2016 was another record-breaker for Chinese companies going global. An increasing number of Chinese companies are moving beyond the country’s borders to cultivate markets overseas, pursuing growth through exports, partnerships, acquisitions or by developing a stronger local presence.

It’s been far from plain sailing, however. Many are facing a number of challenges in their international expansion, ranging from navigating through complex and stringent legal and fiscal compliance requirements to adapting to an array of new political uncertainties.

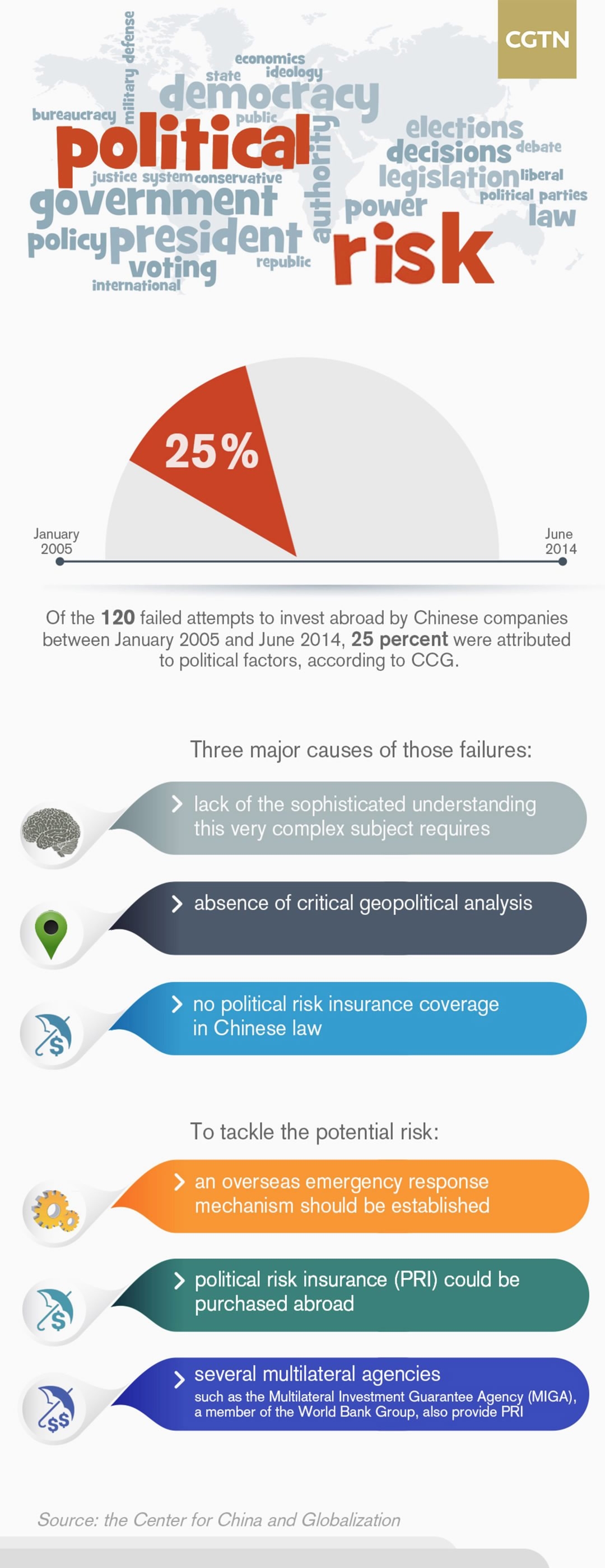

Political risk is the biggest concern for many Chinese enterprises going global, while legal risk is the most commonly encountered, according to a report from the Center for China and Globalization (CCG), an independent think tank based in Beijing.

CFP Photo

Politics is everyone’s business

Political risk is influenced by the passage of laws, the foibles of leaders, and the rise of popular movements - in short, all the factors that might politically stabilize or destabilize a country.

To help weigh challenges against opportunities, Chinese companies mulling foreign ventures routinely consult economic risk analysts. But basing global investment decisions on economic data without understanding the political context is like basing nutrition decisions on calorie counts without examining the list of ingredients.

In 2013 the Obama administration abruptly barred Ralls Corp, owned by executives of Chinese manufacturer Sany Group, from developing the Butter Creek project in Oregon on “national security” grounds and ordered the projects sold. They were located near a US Navy test base. It was the first time a US president blocked a foreign business deal since 1990.

CFP Photo

Obama also barred the use of Sany’s Chinese turbines in the project - even if they were under new ownership - and objected to a new owner chosen by Ralls. As a result, Sany said it might lose 20 million US dollars.

One popular approach to quantify the impact of political risk on investment projects is to take that risk into account through an adjustment to the discount rate.

That is, the investment analysis initially ignores political risk and forecasts the company’s cash flows assuming that no political risk event will take place, but then applies an upward adjustment to the discount rate to reflect the political risk. The majority of such approaches make use of sovereign spreads to obtain market-based and forward-looking readings on political risk.

The sovereign spread, also referred to as country spread, is the difference between the yield on a bond issued by a developing country in US dollars and a US Treasury bond of similar maturity.

Facing legal challenges

Legal considerations are as important as financial and political considerations to the success of an investment transaction.

With respect to going global, some Chinese business enterprises lack complete and systematic legal risk identification and avoidance capabilities.

CFP Photo

In 2015, about 16 percent of China’s unsuccessful foreign investment deals directly or indirectly faltered due to legal reasons, according to CCG.

Chinese bike-sharing startup Bluegogo is now seeking permission to operate in San Francisco after running afoul of city lawmakers in January. Supervisor Aaron Peskin ran down the bike company in a press conference on January 18, accusing Bluegogo of riding into a new market with no regard for local law.

Bluegogo plans to bring some 20,000 of its “smart” bikes to San Francisco's streets. It’s a business model innovative Silicon Valley companies such as Lyft and Airbnb also know well: launch first, worry about local laws later.

To make sure all legal bases are covered, the CCG report suggested taking certain steps, including: getting a full assessment of the possible legal risks related to assets, contracts, securities, intellectual property, personnel employment and environment protection, conducting thorough due diligence, and retaining lawyers familiar with the host country law.