The world’s largest bank by assets, Industrial and Commercial Bank of China (ICBC), is deeply involved in providing easy financing and smoothing trade along the routes of the Belt and Road Initiative.

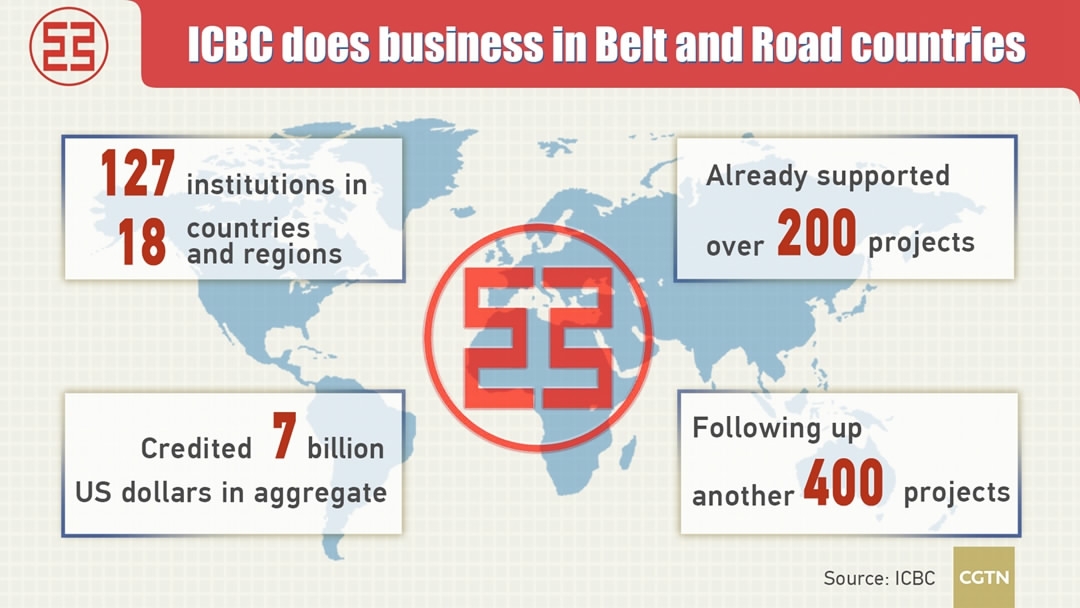

The bank has so far established 127 institutions in 18 Belt and Road countries and regions, and supported over 200 projects with seven billion US dollars in aggregate credit, ICBC President Gu Shu told CGTN in an exclusive interview.

