Bike-sharing service provider Mobike on Friday announced that it had attracted 600 million US dollars in its latest fundraising round, bringing the company's investment for 2017 to nearly one billion US dollars and stealing a march on principal rival, ofo.

Davis Wang, CEO and founder of Mobike, said the new investment will support three targets over the coming months: accelerated global expansion, increased investment in research and development of Internet of Things technology and investment in infrastructure to support "innovations in the field of AI and intelligent hardware".

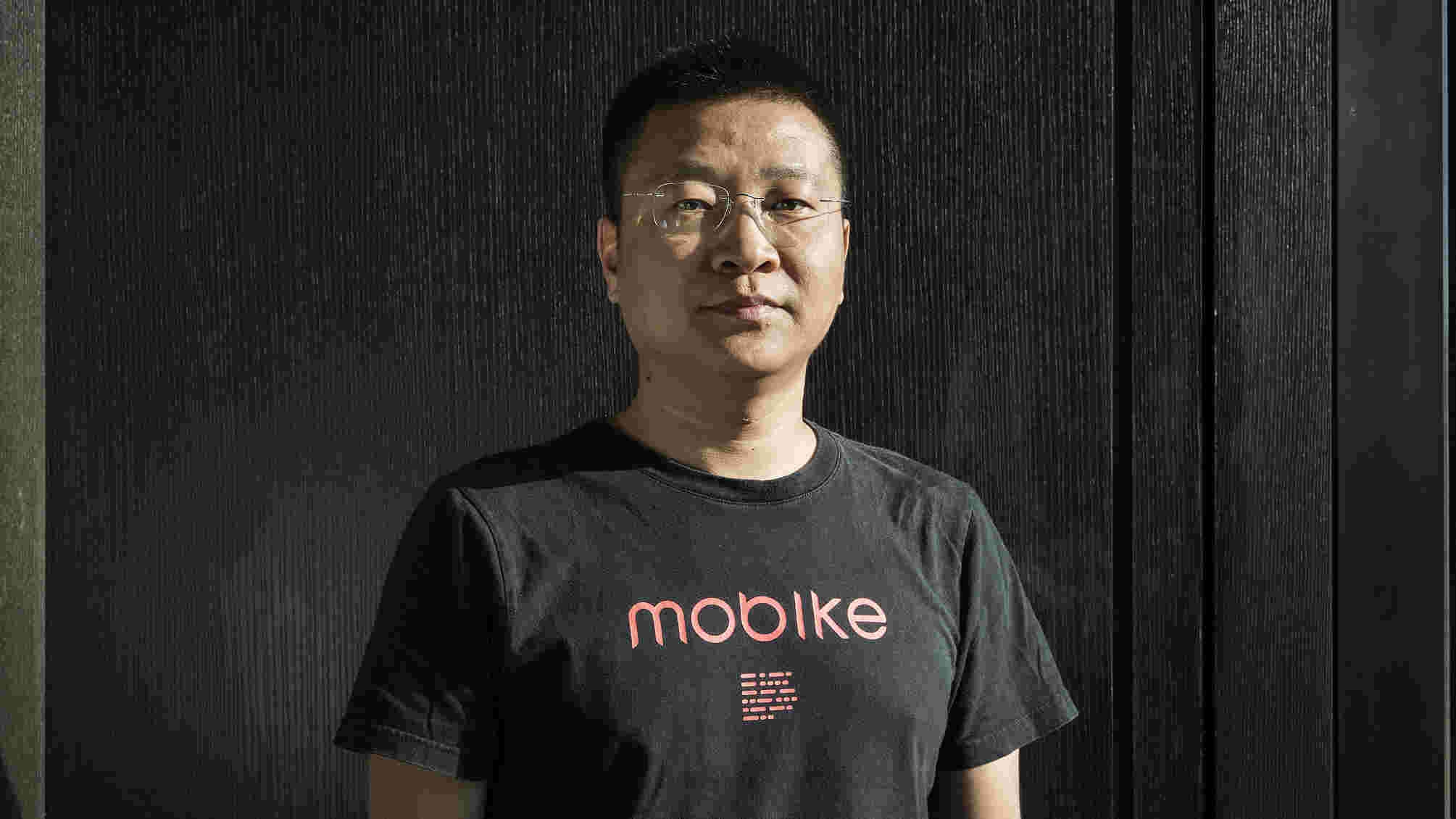

Davis Wang, Mobike CEO and founder, aims to make the bike-sharing service available in 200 cities by the end of 2017. /VCG Photo

The company now plans to be operational in 200 cities by the end of this year, former Uber executive Wang said, doubling its previous annual target

Mobike hit the 100-city mark on June 12, when a launch in northwest England's Manchester was announced.

The service is Mobike's first outside Asia. It launched in Singapore in March, and has targeted further European expansion in the coming months.

Mobike and ofo are the principal rivals in China's bike-sharing industry. /VCG Photo

Principal rival ofo is also reported to be in the market for fresh investment, with Bloomberg revealing that the company is looking for around 500 million US dollars at a valuation of three billion US dollars.

It too has an eye on global expansion. It currently operates in China, the US, the UK and Singapore, and aims to enter 20 countries and 200 cities this year.

Global appeal?

Bike-sharing services are in operation across the world, but the dockless option - allowing riders to leave the bicycle anywhere, avoiding a need for infrastructure investment in docking stations - offered by the established Chinese companies is appealing for cash-strapped local governments.

Bikes from Mobike and ofo don't require infrastructure spending on docking stations, which could appeal to local governments. /VCG Photo

Mobike, ofo and similar platforms offer a cost effective option - no funding from the taxpayer is required.

By contrast, "Boris bikes" cost Londoners 225 million pounds over six years in funding for docking stations and infrastructure development. It is also reliant on major sponsorship deals and is yet to be self-funding.

Expansion is likely to be tested by regulatory difficulties, however, and objections from existing bike-share companies.

