Business

13:00, 11-Mar-2017

China’s private enterprises dominate ‘Go Global’ era 4.0

Updated

11:01, 28-Jun-2018

By CGTN's Yao Nian

China’s entertainment conglomerate Dalian Wanda Group acquired the US Hollywood production company Legendary Entertainment for 3.5 billion US dollars in January 2016.

A hostess checks tickets at the Wanda cinema next to the Wanda Group building in Beijing on January 12, 2016. /CFP Photo

A hostess checks tickets at the Wanda cinema next to the Wanda Group building in Beijing on January 12, 2016. /CFP Photo

A month later, China’s e-commerce giant Alibaba Group bought 33 million shares of the Chicago-based Groupon, becoming the fourth-biggest stakeholder in the world’s largest coupon website.

The Groupon website is pictured on November 8, 2012. /CFP Photo

The Groupon website is pictured on November 8, 2012. /CFP Photo

The deals are merely two key investments by Chinese enterprises exploring the global market in the country’s “Go Global” era 4.0, a period in which private companies are becoming the main driving forces.

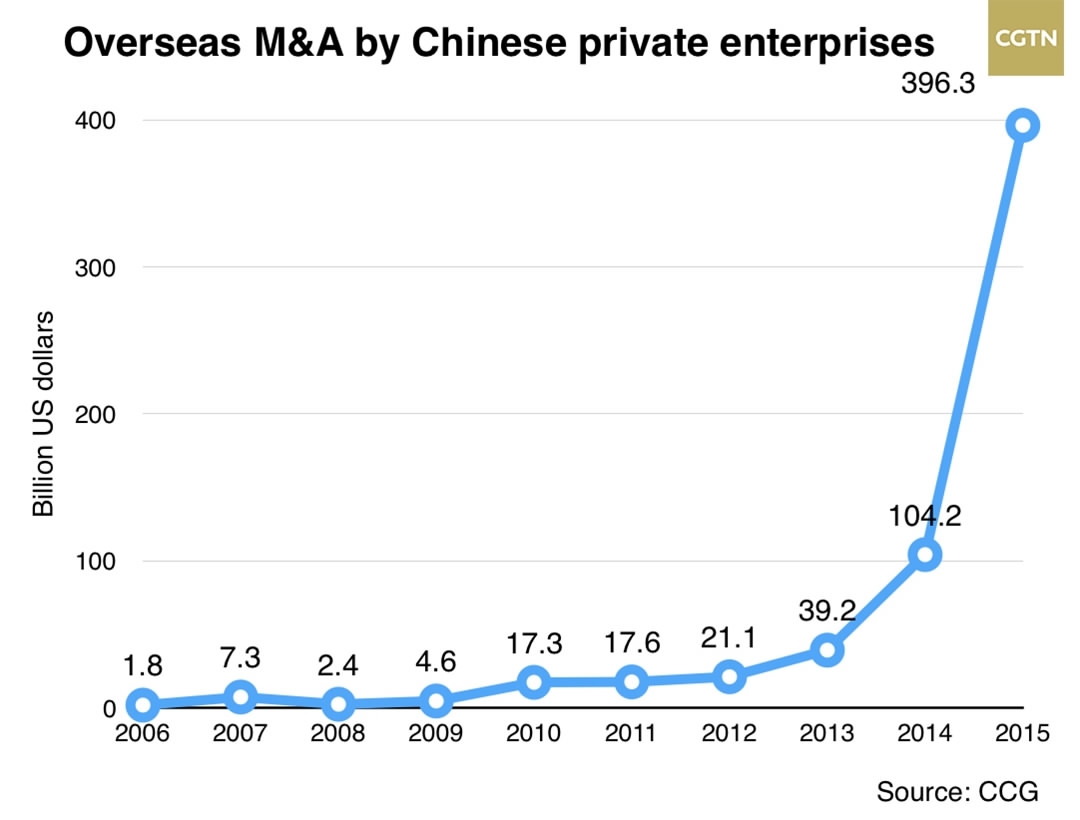

In the first half of 2016, Chinese private enterprises completed 290 mergers and acquisitions (M&A) overseas, accounting for 64 percent of the total M&A deals by all Chinese enterprises, according to Center for China and Globalization (CCG).

