20:57, 03-Nov-2017

Mobile Payment: Alipay takes aim at US market

China leads the world in mobile payments. Last year Chinese consumers spent 5-point-5 trillion dollars through platforms like Alipay and WeChat Pay - the country's two dominant mobile payment providers. In the United States, credit and debit cards are the favored form of payment but Alipay has nevertheless set its sights on entering the market. Karina Huber has more.

More than 950,000 Chinese tourists visited New York City last year. One of their favorite activities is shopping and it's now a lot easier for Chinese travelers to pay for things when in the U.S. Alipay, a mobile payment platform, recently struck a deal with payments processor First Data to become available in the U.S. Roughly four million merchants across the country now accept the form of payment.

SCOTT KESSLER, DIRECTOR EQUITY RESEARCH, CFRA "From the perspective of a U.S. merchant, there's really very limited downside to having that available and there's a lot of upside because hey if you're able to sell more and sell more in a frictionless fashion, that's a good thing for your business."

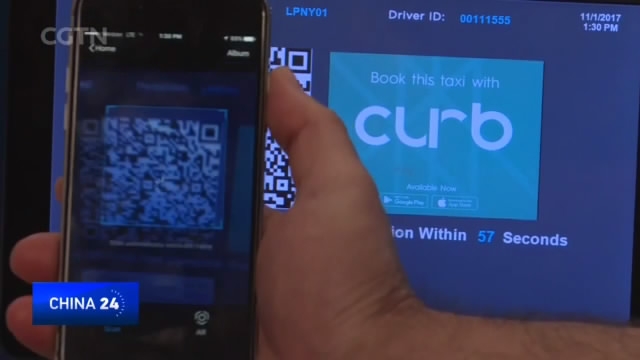

Alipay can be used to pay for hotels, luxury goods and now taxis. As of November, roughly 14,000 yellow cabs - two-thirds of the fleet in New York also accept the payment. The majority of taxis in Las Vegas also take Alipay.

JASON GROSS HEAD OF MOBILE, VERIFONE TAXI SYSTEMS "The first thing they do when they get out of the airport is hop in a cab. So what more of a perfect place to give them that same convenience and experience of paying than in the back of a taxi."

Making payments is simple. At the end of a ride, you press Alipay, enter a tip, scan the QR code and you're done.

KARINA HUBER NEW YORK Alipay's entrance into the world's number one consumer market is part of its global strategy. At the moment, the service is being used almost exclusively by Chinese visitors but if the company plans to gain widespread adoption among U.S. consumers, analysts warn it could face an uphill battle.

That's in part because mobile payment transactions in the U.S. are not as common as they are in other countries like China. Another challenge: a competitive marketplace.

SCOTT KESSLER, DIRECTOR EQUITY RESEARCH, CFRA "There are so many established brands and businesses centered on and focused on the mobile payments area that it's one of the reasons why it's going to be that much more difficult for a Chinese company really make a significant impact."

Perhaps Alipay isn't seeking to become a major player among U.S. consumers. With the number of Chinese tourists to the U.S. expected to balloon to 6.5 million annually by 2020, catering to them could be reason enough to invest in America. Karina Huber, CGTN, New York.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3