Politics

17:05, 09-Mar-2017

China’s top SOE regulator outlines recent achievements, and goals for this year

Updated

11:00, 28-Jun-2018

Xiao Yaqing, head of China’s State-Owned Assets Supervision and Administration Commission of the State Council (SASAC), met with the media to discuss state-owned enterprises (SOE) reforms on Thursday, on the sidelines of the annual Two Sessions.

“We have made a number of breakthroughs and achievements in key, difficult areas of reform. For instance, corporate governance structure and general management hiring. Certain companies have successful experiences in selecting managers or deputy managers directly. We have also pushed forward the restructuring of state-owned enterprises,” said Xiao, chairman of SASAC.

China's State-Owned Assets Supervision and Administration Commission (SASAC) briefed the media on SOE reforms, on the sidelines of the Two Sessions, March 9, 2017. /CFP Photo

China's State-Owned Assets Supervision and Administration Commission (SASAC) briefed the media on SOE reforms, on the sidelines of the Two Sessions, March 9, 2017. /CFP Photo

For 2017, Xiao said certain goals need to be achieved in order to further promote mixed-ownership of state-owned enterprises. He said regrouping of centrally-administered enterprises will be pushed hard, especially in the steel and coal sectors, as well as heavy machinery and thermal power.

Xiao also said that “corporatization reform” will be accelerated among SOEs. The reform will be completed among centrally-administered enterprises this year.

The revenue for centrally-administered state-owned enterprises was 23.4 trillion yuan (3.39 trillion US dollars), a 2.6 percent increase from a year ago, amid a downward economic pressure in 2016 in China. Profits from last year’s central SOEs came to 1.23 trillion yuan (178 billion US dollars), a 0.5-percent increase from a year ago. He said it reflected the stability of the country’s economy.

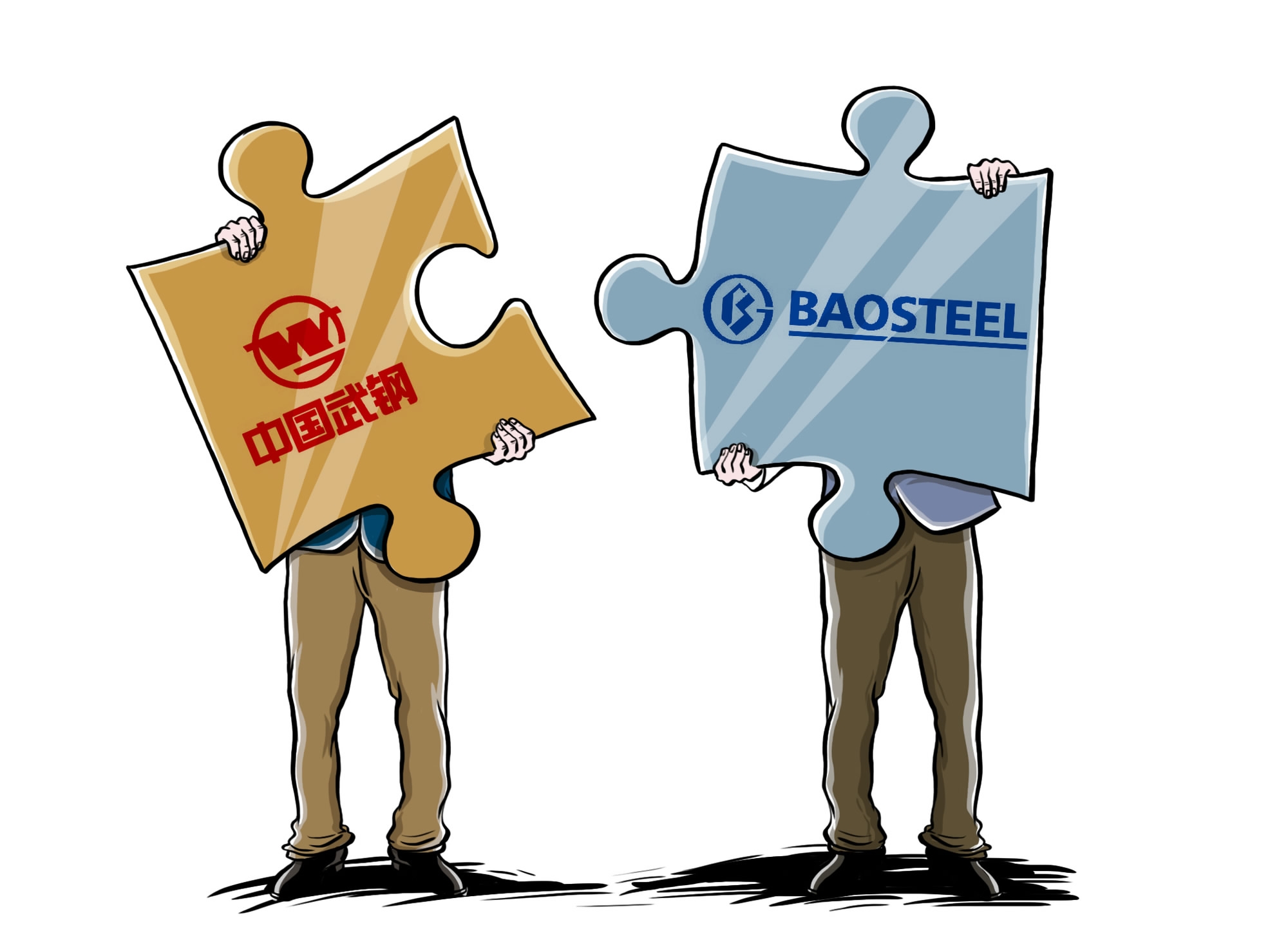

Regrouping of central SOEs has seen progress. For instance, after Baosteel and Wuhan Steel’s merger, allocation of capacity improved, greatly reducing redundancies in construction and investment. Tens of millions of tons in steel and iron overcapacity were cut.

Baoneng Steel and Wuhan Steel completed their mega-merger in September 2016. /CFP Photo

Baoneng Steel and Wuhan Steel completed their mega-merger in September 2016. /CFP Photo

Regarding mixed ownership, Xiao said this should be expanded. But he also said it does not apply to all state-owned enterprises. Those who would benefit from mixed ownership should do it, while some should use holding companies, and others should be state-owned. “Ownership is a very important measure, but it’s not the only way to solve all problems,” he said, “In the process of advancing mixed ownership reform, the right direction must be followed by the central government.”

Mixed ownership would allow private funds to come into state firms and improve corporate governance.

There were a number of mergers and acquisitions in 2016. Ten SOEs combined into five. Aero Engine Corporation of China was established in August, focusing on airplane engines and related technology. The number of SOEs under the state asset watchdog is now down to 102.

7km

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3