Business

13:00, 12-Mar-2017

Chinese phone brands dial up efforts to go global

Updated

11:00, 28-Jun-2018

China’s smartphone makers were out in force at the Mobile World Congress in the Spanish city of Barcelona last week, demonstrating that they are not just fast adopters, but innovators as well. They hope that cutting-edge technology will take them global.

CGTN Photo

CGTN Photo

Imitation or innovation: Can Chinese brands flourish worldwide?

In the 1970s, electronics from companies in rapidly industrializing Japan flooded Western markets. Goods from Sony, Sanyo, Sharp and others first imitated and undercut, then improved upon and outmuscled products from domestic manufacturers like RCA and GE. In the 2000s, gadgets from South Korean makers like Samsung, Hyundai and LG repeated the exercise on their Japanese forerunners: undercut on price, outpace with innovation, profit.

For years, Chinese phone makers served in the shadows as manufacturers for Nokia and others. Everything changed after Google introduced Android in 2008.

The inexpensive and customizable mobile operating system, an answer to Apple’s status-quo–shattering iPhone, made it possible for any electronics company with some savvy to develop a worthy alternative.

In no time, Chinese companies shifted their strategies from churning out white-label devices for others to building brands for themselves.

CFP Photo

CFP Photo

Chinese phone makers are now facing a new era in the smartphone market, a Chinese era, studded with a new generation of wily entrepreneurs and clever engineers armed with lessons learned from those that came before.

Yes, some copy Western ideas, sometimes even down to trendy minimalist outfits as nearly everyone in the phone industry wears black onstage in emulation of Steve Jobs. But many are genuinely innovating as they race to become the next Nokia of the 1990s: affordable, high tech, global.

Gradually they have won over Chinese consumers. Local names displaced iPhones and Samsung Galaxy devices by market share in 2016, according to International Data Corporation (IDC). They have done so by going steadily up-scale, employing vast retail networks, and speeding up packing the bells and whistles.

Seven of the top 10 Chinese patent-appliers in 2016 make smartphones, according to the State Intellectual Property Office (SIPO). Of those, OPPO, Huawei and Xiaomi filed close to 12,000 applications or a third of the total, the SIPO data showed.

“In terms of technology and innovation, Chinese players are very close to industry leaders like Samsung,” said Kitty Fok, a research director at IDC China. “China’s gigantic mobile Internet market helped to boost online services, which require hardware with better performance. Many local players caught the opportunity to shake off the copycat label.”

For instance, the current Chinese market leader, OPPO, made features like rapid charging, low-light photography and 6GB memory standard (the iPhone still lacks quick charging). OPPO is now focusing its energies on the camera, targeting selfie-obsessive youngsters, as well as amateur snappers.

In Barcelona, OPPO unveiled what it calls its most advanced mobile photography technology yet. Its “go five times further” tagline at the Mobile World Congress referred to an optical zoom technique that combines telephoto and wide-angle lenses and a specially designed prism with software to achieve a 5x zoom effect.