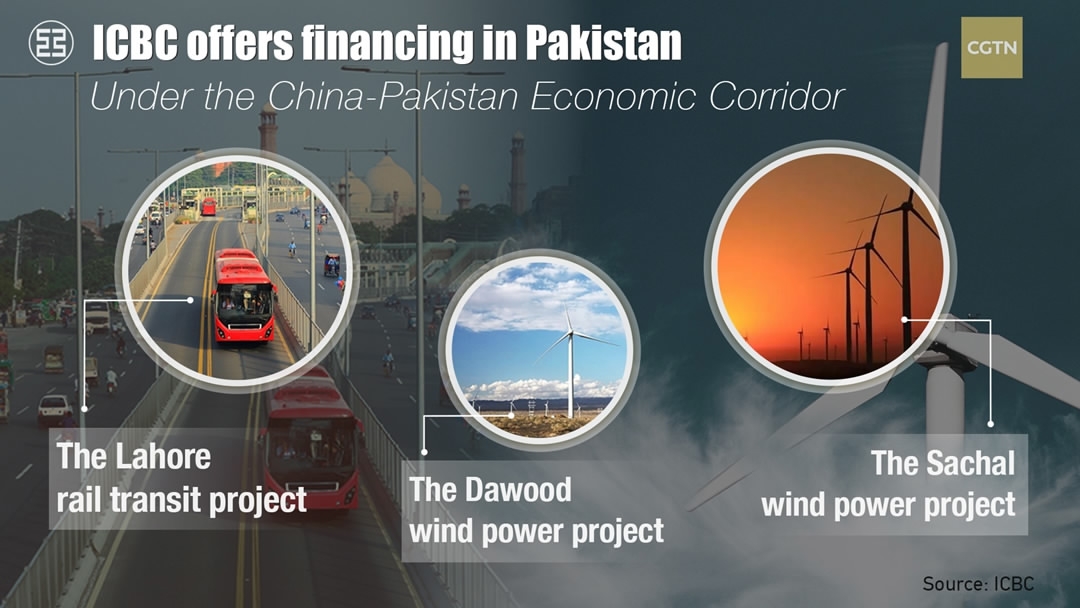

In January, for example, ICBC’s institution in Pakistan provided 13 million US dollars in financing to the country’s first urban rail transit project. It will be designed and built based on Chinese standards in Lahore, Pakistan’s second most populous city and a key industrial center.

Two years ago, ICBC bought a 60 percent stake in Standard Bank’s London-based global markets business. As a commodity trading platform, ICBC-Standard Bank can offer clients from Belt and Road countries cash and derivative products in all liquid currencies.

Gu told CGTN, “ICBC-Standard Bank can help companies in these [Belt and Road] regions to mitigate [commodity trading] price volatility, so they can have more stable and better income for their development.”

Customers queue to draw money from an ATM outside a branch of South Africa's Standard Bank in Cape Town on March 15, 2016. /Reuters Photo

Proposed by Chinese President Xi Jinping in 2013, the Belt and Road Initiative is strengthening infrastructure and connectivity from Asia to Europe and Africa via a wide network of projects, reducing business costs and stimulating trade and investment.

Promoting green finance

ICBC targets environmentally friendly projects in Belt and Road countries, such as those focused on energy saving, pollution prevention, resource conservation and recycling. The bank offers direct financing to make the initiatives sustainable.

“We follow international standards and we make sure that every project is environmentally friendly,” Gu told CGTN. “We carry out stress tests for each project and assess the project impact on the environment.”

Solar panel. /VCG Photo

As the largest green bond underwriting bank in China, ICBC has issued bond instruments to raise funds to support or refinance green projects since 2015. The bank sold green bonds worth 38.3 billion yuan (5.6 billion US dollars) in 2016.

ICBC is backing 16 State Grid biomass power generation projects with green bonds. This could save 999,200 tons of standard coal — equivalent to the reduction of about 2,456,900 tons of carbon dioxide emissions — compared with traditional thermal power projects.

This photo taken on February 3, 2016 shows the wood storage facility of France's largest biomass-fired power plant in Gardanne, southern France. /VCG Photo

“And we are also the first bank that has conducted and published surveys and research on how credit risks can be incurred by environmental issues,” Gu added.

Rising to challenges

Belt and Road countries have diverse legal and regulatory systems and are at different stages of economic and financial development. Gu outlined three challenges faced by ICBC when operating along the routes.

Some Belt and Road countries have legal systems based on Islamic law, others have a common law system or continental law system, so the bank has had to adapt to differing taxation, foreign exchange, investment and other administrative requirements.

Economies in the Belt and Road regions are at different levels of development. Some are developed, others are developing or underdeveloped. Some are market-oriented, but others are government-driven.

London Stock Exchange. /VCG Photo

Financial systems in the countries are also quite diversified. “In some countries, for example, currencies are not freely convertible; in other countries, lending in another country’s currency is strictly prohibited,” explained Gu.

Despite the challenges, ICBC’s backing for a further 400 Belt and Road projects is in the pipeline, according to Gu.

The bank president believes projects in fields like infrastructure, telecommunication and energy can benefit the lives of millions of people living along the Belt and Road routes for generations to come.

Copyright © 2017