Chinese mainland’s OTC market will face competition from Hong Kong

By CGTN's Xia Cheng

China’s listed startups earned a combined 1.74 trillion yuan (250 billion US dollars) in 2016, up almost 20 percent from the year before and beating A-share companies’ revenue growth.

The companies’ 2016 net profit totaled 116 billion yuan (16.84 billion US dollars), and the growth rate outperformed A-share’s 5.43 percent to top seven percent.

A total of 10,554 listed startups, or the New Third Board companies, published their annual reports on Wednesday. Nearly 80 percent were profitable.

Combined data shows the non-financial sector stands out with 102.57 billion yuan (14.89 billion US dollars) of net profit.

The New Third Board, or National Equities Exchange and Quotation (NEEQ) system, is the Chinese mainland’s over the counter (OTC) trading system for small- and medium-sized enterprises to transfer shares and raise funds. And their positive 2016 annual reports indicates New Third Board’s ability to nurture China’s startups.

Handu Group, owner of China’s online fashion brand Handu, listed on New Third Board last December. The company has been expanding rapidly since it listed and its market value topped 3.5 billion yuan (508 million US dollars) last month. /Handu Photo

“Many companies have leaped in size after being in the OTC market for two years. This is what we want, which is to support smaller companies,” said Sui Qiang, deputy general manager of NEEQ.

Government data uses its own methodology to measure companies' R&D strength. It shows that the overall innovation level in the mainland OTC market is 3.6 percent, while the overall R&D capability in China is only two percent.

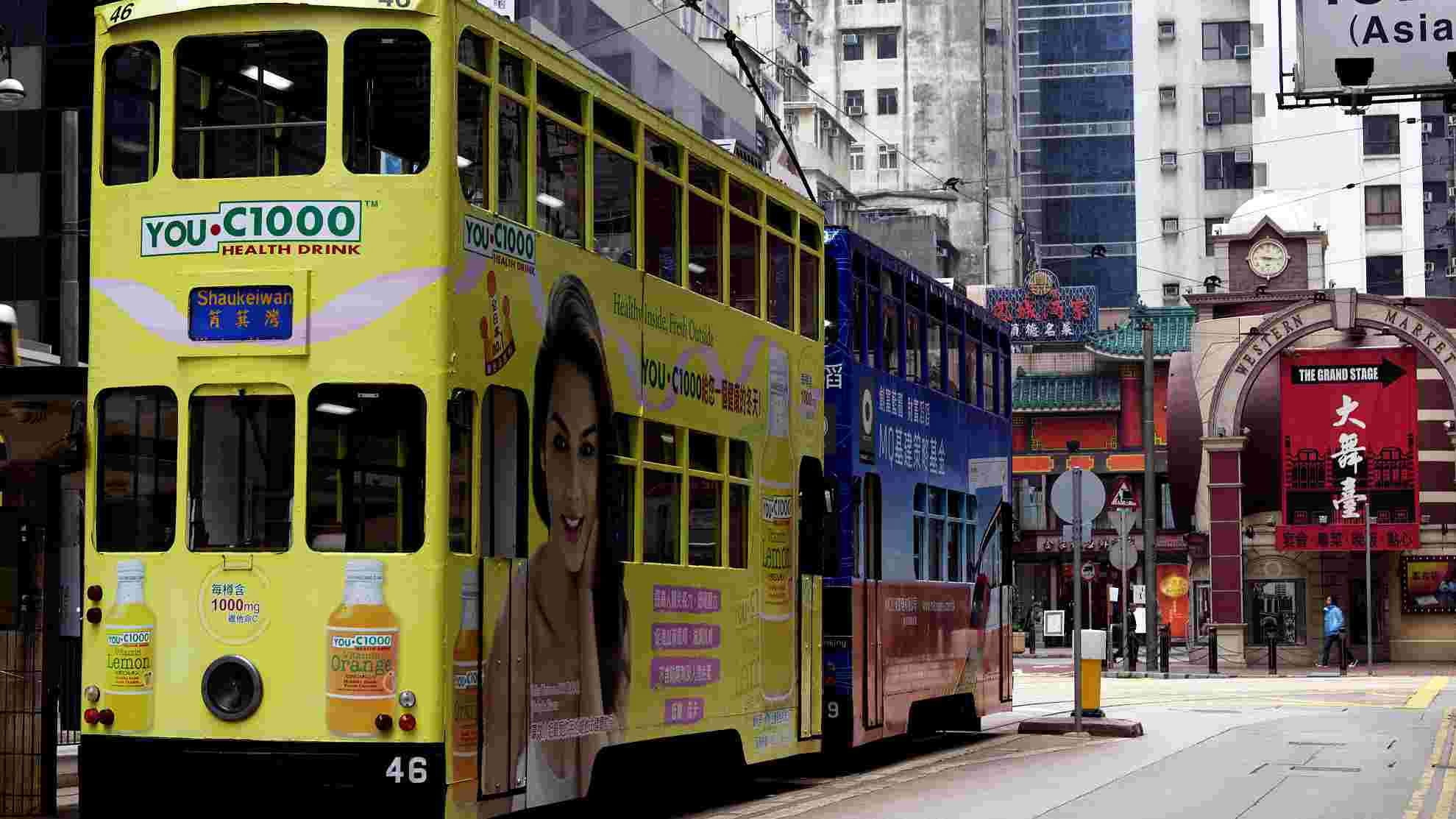

But the mainland OTC trading system will soon face tough competition from Hong Kong, as the Hong Kong stock exchange is planning its own Third Board for startups.

If it goes online, the Third Board in Hong Kong would be considered a better channel for mainland tech firms to raise funds and go global. Mainland startups seeking opportunities in the Belt and Road Initiative would also favor Hong Kong as a financial gateway to the rest of Asia and beyond.