Business

23:17, 26-Mar-2017

Deposits in danger: How to lock a safe deal with bike-sharing companies?

Updated

11:10, 28-Jun-2018

An unmissable fleet of fluorescent orange, yellow and blue bicycles has hit the streets of urban China, and bike-sharing is gaining momentum by many Chinese people, especially for short distance trips.

More Chinese people are choosing shared bicycles. /CFP Photo

More Chinese people are choosing shared bicycles. /CFP Photo

According to a report from Beijing-based BigData Research, by the end of 2016, there were 18.86 million users of shared bicycles, and the number is expected to hit 50 million by the end of 2017.

A few questions

Paying a deposit is a requirement before renting a bike, and the majority of users would not ask to be refunded immediately, as the sum of money paid upfront allows them unlimited rides at a small, somewhat insignificant, fee. Therefore, large amounts of money are being poured in a big pool of money, raising a string of questions: how are these deposits used? Is it possible to embezzle these sums? How to monitor the shared bicycle companies?

Scale of the deposits' pool

In January, Ofo and Mobike, China’s leading bicycle-sharing companies, disclosed that the numbers of registered users have reached more than 10 million each.

Here is a simple math problem: Ofo requires its users to pay a deposit of 99 yuan (14.5 US dollars), based on the company’s figures, the total sum of deposit would be more than 990 million yuan (145 million US dollars). Mobike requires 299 yuan (44 US dollars) as a deposit from each user, its pool would reach 2.99 billion yuan (440 million US dollars). Together, the country’s top two bike-sharing companies would have had 4 billion yuan (580 million US dollars) by early 2017.

Lack of current supervision?

Some media reports have questioned the safety of such large sums of money and pointed at a vacuum in the current supervision system over their usage.

CFP Photo

CFP Photo

Currently, bicycle-sharing companies, such as Ofo, Mobike and Hello-bike, said they have opened special bank accounts to ensure the financial security of deposits, stressing that the advance payments are unavailable for other uses.

Generally, it takes less than seven working days for users to have deposits refunded, said Mobike sources.

Under risk?

Sun Jin from Wuhan University Competition Law and Competition Policies Research Center, said requiring prepayment is not prohibited by law. However, if the amount of deposit is too high or deposits are not refundable timely, consumer rights to fair dealing would be violated and shared bicycle companies not being able to meet their obligations to repay deposits becomes a risk.

“Because many users do not ask to be refunded the deposit instantly, bicycle-sharing companies collect huge amount of money,” said Cao Zhefu, a lawyer in Tianjin Zhongmei law firm.

It may lead to “disguised fund-raising or possession of fund,” Cao added.

CFP Photo

CFP Photo

Many experts say the biggest risk of bike-sharing schemes is that if these firms file for bankruptcy or large amounts of deposit are misappropriated, users could fail to get what they paid back.

Liu Chunyan, associate professor at Tongji University Law School, said some bicycle-sharing companies have announced that some users with good credit ratings would not need to pay money up front. That would heat up the battle for market share, and companies that require deposits would be crowded out, therefore their users would likely fail to get their deposits back.

How to monitor?

Liu said the funds deposited have financial attributes, and it is easy to cause market failure if the platform with financial attributes is free from supervision.

Liu added that because the bicycle-sharing model is still in its early stages, there is a pressing need for government regulation and oversight.

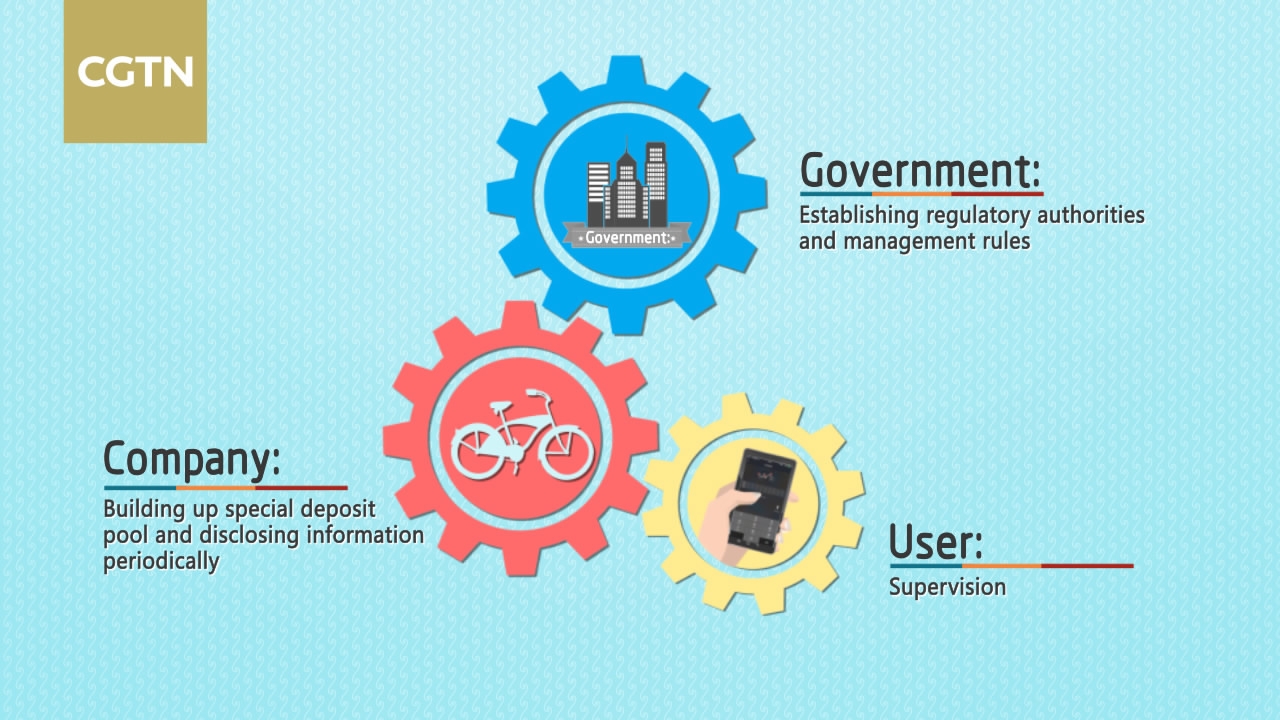

Government, shared bicycle companies and users should work together. /CGTN Photo

Government, shared bicycle companies and users should work together. /CGTN Photo

Many experts believe that a joint scheme among government, shared bicycle companies, and users is needed to counter the risk of deposit management.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3