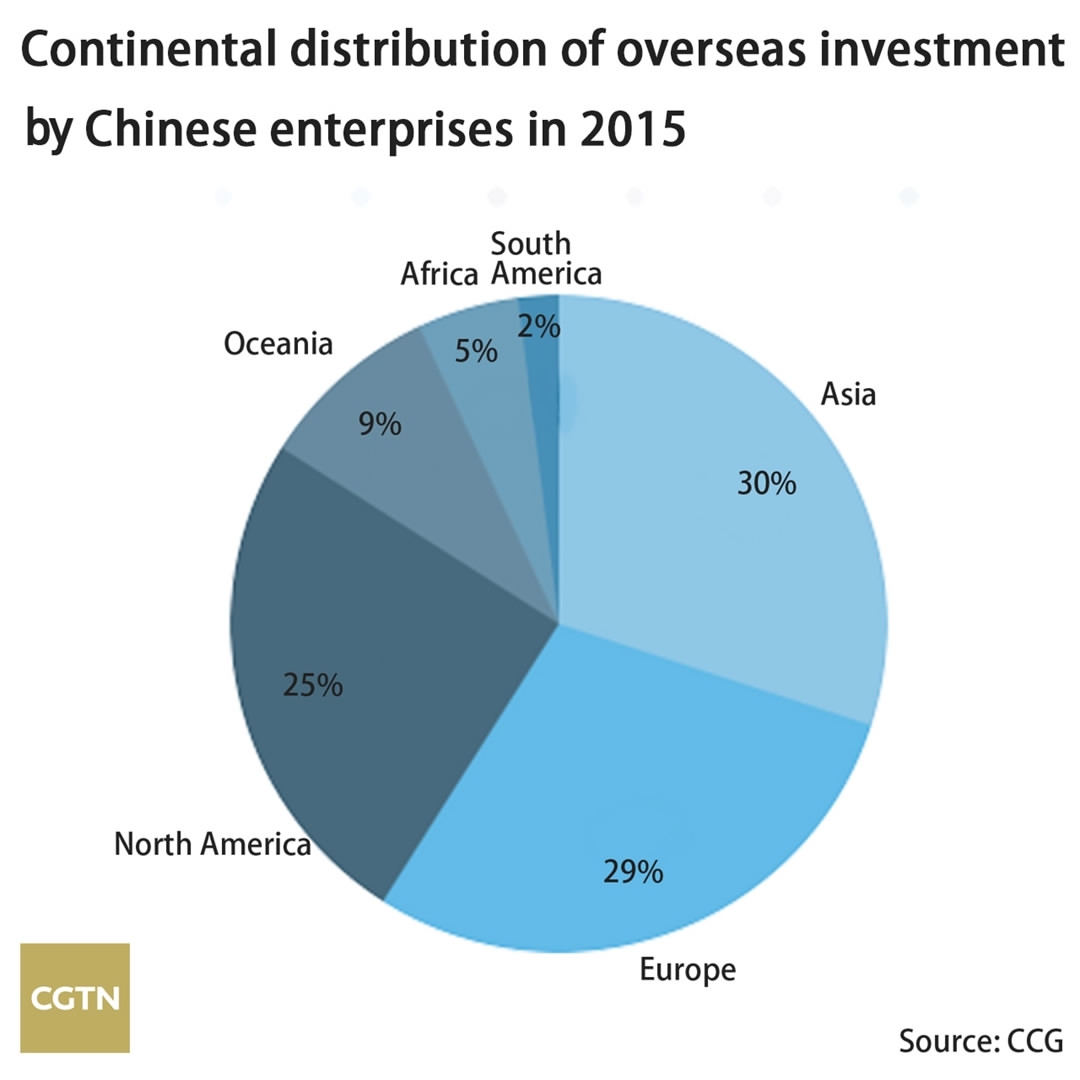

Meanwhile, about 20 percent of Chinese investment went to the US, amounting to 44.7 billion US dollars in total, said CCG. Apart from the US, countries in Asia and Europe are also popular investment destinations for Chinese firms.

Chinese companies’ overseas ventures in the new era show novel features, such as diversified investments and higher end positions within the global value chain.

Diversified investments

M&A is the major approach of overseas investment for Chinese enterprises. About 88 percent of over 2,858 agreements by Chinese companies overseas were completed via M&A between 2000 and 2016, said CCG.

In the first quarter of 2016, China saw a record high of 92.2 billion US dollars in acquisitions abroad, according to data supplier Dealogic. China is now number one in global cross-border M&A enjoying a 30 percent market share.

Chinese enterprises carry out M&A to obtain resources, technologies, brands and market channels. For example, China’s Midea Group bought an 80.1 percent stake in Toshiba’s home appliance business last April for its core technology.

Midea home appliances are sold in Shanghai on January 23, 2005. /CFP Photo

Midea home appliances are sold in Shanghai on January 23, 2005. /CFP Photo

Greenfield investment, another form of foreign direct investment where a parent company builds its operations in a foreign country from the ground up, however, exceeds M&A in terms of total investment amount.

Under the Belt and Road Initiative, Chinese enterprises invest in Africa mainly through the greenfield approach, which can promote local industrial development, infrastructure construction and employment.

Chinese labor-intensive and resource-intensive enterprises generally prefer greenfield investment in less developed or developing countries, so as to gain raw materials and labors.

Higher value-added

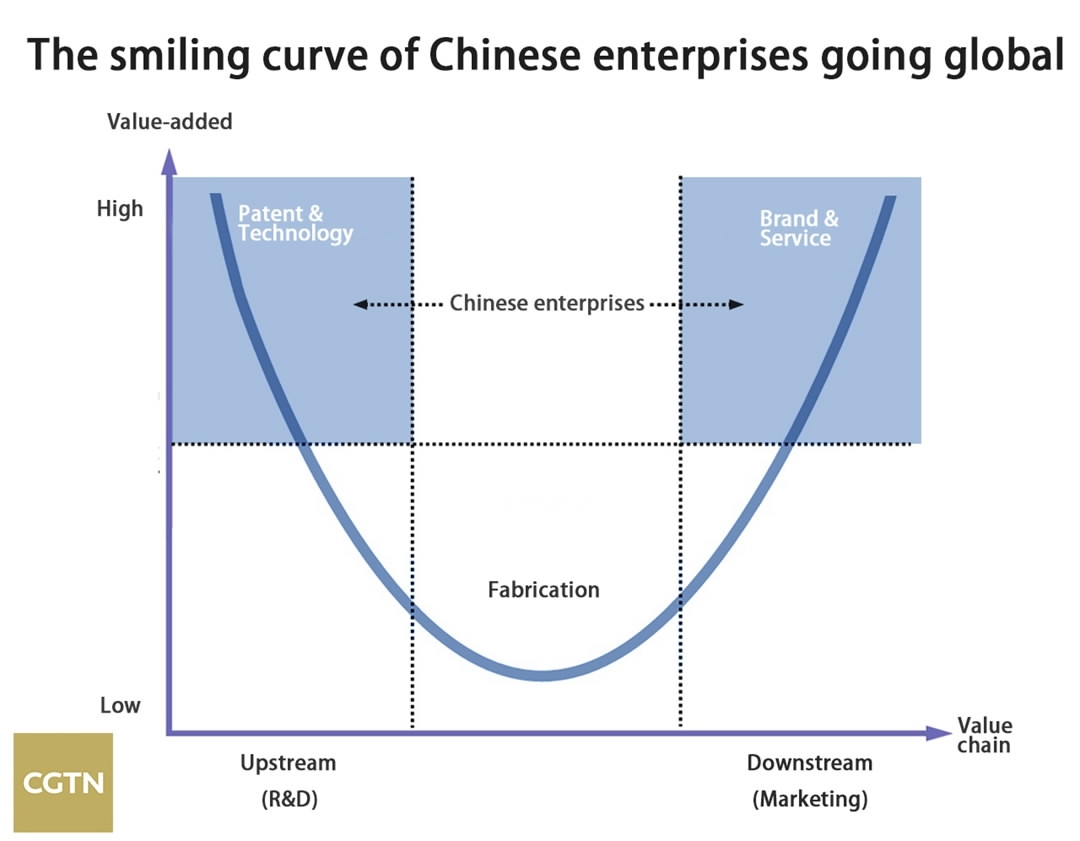

With “Go Global” era 4.0 coming, Chinese private enterprises upgraded their positions within global value chains to achieve higher value-added.

In the smiling curve, Chinese enterprises shift their focus from fabrication to research and development (R&D) as well as marketing. They are improving their global and area competition.

China’s semiconductor company Tsinghua Unigroup, for example, purchased a 51 percent stake in New H3C from Hewlett Packard in 2016, following its acquisition of Western Digital, SPIL Changhua, and Chip Mos Technologies in 2015.

Through acquisition, Tsinghua Unigroup has gradually created a whole semiconductor industrial chain from chip designs and fabrication to devices R&D, software and system integration, to improve its global brand.

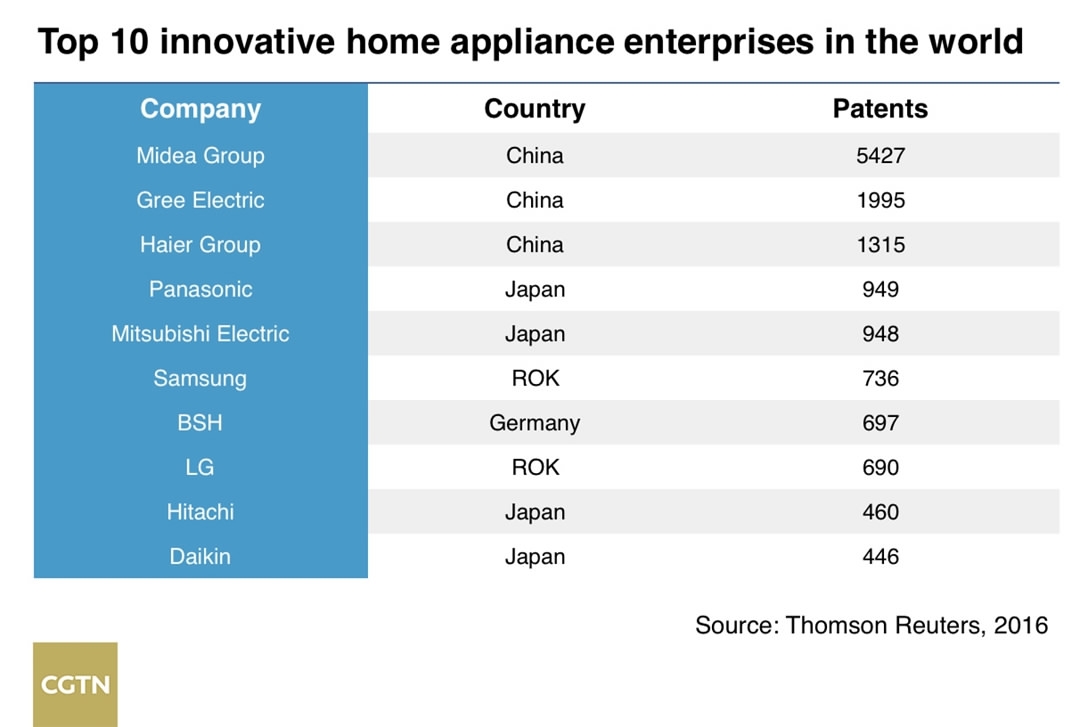

Chinese enterprises are growing into world-class innovators. Take home appliance enterprises for instance, the top three innovators in the world are all from China. Midea Group is far ahead in the number of patents.

Chinese enterprises are also going global to cater to China’s economic transformation to services and Internet-connected consumption. They are helping “Made for China” to become accepted worldwide, and making China a world market.

“Go Global” eras

Since 2001, Chinese enterprises have gone global as a proactive part of the country’s opening up strategy.

During “Go Global” era 1.0 over 10 years ago, many Chinese enterprises simply set up sales networks abroad, engaging in low-end international trade.

“Go Global” era 2.0 was dominated by state-owned enterprises that mainly aimed at overseas oil and natural gases, as well as infrastructure projects.

“Go Global” era 3.0 saw Chinese private enterprises begin to rise in foreign markets, with “Made in China” received globally.

“China Manufacturing 2025” is sold in China on July 27, 2016. /CFP Photo

“China Manufacturing 2025” is sold in China on July 27, 2016. /CFP Photo

The 18th CPC National Congress in 2012 emphasized its support for the go-global strategy. Since 2014, the Chinese government has cut red tape on overseas investment to reduce business costs and speed up business activities.

The inclusion of the Chinese renminbi (RMB) in the Special Drawing Right basket, effective since last October, has also helped Chinese enterprises invest overseas in RMB, minimizing their foreign exchange risks and costs when going global.

SDR basket includes the US dollar, euro, Chinese RMB, British pound and Japanese yen. /CFP Photo

SDR basket includes the US dollar, euro, Chinese RMB, British pound and Japanese yen. /CFP Photo

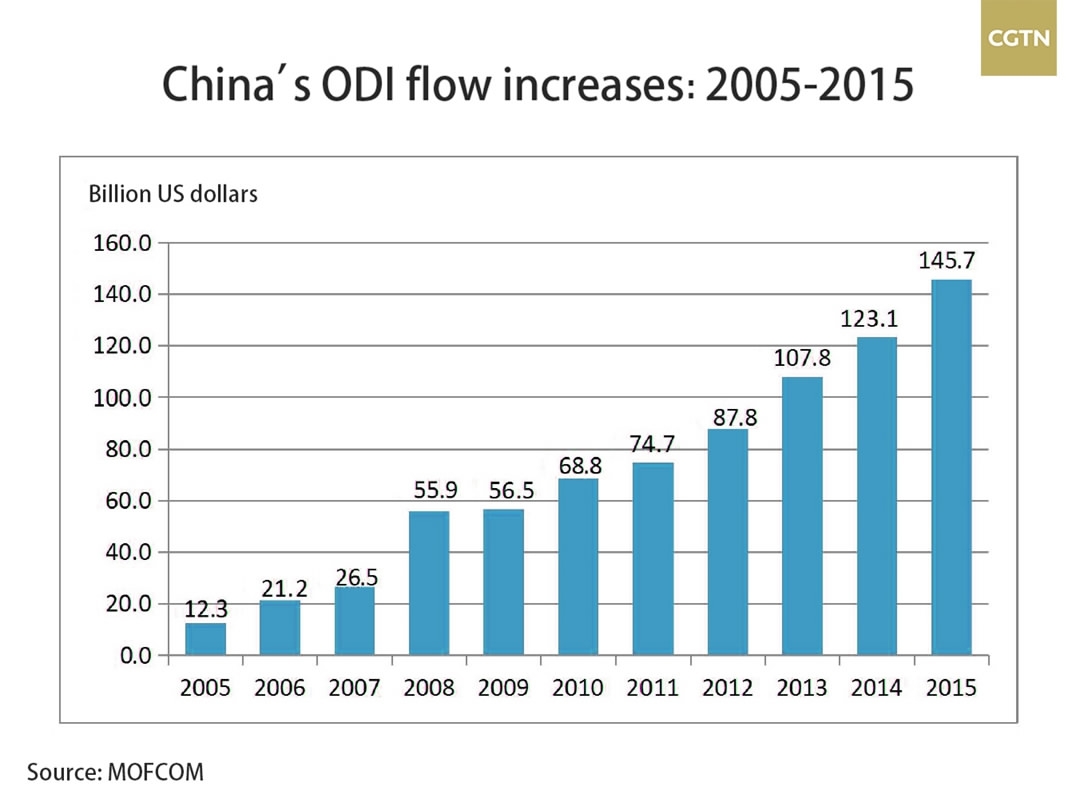

Despite an emerging de-globalization sentiment, China’s enterprises have maintained the outgoing trend with non-financial outward direct investment (ODI) reaching 170.1 billion US dollars in 2016, a growth of 44.1 percent year-on-year, according to the Chinese Ministry of Commerce (MOFCOM).

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3