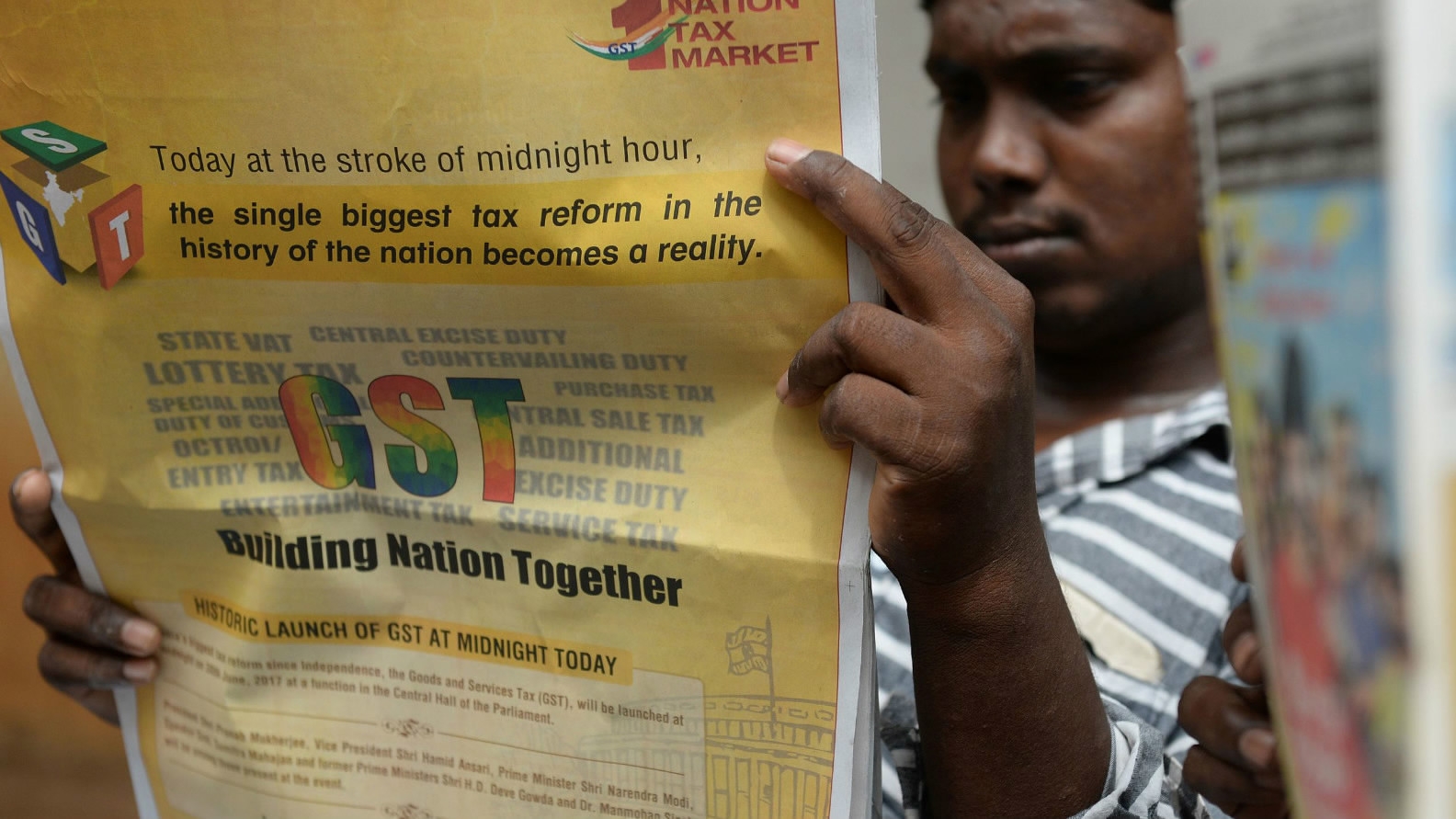

A man reads about the new Goods and Services Tax (GST) at a shop in Chennai on June 30, 2017. /VCG Photo

“GST is a tax system of a new India and GST is system of digital India,” said Prime Minister Narendra Modi, “GST is not only a tax reform but also an important move toward economic reforms.”

It is India's first national tax system, replacing a range of federal and state taxes.

However, confusion and uncertainty among traders have been on the rise, with many business associations saying they were given insufficient consultation.

Mahendra Aggarwal, president of All Delhi Computers Traders Associations, noted that authorities were enforcing a new law with cumbersome requirements that would make compliance difficult and time-consuming.

“Earlier, we used to file a return every three months, now we have to file three in one month. A total of 37 returns have to be filed. Earlier it was a total five in a year. You said ‘One Nation One Tax,’ how is it one tax?” said Aggarwal.

View of the Indian Parliament illuminated prior to a special session for the implementation of the new Goods and Services Tax (GST) regime in New Delhi on June 30, 2017. /VCG Photo

India’s chartered accountants, who have a massive responsibility to make the implementation of GST successful, have expressed mixed reactions to the reform. Some have welcomed the move, while others said the government pushed the new tax regime through too quickly.

“The idea of bringing GST is not bad, but what I feel is that they have not professionally done it. It is a more political decision. They have been keeping in confidence, only politicians. They have never called professionals who could provide them better feedback. That is why they see lots of problems,” said accountant D.S. Aggarwal.

The impact of GST is expected to be seen after one financial quarter.

However, many experts said the economy would face aftershocks for at least a year. The price of some goods and services have gone up but in the long term the new tax system is expected to put India on a higher growth path.

Related story: