By CGTN's John Goodrich

Asia’s infrastructure needs have been described as “daunting” by the Asian Infrastructure Investment Bank (AIIB), and another multilateral institution focused on Asia, the Asian Development Bank (ADB), has placed a figure on requirements: 26 trillion US dollars.

That’s the investment in infrastructure required to maintain Asia’s growth momentum up to 2030, the ADB estimated in February 2017, when funding to mitigate climate change is included. The number is 2.5 times China’s GDP in 2015.

How can this possibly be achieved?

On the sidelines of the Belt and Road Forum for International Cooperation in Beijing on Monday, ADB Vice President Stephen Groff told CGTN Digital that the additional investments in infrastructure and regional cooperation under the Belt and Road Initiative were good news for Asia.

CGTN Digital's John Goodrich talks to ADB Vice President Stephen Groff /CGTN Photo

“We think that both investments in infrastructure and investments in regional cooperation are critical to poverty reduction and a lessening of inequality, so we certainly welcome this initiative and look forward to working together with the government of China on this.”

Specific projects for cooperation are “still under discussion,” but the ADB’s general viewpoint is that the more institutions that are involved in infrastructure investment in Asia, the better for the region’s people. Groff notes that an MOU (Memorandum of Understanding) between major multilateral institutions in the region was signed on the first day of the Belt and Road Forum.

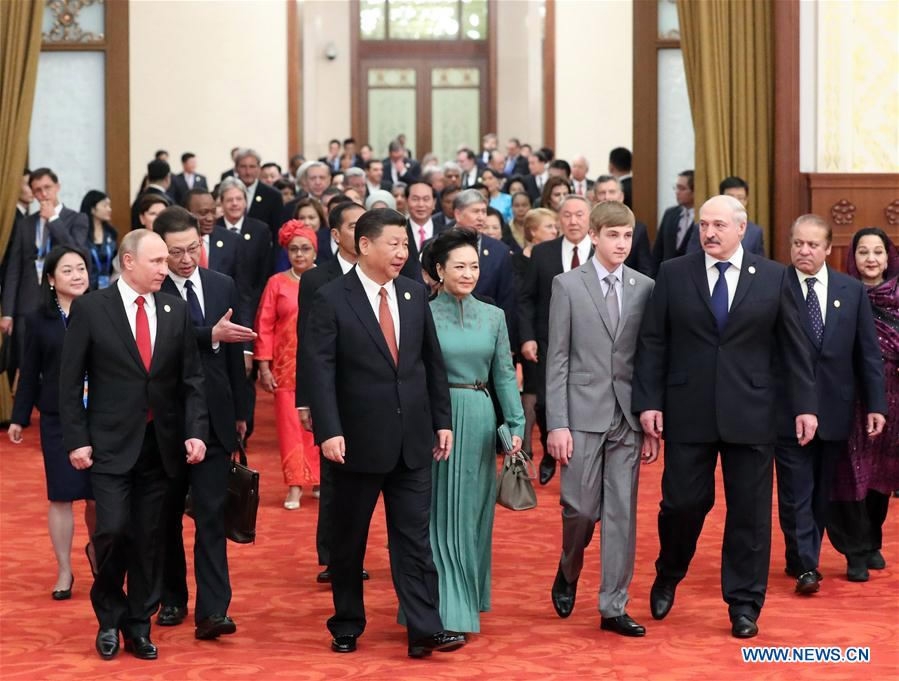

Chinese President Xi Jinping, his wife Peng Liyuan and other distinguished guests of the Belt and Road Forum (BRF) for International Cooperation attend a welcome banquet in Beijing, May 14, 2017. /Xinhua Photo

“Our estimates for Asian Pacific infrastructure needs are 26 trillion US dollars between now and 2030, so there’s plenty of room for all players to come in and make those investments.”

The ADB Vice President emphasized that multilateral institutions must cooperate, and seek to attract private sector involvement, if the colossal funding requirements are to be realised.

CGTN Digital's John Goodrich talks to ADB Vice President Stephen Groff /CGTN Photo

Groff said things had gone “very smoothly” for the AIIB — sometimes described as a rival to the ADB — in its first year of operation. “We work very closely with the AIIB, we signed an MOU with them early in their existence, we’ve co-financed now three projects with the AIIB. So we don’t view them as a rival at all, we view them as an institution that we can work very closely with.”

President Xi Jinping announced an extra 100 billion US dollars for spending on infrastructure projects under the Belt and Road framework on the first day of the forum. Those resources give strong impetus to the project, but Groff believes that “looking at how we get private sector investment, and mobilize private sector investment” is also vital if Asia’s infrastructure requirements are to be met.

ADB estimates for Asian Pacific infrastructure needs are 26 trillion US dollars between now and 2030. /VCG Photo

The ADB’s total lending last year was about 30 billion US dollars including co-financing, according to Groff, of which a share was mobilized through the private sector.

“We’re looking to expand that (private sector investment) quite dramatically over the course of the coming years. We do view that the needs are so huge that if we can’t figure out ways that we can engage the private sector and make these kind of projects bankable and attractive to them, we’re never going to reach that 1.7 trillion US dollars a year of investment that’s going to be required to keep growth and momentum in the region.”

CGTN Digital's John Goodrich talks to Ronald C. Perera, chairman of Sri Lanka’s state-owned Bank of Ceylon on May 15, 2017. /CGTN Photo

Ronald C. Perera, chairman of Sri Lanka’s state-owned Bank of Ceylon, which is already involved in several infrastructure projects linked to the “vitally important” Belt and Road, also emphasized the importance of cross-border cooperation to the initiative in a separate interview with CGTN Digital.

“We already have large trade links with China. The Bank of Ceylon has several correspondent links to banks in China, in fact I met several of them in the past few days. And we find it rather easy to work with them, given the volume of business and trade we do with China. I find that it is a very pleasant and advantageous relationship.”

Chinese President Xi Jinping, his wife Peng Liyuan and other distinguished guests of the Belt and Road Forum (BRF) for International Cooperation pose for a group photo before a welcome banquet in Beijing, China, May 14, 2017. /Xinhua Photo

Groff stressed that while the need for physical infrastructure building in Asia is “huge," addressing policy issues is also crucial to success.

“It’s not just physical infrastructure that’s required, it’s also looking at trade policy, at investment policy, looking at quarantine, looking at customs, looking at all these kinds of policies. Because it’s often the software side of the equation that is holding up the movements of goods and services across borders."

"So we need to be looking at the investment side, which is absolutely critical, but looking at the policy side as well in order to facilitate increases and improvements in trade, and ultimately improvements in economic growth."

The Belt and Road Initiative, allied with multilateral institutions and boosted by private capital, could be the key to meeting Asia’s infrastructure requirements.

11km