Powered by new growth engines and reforms, the Chinese economy has maintained a strong performance despite downward pressure and uncertainties.

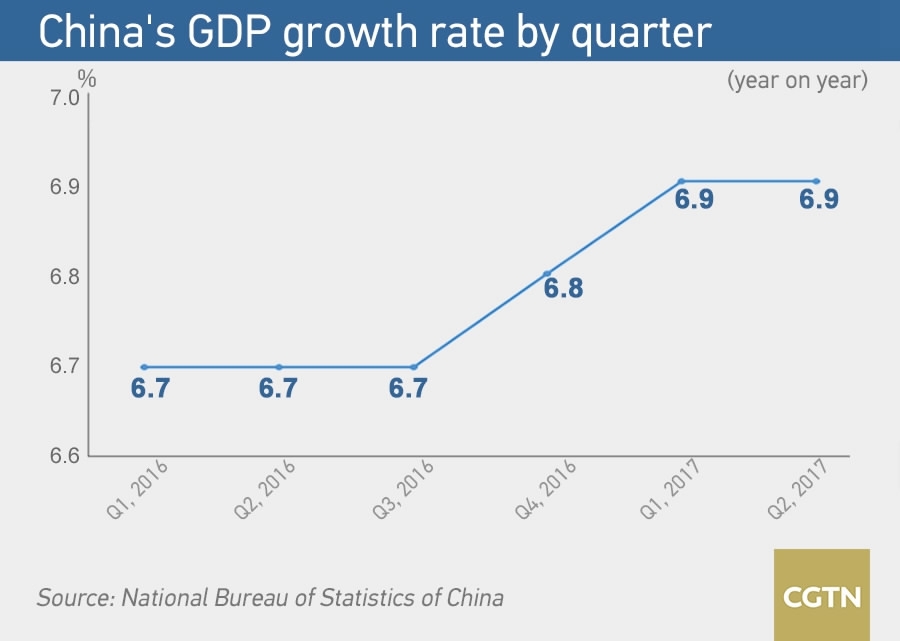

China's GDP grew by 6.9 percent year-on-year in the second quarter of 2017, flat from the first. Compared with the quarterly growth rates of 6.7, 6.7, 6.7 and 6.8 percent respectively last year, the world's second largest economy shows a more robust momentum this year.

CGTN Graphic

The latest figures released by the National Bureau of Statistics (NBS) on Monday leave little doubt that China will meet its annual growth target of "about 6.5 percent."

"I'm pretty optimistic," Jeremy Stevens, an economist at Standard Bank, told CGTN. "I don't think growth will go below 6.5 percent for either of the next two quarters."

Decoding Chinese economy

Stevens called the performance of China's economy in the first half of 2017 "pretty impressive."

This impressiveness is not only highlighted by the growth rate, but also achievements in economic restructuring and improvement of people's livelihood.

The figures show that consumption has contributed more to growth while the service sector has expanded its share in the economy.

In the first six months of 2017, retail sales of consumer goods grew by 10.4 percent year-on-year, up from 10 percent for the first quarter.

The service sector grew by 7.7 percent, outpacing a 3.5-percent increase in the primary industries and 6.4-percent in the secondary industries. By the end of June, the service sector already accounted for 54.1 percent of the overall economy.

Some 7.35 million new jobs were created in China's urban regions from January to June, 180,000 more than the same period last year, while per capita disposable income grew by 8.8 percent, higher than the GDP growth rate of 6.9 percent.

According to NBS spokesperson Xing Zhihong, the steady growth was the result of progresses in supply-side structural reform and new development concepts.

In a commentary published on People's Daily's social media account on Monday, reporter Lu Yanan echoed Xing's words, attributing the impressive economic performance to the country's new growth engines and deepening reforms.

"According to estimates by some experts, new engines already contribute to 30 percent of China's economic growth," Lu wrote. "The new engines such as sharing economy, platform economy and high-tech industries have activated consumption, boosted job growth and facilitated the upgrade of traditional industries, becoming the locomotive of the future of China's economy."

A smooth shift from traditional growth engines to new ones needs more "dividends" of reforms, she added.

Shared bike boom in China. /VCG Photo

Reforms and risks ahead

China's faster-than-expected GDP growth has given policymakers room for deeper reforms, a Reuters article said on Monday.

Chinese officials will have more room to rein in financial risks by deleveraging and controlling debt levels, the report explained.

At the fifth National Financial Work Conference last week, Chinese Premier Li Keqiang noted that deleveraging should be pushed forward in an "active yet prudent" way, indicating a fine balance between deleveraging and maintaining growth.

"Given a reasonably healthy economy, we will see similarly contractive measures into the future," Brock Silvers, managing director of Kaiyuan Capital, told CGTN on Saturday.

While expressing his confidence that China's economic performance in the first two quarters "has laid a solid foundation for achieving the annual target," the NBS spokesperson also warned of uncertainties and instabilities in the world as well as prominent long-term structural contradictions at home.

Xing's concern is shared by some economists.

"In general, we expect GDP growth to remain robust in the second half but slower than the first half, due to the high base," Citi economists said in a research note. "Looking ahead, uncertainty remains on investment and trade."

A new energy vehicle exhibition in Beijing, July 14, 2017. /VCG Photo

Chen Yanbin, a researcher at Renmin University of China, said at an economic forum on Monday that the Chinese economy would still face downward pressure in the second half of the year.

The pressure could come from a cool-down of the housing market, a slowdown of fixed asset investment growth, an increase of production costs for enterprises, a rise of financing costs for the real economy amid deleveraging as well as external uncertainties.

Chen suggested lowering overall taxes for residents and enterprises, which could further invigorate the economy. He also said a slightly more relaxed monetary policy could contribute to economic stability.

Related stories:

NBS: China's economy keeps 'steady, sound' growth in H1

Experts: Consumption and investment drive Chinese economy in H1