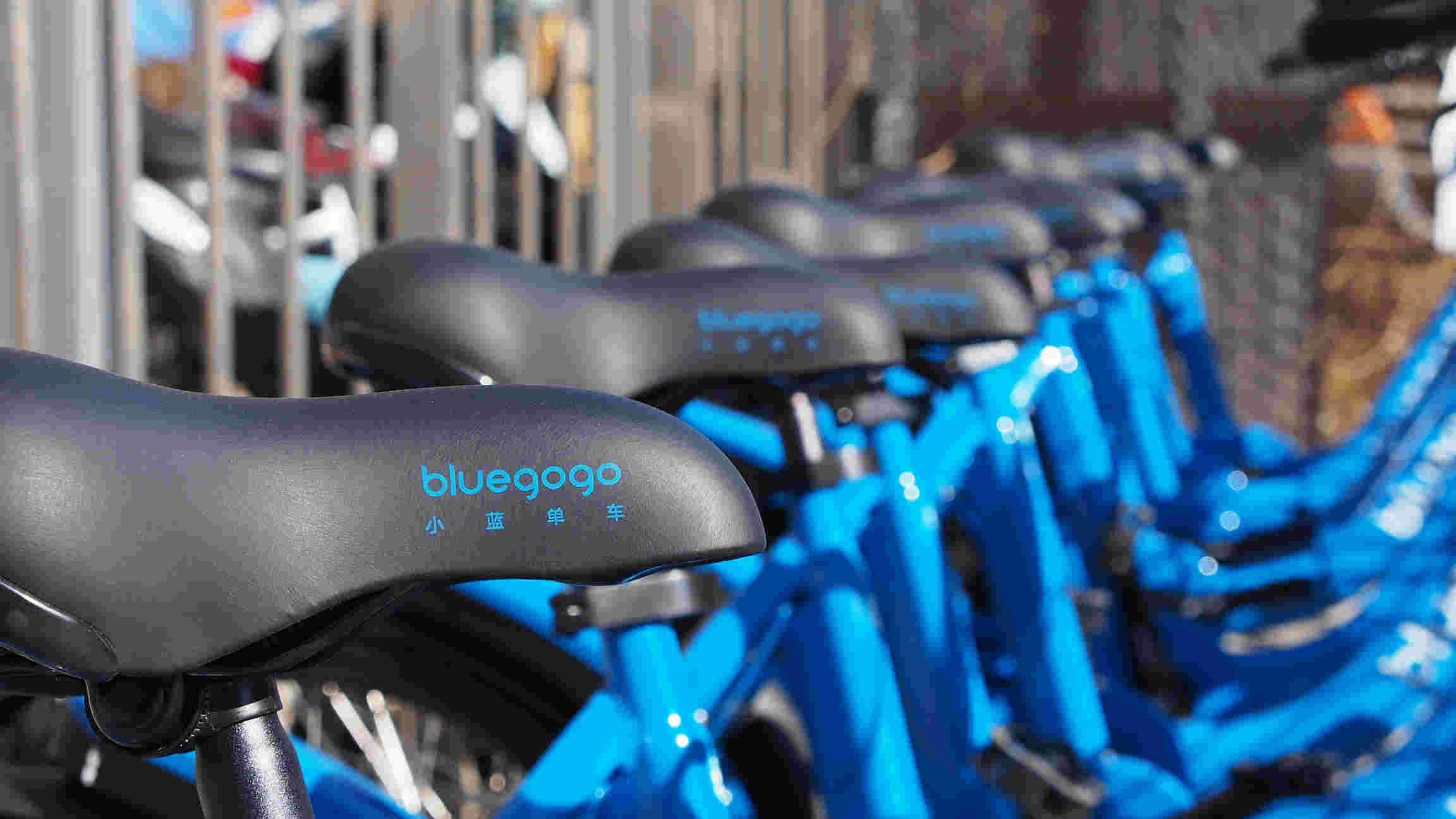

The San Francisco News reported that bluegogo, another Chinese operator, suspended its attempt to enter the US city after objections from local politicians and a rival project backed by US car company Ford.

Chinese bike-sharing company bluegogo suspended operations in San Francisco after local objections. /VCG Photo

The emergence of domestic copycats could also put a spoke in the wheel of Chinese bike-sharers - a service called Yobike, conceived by Chinese tech entrepreneur Bin Wang, has already successfully launched in the UK.

Business sense?

The bike-sharing phenomenon has sparked a cycle revival in China's cities, providing convenience and an environmentally friendly travel option on often gridlocked streets. But what is the business rationale behind these multi-million dollar investments?

Mobike and ofo now claim to provide around 20 million rides per day. Although each ride typically costs only one yuan (15 US cents) - and free rides are common - the journeys create significant data and mobile traffic, part of the attraction for China's major Internet companies.

Over 30 bike-sharing companies are currently competing on China's streets. /VCG Photo

"If you view these companies not just as transportation vehicles but as platforms for data about users and also gateways for other services, there’s a lot of value to explore,” Zhou Xin, a consultant at Trust Data, told Bloomberg.

Mobike's latest fundraising round was led by Tencent, the owner of WeChat, a social and commerce platform with over 900 million subscribers via which Mobikes can be rented.

"Over the past year, Mobike has achieved incredible growth. We will continue to offer our core resources and all the support we can -- including through our very successful WeChat partnership -- to continuously empower Mobike’s growth, innovation and expansion."

Pony Ma, chairman and CEO of WeChat owner Tencent, on June 16, 2017

Mobike also raised 215 million US dollars in a fundraising round in January and later secured undisclosed strategic investments from Foxconn and Temasek Holdings.

Proxy war?

A slew of bike-sharing services have hit China's streets over the past year - around 30 and growing - but the principal battle remains between Mobike, backed by Internet giant Tencent, and ofo, which has received significant investment from Alibaba affiliate Ant Financial and dominant ride-hailing app Didi Chuxing.

The rapidly accelerating startups were identified by Bloomberg this year as players in a proxy war between the Internet giants.

Ofo promotes payment services such as Alipay and is connected to Ant Financial's Sesame Credit system, while Mobikes can be released and paid for via Tencent’s WeChat.

Related stories:

Mobike expands bike-sharing service to Singapore