MSCI, the provider of investment index and analysis tools, is about to announce whether China's A-shares are included in its benchmark emerging markets index, whose market value is 1.5 trillion US dollars. Inclusion in the index would assure more foreign participation in China's growing stock markets.

After three previous failed attempts at inclusion in MSCI's emerging markets index, many analysts are saying this is the year that China will make it in, as the last time MSCI rejected A-shares' inclusion due to accessibility of global investors.

Designed by Yao Nian and Zhang Tao

Chinese regulators have made great efforts clarifying areas MSCI had questioned previously, including capital repatriation, taxes and legal control of purchased shares.

The index provider itself has also updated its proposal for A-share inclusion - yet another reason the experts are betting on inclusion this year. MSCI cut the number of potential A-share additions to the index to 169 large caps from 448.

Many of the 169 constituents under consideration by MSCI are from non-bank financial institutions, real estate and bio-pharmaceutical sector. Banks, food and beverage, and non-bank financial institutions account for the most in terms of weight.

How possible is MSCI's inclusion of China's A-shares? /CFP Photo

"I probably say around 60 percent at this stage. Even if it were to happen, [the amount of] money expected to be bringing in the actual size of the market is very small," said Alexis Calla, global head of Investment Advisory & Strategy department at Standard Chartered Bank, "but when you want more money for that to become a significant driver we are talking about years but not about months in that case."

Laura Cha, chairman of the HK Financial Services Development Council, and formally vice chairman of the China Securities Regulatory Commission, says China has been working on its stock market reforms and being included in the MSCI will speed up the process.

"While it hasn't happened, it hasn't stopped the market from moving; the reform from proceeding. I think once it's in, it becomes one of the benchmarks, it's easier in many respects," Cha said.

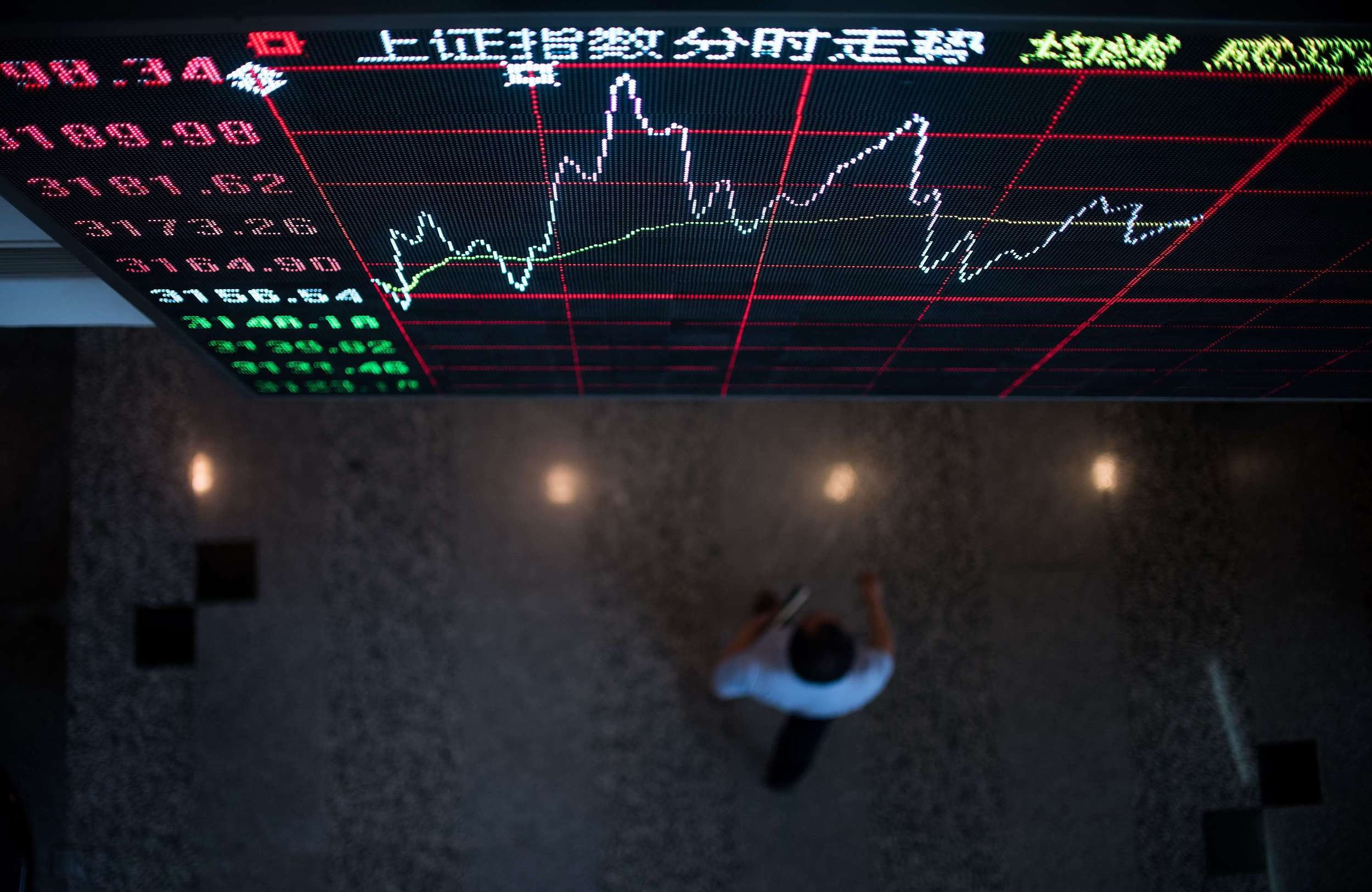

Shanghai Stock Exchange /CFP Photo

The American Global Investment manager Black Rock said in a widely reported statement two months ago that it is supportive of China's A-shares inclusion in global indices. That was the first time the billion-dollar company had made such a statement, interpreted as strong backing for the inclusion of China's A-shares in the MSCI benchmark.

Meanwhile, Morgan Stanley is also seeing a more than 50 percent of a "Yes" possibility, although it noted that actual implementation would not take place until June, 2018.

What if it's "Yes"?

If MSCI approves the inclusion, a 0.5-1 percent rise in the Shanghai Composite Index is expected, according to Morgan Stanley. The inclusion is also likely to push forward listing of A-shares by MSCI's rival, British stock indexes provider FTSE Russell, in its Emerging indexes, which began in 2015.

CFP Photo

What if it's "No"?

China’s first joint venture investment bank, China International Capital Corporation Limited and Morgan Stanley both think that impacts in the short-term are not significant if the MSCI still decides to not include A-shares into its emerging markets index.

The A-share market might first react with a minor decline of 1.0 percent," Morgan Stanley said in a recent report.

There will not be significant efforts seen, as only 11.5 billion US dollars will be injected into the MSCI ACWI Index, MSCI Emerging Markets Index, and MSCI Emerging Markets Asia Index, comparing to A-shares daily trading volume, 162.52 billion yuan (23.8 billion US dollars) on June 20, said BOC International, an advisory services that offers investment banking and securities brokerages services.

(Yao Nian contributed to this report.)

Related stories: