“Team up, mate?” this has become a common greeting for Chinese game players recently, thanks to the huge success of mobile game Honour of Kings. The phrase originates from players inviting friends to join them in the blockbuster game, which has hooked young Chinese.

Honour of Kings (“王者荣耀” in Mandarin), a mobile multiplayer online battle arena (MOBA) game, has over 200 million registered users and 50 million active daily users. That’s roughly the same as the total population of South Korea.

A young boy plays Honour of Kings. /Photo from Internet

A patient doesn't want waste his time, playing the game. /Photo from Internet

The world’s highest grossing iOS game in March and April, Honour of Kings has made about three billion yuan (some 441 million US dollars) in gross revenue for each month of the first quarter of 2017.

Launched by China’s largest Internet company Tencent, gamers sign up with their QQ or WeChat accounts to play what is essentially a five-on-five mobile version of League of Legends (LOL). LOL was originally published in 2009 by Tencent-owned Riot Games, a US-based game developer.

Since its launch in November 2015, the mega-hit game, also known as Glory of Kings, has long been the most downloaded app in China. And now it is heading abroad.

Shaoxing City in east China’s Zhejiang Province held its first Honour of Kings competition in April 2017. /VCG Photo

Chinese mobile games' first moves overseas

In late 2016, Honour of Kings launched versions in Thai and Vietnamese. It finally made its first forays in Western markets under the new name Strike of Kings, which launched on February 20, 2017. Two months later, the game entered the South Korean market.

Versions of Honour of Kings /Screenshot from AppAnnie

The European version of the game, adapted in partnership with DC Comics, is available in 14 countries such as Austria, the Netherlands and the United Kingdom.

The hit game has graced the top 10 rankings both on App Store and Google Play in Vietnam, Thailand and Turkey, according to mobile market consultancy AppAnnie.

Obviously, Honour of Kings is not the only successful game to have looked to markets overseas. Another hugely-popular game named Onmyoji (“阴阳师” in Mandarin), made by leading Chinese Internet company NetEase, released a Japanese version on February 23, 2017. The role-playing game (RPG) topped the country’s list of most popular free apps within 24 hours.

Versions of Onmyoji /Screenshot from AppAnnie

Unlike these massive mobile game companies, small-and-medium-sized developers started their overseas businesses even earlier, such as IGG’s Castle Clash in 2013 and Elex’s Clash of Kings in 2014. The games are all the rage in certain regions, but have failed to take the entire world by storm.

According to research institute Cheetah Lab, an increasing number of mobile games from Chinese developers made it into the top 1,000 rankings globally in 2016, almost rising 80 percent year-on-year.

Chinese game giants look abroad

A noticeable growing trend is that China’s giant Internet companies like Tencent and NetEase have decided to promote their games abroad since 2016.

In 2013, most established companies were focusing on developing PC games, with mobile gaming and talk of overseas expansion left to smaller counterparts. It wasn’t until 2015 that China’s Internet titans saw the potential in “going mobile.”

Last year, Tencent and NetEase, the two top-grossing game developers, enlarged their duopoly over China's mobile games market, with a combined market share approaching 70 percent.

China’s biggest game companies face increasing pressure when it comes to increasing revenues in the domestic market due to narrowing room for growth, so the most logical step is to look for new markets overseas.

Onmyoji cooperated with KFC to release its own special meal in April 2017. / VCG Photo

In a report jointly published by China Audio-video and Digital Publishing Association and Gamma Data, Chinese publishers earned 4.65 billion US dollars in 2016, accounting for 13 percent of the global mobile game market. It estimated that the overseas sector will grow further, reaching an estimated worth of seven billion US dollars, and making up 71.5 percent of total overseas game revenue in 2017.

How can Chinese game companies succeed overseas?

How can Chinese game companies perform better in overseas markets?

1. Companies can use their experience of overseas markets and local conditions to adapt their strategies and find shortcuts to growing popular abroad.

VCG Photo

Up to now, big companies like Tencent have taken a fairly prudent and slow approach to overseas expansion. Honour of Kings and Onmyoji have been available overseas for more than half a year, but the latest version is still unavailable outside of China. By contrast, Mobile Legends, a MOBA game produced by Shanghai-based Moonton Technology, reportedly launched overseas within three months, and became one of the top 10 most downloaded apps in 59 markets.

2. With sufficient funds, big companies have the budgets to properly market and promote their games. On May 31, NetEase released a promotional video for Onmyoji featuring renowned Japanese actress Haruna Kawaguchi on YouTube, garnering over one million views.

Screenshot of Onmyoji’s promotional video

3. Working closely with a publisher who understands the market is a shortcut to increased local appeal. Again, gaming titans like Tencent have a financial advantage. Tencent has cooperated with Japanese developer Aiming, and invested over 3.5 billion US dollars in overseas mobile game firms like South Korea-based CJGames and US-based Riot Games, according to baijingapp.com.

Cosplay of figures from Onmyoji /VCG Photo

4. Chinese publishers no longer have to purely cater to the local tastes of overseas gamers, but can also try to regain the initiative and develop innovative games, Google Play’s Greater China Business Development Zhang Lei said.