Chinese smartphone brands awareness on the rise

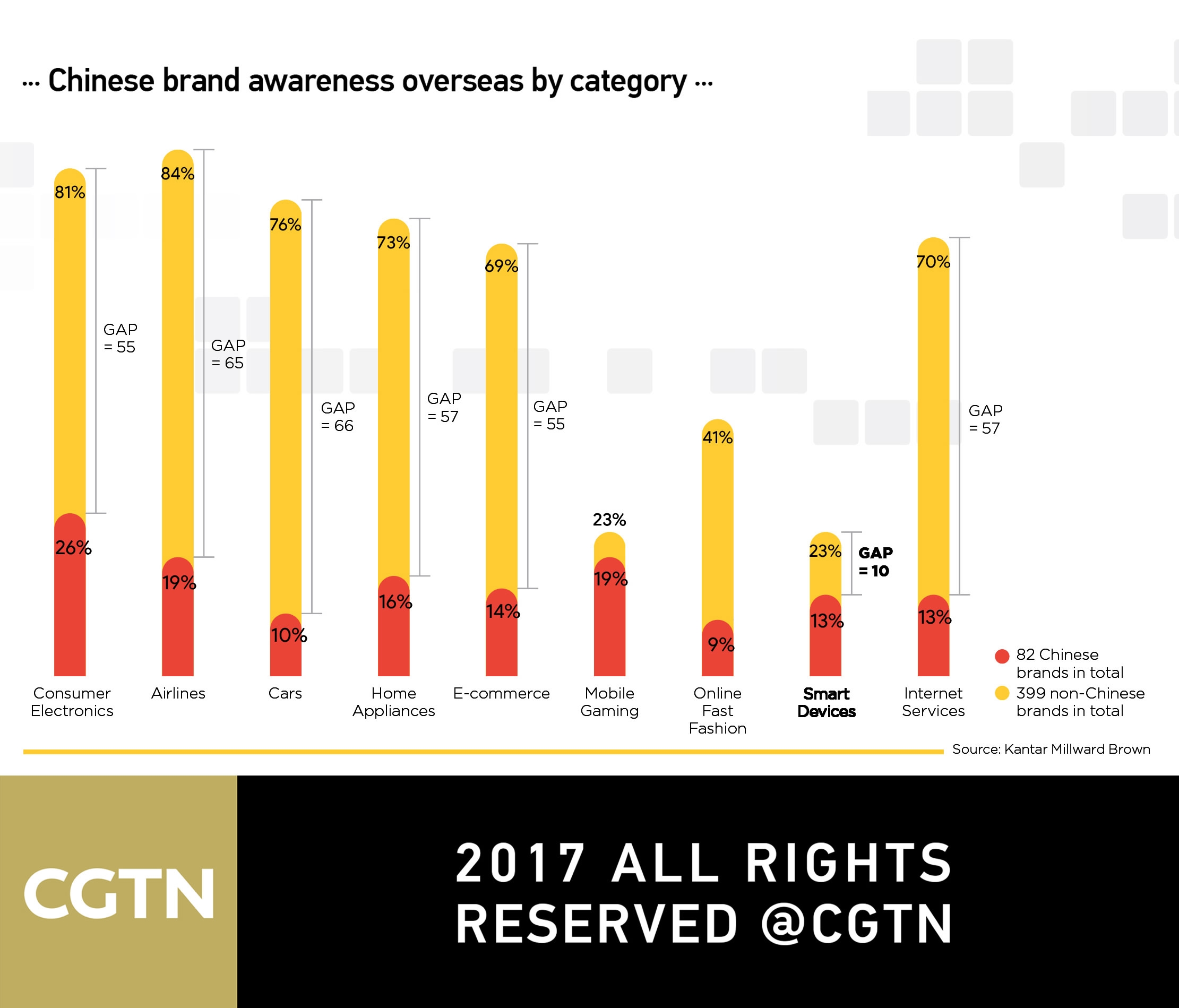

People outside of China would historically have struggled to name a Chinese phone brand. But marques from the Middle Kingdom have become far better known recently, despite entering overseas markets late. In some of the countries in which they are competing, there are few local competitors, resulting in a narrower awareness gap.

According to brand equity database BrandZ, a gap of 66 percentage points separates people aware of a local or global car brand from those aware of a Chinese brand. In contrast, the gap in smart devices is only 10 percentage points.

Next Steps

The great challenge facing China’s phone makers is that their global expansion will pit them against the same multinational tech giants they bested in their favorable home market.

Strategy Analytics, a market research firm, has also shared a report on profits made by smartphone manufacturers in 2016.

CFP Photo

CFP Photo

As the tradition goes, Apple continued to rake in the most profit in the global smartphone market, with the report claiming a figure of 79.2 percent of the overall industry and 44.9 billion US dollars total operating profit for last year.

In comparison, Samsung secured 14.6 percent of global smartphone industry profit in 2016 and managed to rake in only 8.3 billion US dollars of operating profit last year.

Chinese manufacturers Huawei, OPPO, and Vivo all managed to rake in a positive share of the global smartphone industry's profit last year, the report added. Huawei accounted for 1.6 percent in global profit, OPPO grabbed 1.5 percent, and Vivo accounted for 1.3 percent.

These numbers highlight Apple's abilities of maximizing profit margins by minimizing product cost and not competing on price, something that other OEMs haven't been able to crack.

Still, the race is on and Chinese phone makers can’t look back. In almost every corner of the globe, Chinese players are present in this market and ready to make a sale.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3