Samsung Pay to play catch-up in the UK market

2017-05-17 17:00 GMT+8

8150km to Beijing

Editor

Yao Nian

By CGTN’s Natalie Powell

Samsung Pay has now come to the UK, 18 months after it was released in the US.

Banco Santander SA, MBNA Corp and Nationwide are now the three major banking partners of Samsung Pay in the UK market.

Contactless card payments hit the UK in 2015 and have created a huge market since. A quarter of all card transactions are made using the technology, according to a January report from the UK Cards Association.

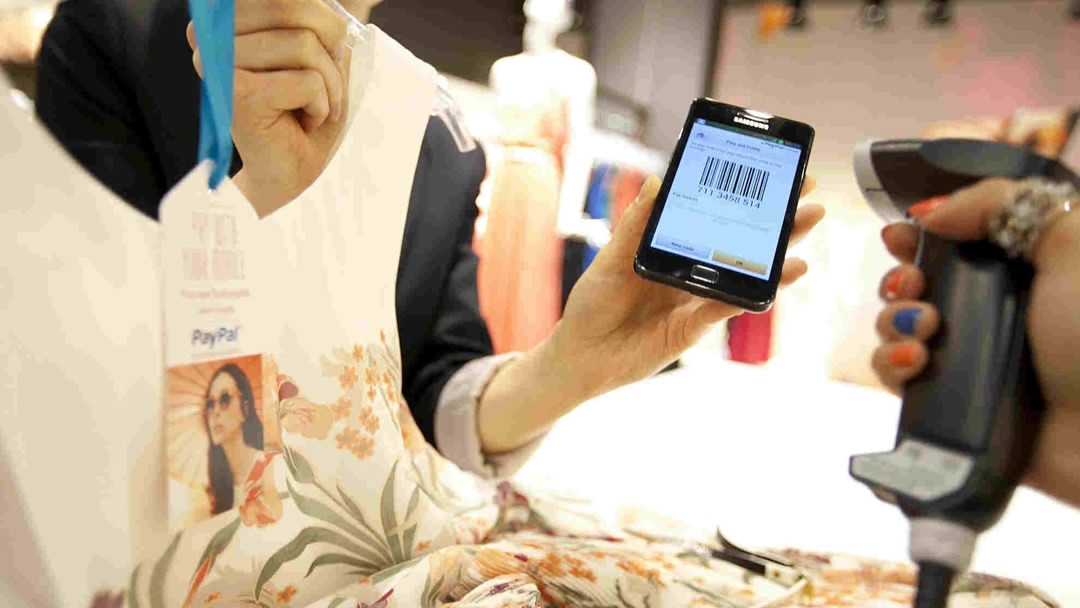

Online payment has long been available in the UK for several years.PayPal UK launched its smartphone app allowing shoppers to pay safely on the high street via PayPal back in 2012. /CFP Photo

Released with very little fanfare, the Samsung Pay service simply appeared in the UK’s Galaxy App Store as a download. That means Samsung Galaxy users in the UK can now pay for goods through this system using their smartphones.

UK businesses are also getting on board with the cash-free payment technology. Carve, a restaurant in London, adopted it to reduce cost.

“We think it’s 21st century, technology is taking over, people haven’t got time to carry cash. So it was to get a lot of speed into service as well as taking out the complexity within the business of cash handling, cashiers, which add cost to the business,” said Atif Amin, co-founder and director of Carve.

Samsung Pay mobile wallet system is demonstrated at its Australian launch in Sydney on June 15, 2016. /CFP Photo

As convenient as contactless payment is, latecomer Samsung Pay faces a great deal of competition from Android and Apple Pay in the UK market.

“I think it’s difficult, obviously it’s only available on Samsung devices and anyone already using a Samsung device could already be on Android Pay and you’ve got to move these consumers to Samsung Pay,” said James Peckham, Phones Writer with TechRadar.

However, Bloomberg reports a notable difference between Apple Pay and Samsung Pay in London’s public transit system. Apple Pay requires users to scan their fingerprint to pay for a bus ride, which Samsung Pay users will not have to do. That’s because Samsung has worked with London’s public transit regulator to allow Samsung devices to complete a payment without authentication to speed up boarding.

8150km

Copyright © 2017