By CGTN’s Cheng Lei

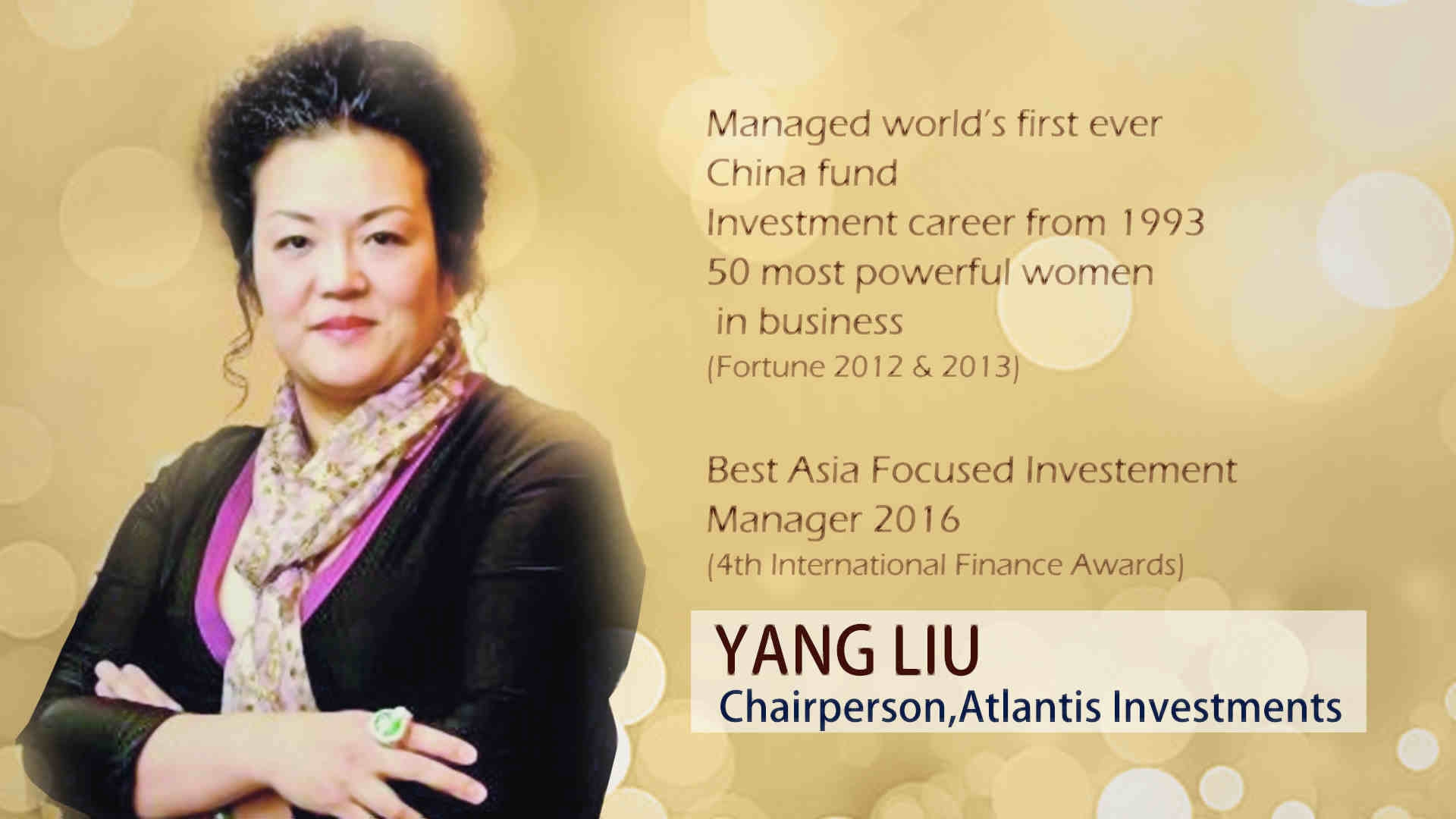

The Hong Kong market has changed tremendously over the past two decades – rally and crash, mega IPOs, and the entry of mainland companies. One investor who has had an extraordinary run in the market is Yang Liu, chairperson of Atlantis Investments. Her sage words of advice? Patience in Hong Kong's investment market.

CGTN Photo

IPO souvenirs show an illustrious investment career. Liu established her name in 2003. When the SARS outbreak scared away fund managers and drove down the stock market, she bottom-fished and later cashed in on a stunning 93 percent rate of return. This is one reason Liu is dubbed the "female Warren Buffett" of Hong Kong.

Liu has attributed her success to being “lucky”, after meeting with an ambitious entrepreneur.

CGTN anchor Cheng Lei (L) with Yang Liu, chairperson of Atlantis Investments, after an interview in Hong Kong, June 22, 2017. /CGTN Photo

“That’s a miracle. I met with the entrepreneur who really wanted to grow the company from town ownership to become a world leader in the medical device world. Secondly, I invested in the company whose fate in the industry – that’s healthcare, that’s medical devices. So the capacity and expenditure on the healthcare industry has been growing at the double digit Compound Annual Growth Rate (CAGR),” Liu explained.

In the past 20 years, Hong Kong's Hang Seng Index has hit as low as 8,331 and climbed as high as 31,958 – with double digit moves marking major market turmoil. It takes toughness to survive the Hong Kong rollercoaster.

CGTN Photo

“You're probably lost in the dark. Then you try to survive,” that is how Liu describes her investment philosophy. And her success in the Hong Kong market also proves her investment style – purchase of the resurrection.

“2008, 2001, 2002 and most recently 2015, I guess a lot of participants have gone. If you want to survive, you have to know the policy, the momentum, the know-how. And you have to work out your own investment style and investment philosophy. That can help to stay in this turbulent market and stay calm,” Liu said.

A mini-statue of Liu in her office in Hong Kong, June 22, 2017. /CGTN Photo

While some experts warn that more investment banking jobs would eventually move from Hong Kong to the mainland, making Hong Kong’s investing environment less attractive - Liu remains confident of the Hong Kong market.

“When I invest big money into a market, it is the top down combined [with] the bottom up. From the top down, Hong Kong is the second to none. From the bottom up, you have to be so close to the companies and the people,” Liu noted.

“Patience must be required,” Liu stressed, advising to keep doing, “The exactly same thing you have been doing for the past many years – the company visits, discussion, brainstorm and the verifying trips with the companies you want to stay in with longer time and for better returns.”

Related stories:

Hong Kong Faces: Laura Cha confident region will remain world financial center

Hong Kong Faces: Property tycoon Ronnie Chan wants to bridge East and West

Hong Kong Faces: Former HKEX chief says financial crisis made Hong Kong stronger

Hong Kong Faces: MTR Chairman Fred Ma draws global map for company

Hong Kong Faces: Business leader calls to rebuild city's competitiveness