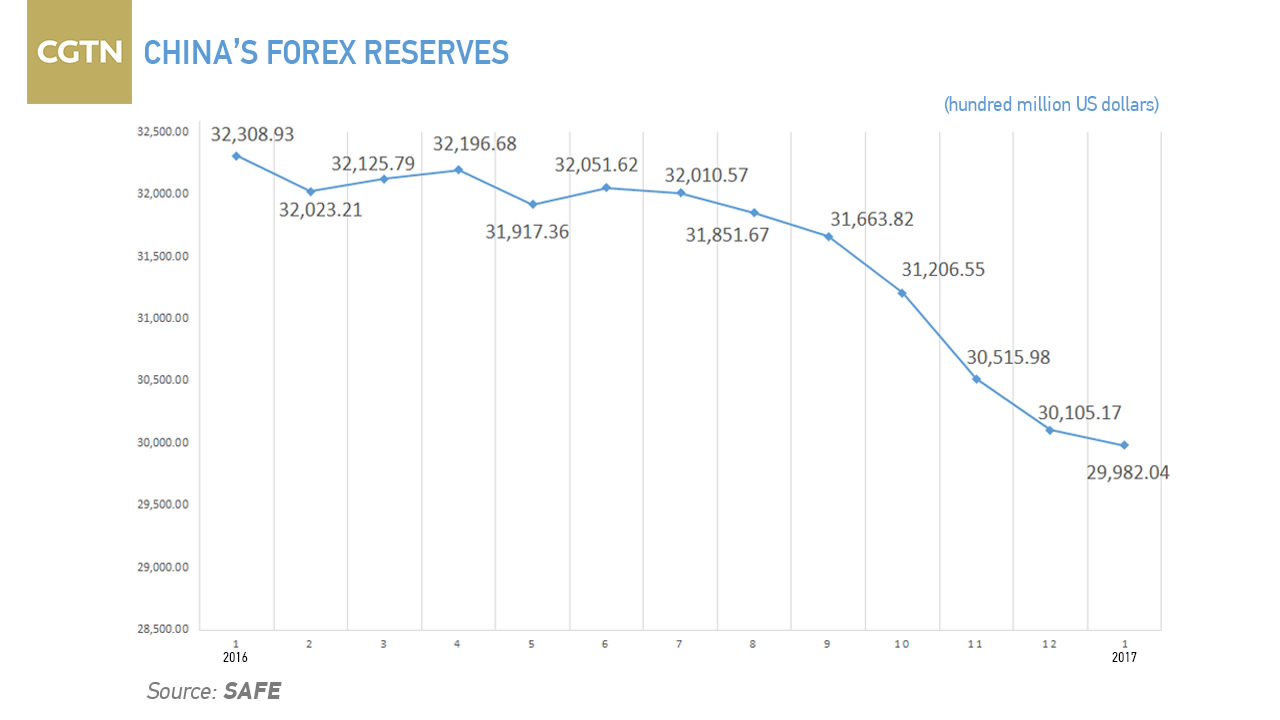

China’s foreign exchange reserves declined for a seventh straight month in January, falling to 2.998 trillion US dollars - below 3 trillion US dollars for the first time in nearly six years.

The reserves dropped from 3.01 trillion US dollars in December 2016, according to the State Administration of Foreign Exchange (SAFE).

The decline was down from a 41 billion US dollar fall from November to December, and the smallest in seven months

CGTN Photo

SAFE attributed the decline to the People's Bank of China (PBOC), the country's central bank, injecting foreign reserves into the market to balance capital outflows.

The administration stated it was normal to see foreign reserves fluctuate in light of a complicated domestic and overseas economic environment, adding that China’s foreign reserves are still abundant.

Capital outflow has slowed, SAFE said, adding that capital is expected to flow in a balanced manner across the border in the near future.

CFP Photo

Zhang Jianping, director general of the Center for Regional Cooperation of Chinese Academy of International Trade and Economic Cooperation, thinks that China’s level of foreign reserves is absolutely in the safe zone.

He said that 10 years ago when China’s foreign reserves reached 800 billion US dollars, many wondered how the money could be spent. Now the country has about 3 trillion US dollars in reserve, and people do not think it is enough.

Zhang claimed most economists think that if China has 2 trillion US dollars in foreign exchange reserves, enough to cover the country's foreign debt payments, and six months of import bills, then the country is within its safe zone.

China's import value was 16.80 billion US dollars in December 2016. The country's outstanding external debt reached 1.43 trillion US dollars at the end Q3 last year.

CFP Photo

"The decline of China's foreign reserves and the depreciation of the RMB could strengthen the projection of capital outflows. Stabilization of exchange rate is extremely important in the short-term time period," Zhang says.