Business

14:50, 27-Mar-2017

Toshiba subsidiary faces possible bankruptcy

Updated

11:10, 28-Jun-2018

A subsidiary of Japan’s Toshiba may have to file for bankruptcy due to the increased building costs of two new US nuclear reactors in Georgia and South Carolina, which has already caused the company to spend a record 6.3 billion US dollars.

Westinghouse is Toshiba's US nuclear subsidiary, and, according to the Financial Times, is coming under intense pressure to come under bankrupty protection.

Toshiba's Tokyo-listed stock opened sharply higher Monday, tacking on four percent at the start, but quickly reversed course to end the morning 5.65 percent down at 210.4 yen.

The firm's market capitalization has halved since late December when the pillar of corporate Japan first warned of multi-billion-dollar losses at Westinghouse and said it was investigating claims of accounting fraud by senior executives at the division.

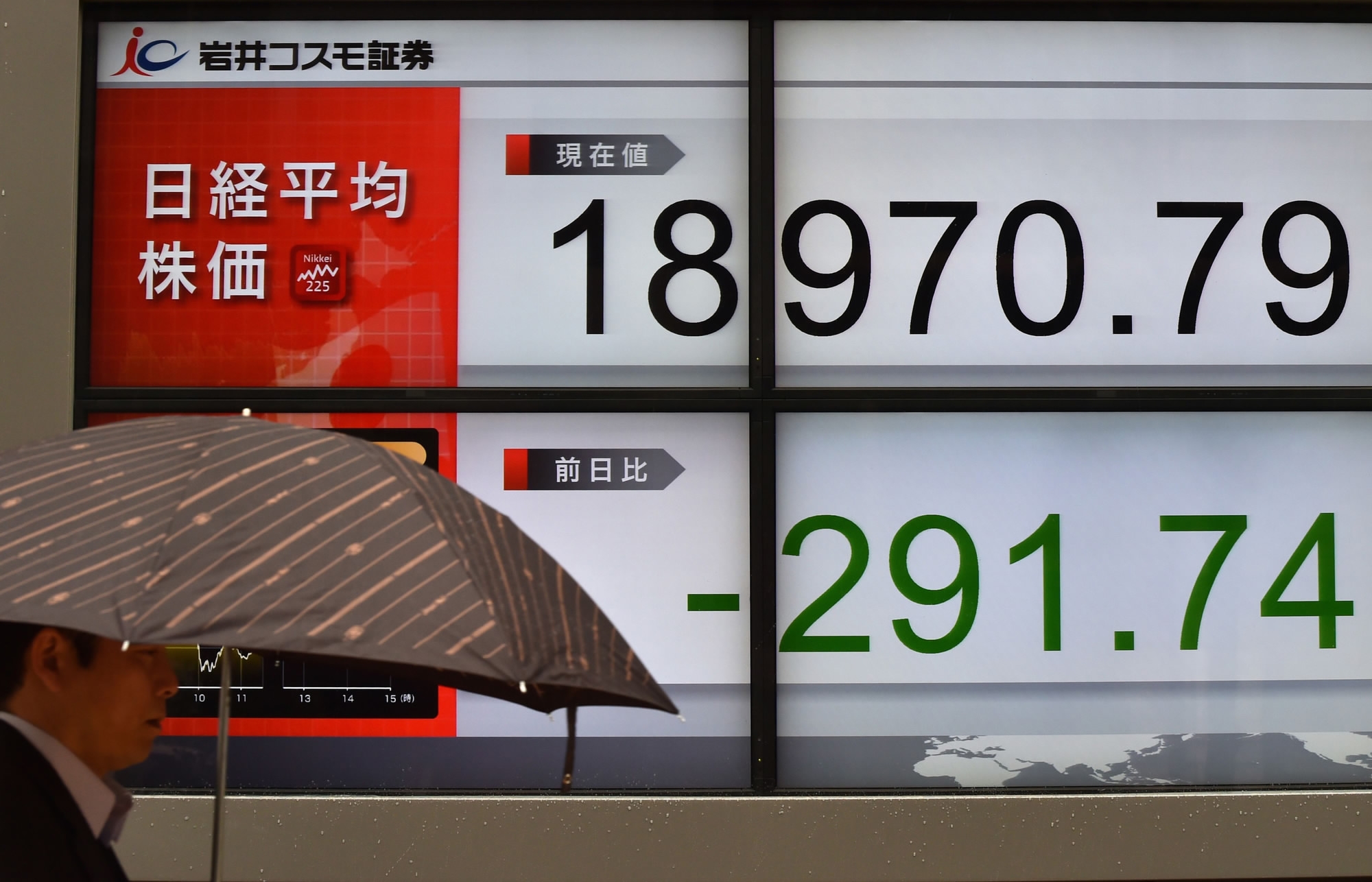

Tokyo stocks sank on a strong yen on the morning of March 27, with automakers and electronics firms taking a hit, while Toshiba dropped on a report that its troubled US nuclear unit could start bankruptcy proceedings this week. / CFP Photo

Tokyo stocks sank on a strong yen on the morning of March 27, with automakers and electronics firms taking a hit, while Toshiba dropped on a report that its troubled US nuclear unit could start bankruptcy proceedings this week. / CFP Photo

A Toshiba spokesman declined to comment on Monday's Nikkei report.

"The fluctuations today are linked to the recent volatility in Toshiba shares," Toshikazu Horiuchi, a broker at IwaiCosmo Securities, told AFP.

"There will likely be more selling if US authorities criticize the bankruptcy restructuring."

Toshiba has said it would try to sell Westinghouse, once lauded as the future of its atomic business after the 2011 Fukushima disaster sidelined new orders in Japan.

Japanese financial regulators have given the company until April 11 to publish results for the October-December quarter, which were originally due in mid-February.

Toshiba delayed their release, saying it needed more time to probe claims of misconduct by senior managers at Westinghouse and gauge the impact on its finances.

A logo of Toshiba Corp is seen outside an electronics retail store in Tokyo, Japan, February 14, 2017. / CFP Photo

A logo of Toshiba Corp is seen outside an electronics retail store in Tokyo, Japan, February 14, 2017. / CFP Photo

Toshiba has previously warned it was on track to report a net loss of 390 billion yen (3.5 billion US dollars) in the fiscal year to March, as it faced a write-down topping 700 billion yen at Westinghouse.

This month, Standard & Poor's cut its credit rating on Toshiba again, warning its finances were quickly deteriorating.

The firm is trying to spin off its prized memory chip business to raise cash, after earlier selling its medical devices unit and most of a home appliance business.

The latest crisis comes less than two years after Toshiba's reputation was badly damaged by separate revelations that top executives had pressured underlings to cover up weak results for years after the 2008 global financial meltdown.

(Source: AFP)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3