OPEC has surprised its doubters and sent crude oil prices up by announcing its first oil output reduction since 2008.

Qatar's energy minister Mohammed Al-Sada (L), president of OPEC, and Secretary-General of OPEC Mohammed Barkindo attend a press conference after an OPEC ministerial meeting in Vienna, Austria, on November 30, 2016. /Xinhua Photo

The landmark deal by the cartel had an immediate impact on the energy market, pushing up crude prices by around 10 percent.

“OPEC has proved to the skeptics that it is not dead. The move will speed up market rebalancing and erosion of the global oil glut,” said OPEC watcher Amrita Sen from consultancy Energy Aspects.

Output Cut

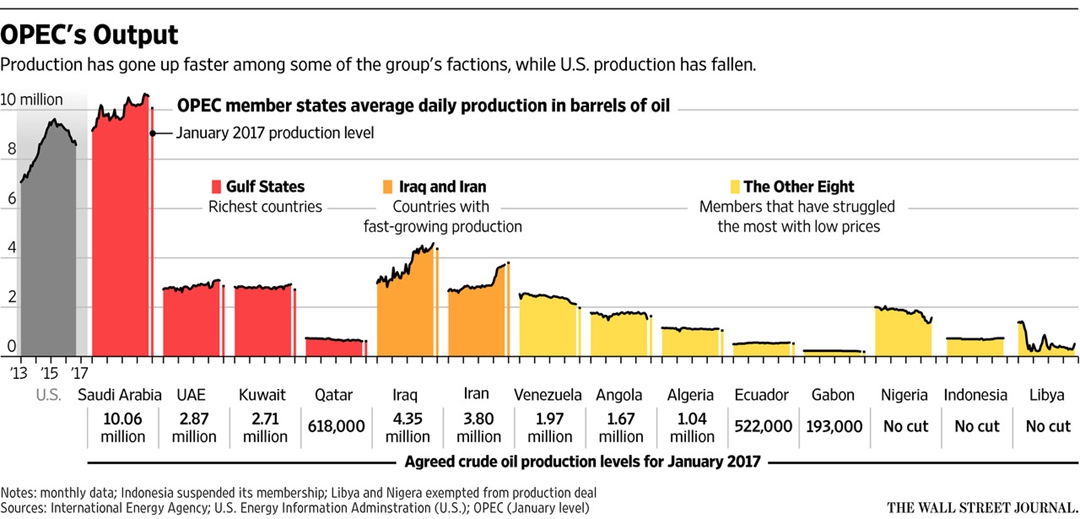

OPEC on Wednesday decided to cut its oil output by 1.2 million barrels per day, setting the ceiling of oil production at 32.5 million barrels per day. /WSJ Photo

The 14-member group overcame bitter divisions between the group’s three largest producers – Saudi Arabia, Iraq and Iran – and agreed in Vienna on Wednesday that it will cut oil output by 1.2 million barrels a day, amounting to about one percent of global production.

Most strikingly, Saudi Arabia, OPEC’s largest producer, which has raised oil production to record levels this year, took the biggest share of reduction by 486,000 barrels a day.

Khalid al-Falih, Minister of Energy, Industry and Mineral Resources of Saudi Arabia, attends the 17th OPEC Ministerial Meeting in Vienna, Austria on November 30, 2016. /CFP Photo

Iraq, OPEC’s second-largest producer, also promised to cut by 210,000 barrels a day, despite its previous claim for special consideration to fight against ISIL.

Exempted from the oil reduction, Iran is allowed to raise output by 90,000 barrels a day, as it recovers from Western sanctions.

OPEC also expects non-member producers to cut an additional 600,000 barrels a day.

Russia, the biggest producer outside the bloc, agreed to an unprecedented cut of as much as 300,000 barrels a day “conditional on its technical abilities.”

It is not clear whether other non-OPEC producers will join the oil reduction. The cartel plans to hold talks with non-OPEC producers next week in Doha.

Why Cut

OPEC’s agreement to cut production boosts crude price.

As a cartel that controls a third of the world’s crude, OPEC hopes to help shrink a supply glut and end depressed oil prices that started in 2014.

The main aim of the cut is “inventory normalization,” according to Jeff Currie, global head of commodities research at Goldman Sachs.

IEA believes that if OPEC members implement their Algiers resolution, the resultant production cut will see the market move from surplus to deficit very quickly in 2017.

The record global oil inventory has made the last two years painful for OPEC, sending its oil export earnings down from 753 billion US dollars in 2014 to a predicted 341 billion US dollars this year.

“What was announced so far is bullish, but January is still far away,” said Giovanni Staunovo, an analyst at UBS.

Questions still remain about the long-term impact of the deal and the ability of the group to enforce the cut.