According to AppAnnie, strategy games made up the majority of the most popular Chinese games according to overseas revenue in 2016. As Chinese game giants have gradually stepped into overseas markets, other Chinese companies tried to provide multiple choices to overseas consumers. Ding Lei, founder and CEO of NetEase said that apart from Onmyoji, NetEase also published a virtual reality game and a strategy game for overseas markets.

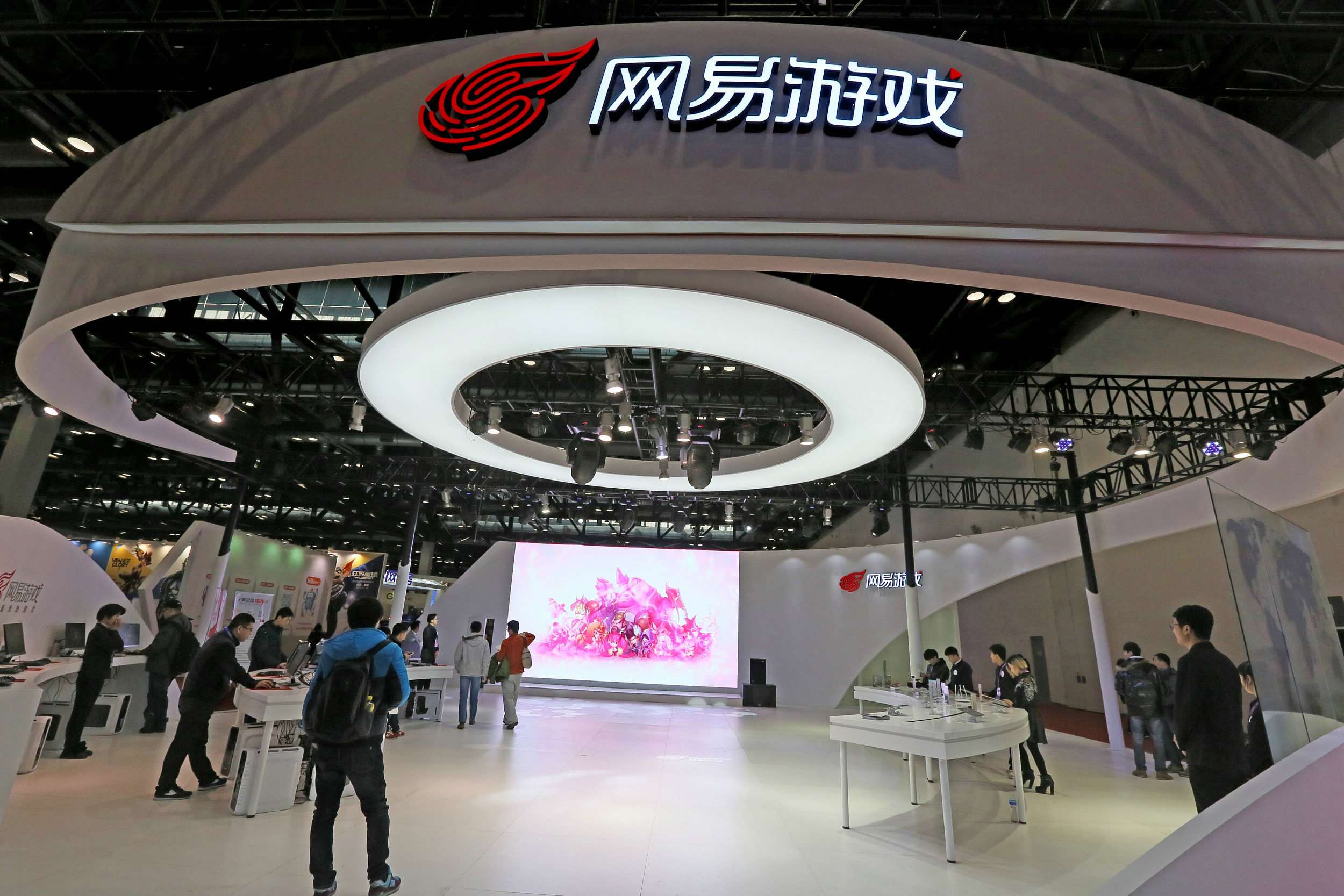

A booth of NetEase Game /VCG Photo

However, publishers still face an uphill struggle when they first enter unfamiliar markets, as they do not have a strong influence over local consumers, especially in mature and long-established gaming markets in Europe, the US and Japan.

Chinese companies merely took a three-percent share in the Japanese market in 2016, and earnings mainly came from just a few popular games, according to a report jointly published by China Audio-video and Digital Publishing Association and Gamma Data.

Overseas students participated in the Honour of Kings campus competition in China in June 2017. /Photo from Internet

Gaming connects different cultures as a form of entertainment. Chinese game giants, despite their struggles, are well on their way to becoming a global force as they link gamers from around the world. What do you think about the future of gaming?