For the first time in the era of the modern automobile, the most valuable US car maker is not based in Detroit.

Silicon Valley's Tesla Inc. overtook General Motors (GM) on Monday to become the US car maker with the largest market capitalization as the century-old automobile industry increases its reliance on software and cutting-edge energy technology.

That milestone is likely to be on the minds of Tesla Chief Executive Elon Musk and GM Chief Executive Mary Barra as they and other CEOs visit the White House on Tuesday to brainstorm tax reform and infrastructure with President Donald Trump.

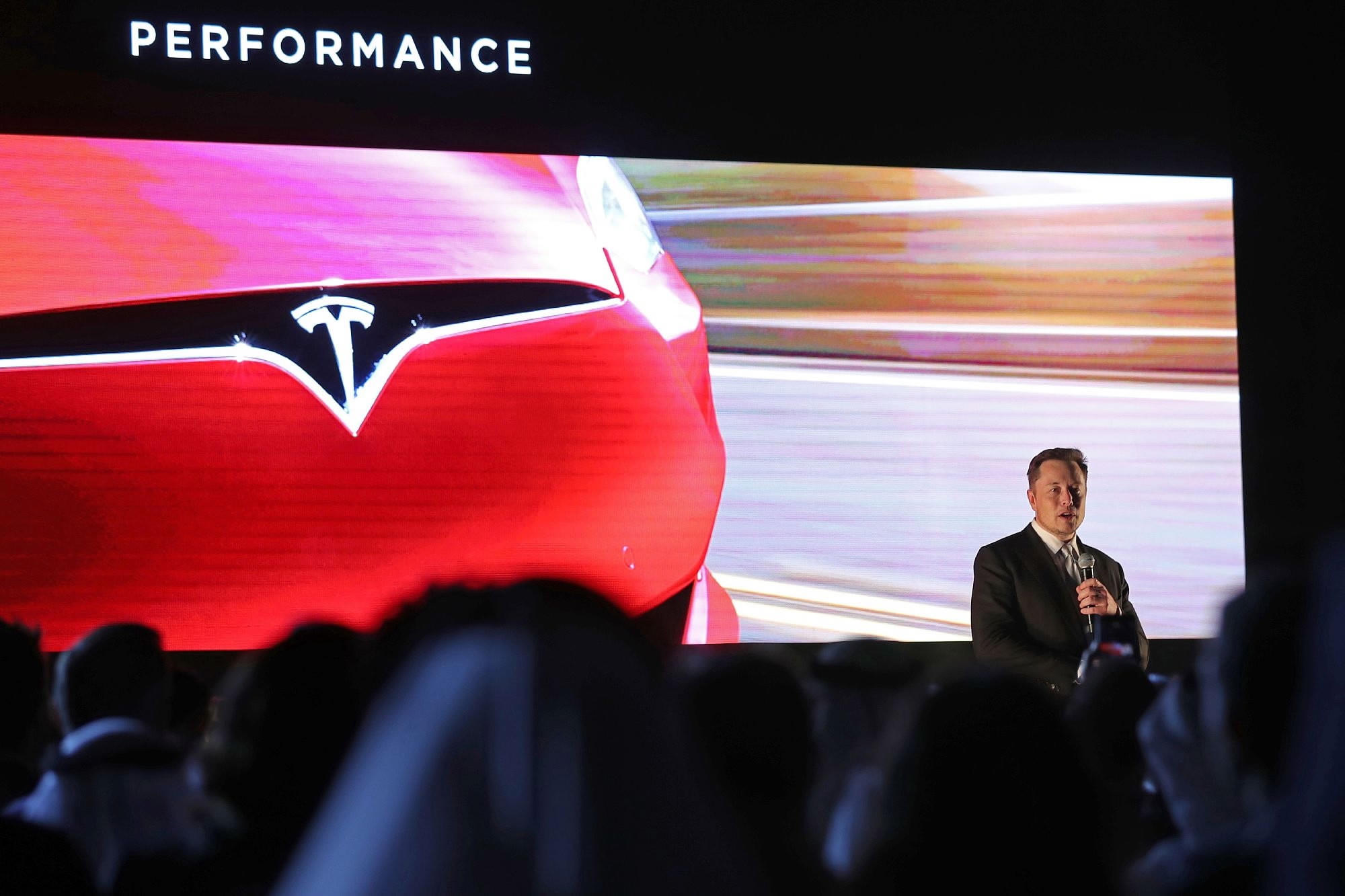

February 13, 2017: Elon Musk, co-founder and chief executive of Electric carmaker Tesla, speaks during a ceremony in Dubai. /VCG Photo

Helped by an analyst's recommendation, Tesla rose 3.26 percent to a record high of 312.39 dollars on Monday. Its market value of 50.887 billion dollars exceeded GM's by about 1 million dollars.

Over the past month, the luxury electric car maker has surged 35 percent as investors bet that Musk will revolutionize the automobile and energy industries.

That compares to a declining share performance by GM in recent years that recently led billionaire investor David Einhorn to propose splitting the stock into two classes to help boost its price.

Tesla's market capitalization is now equivalent to 102,000 dollars for every car it plans to make in 2018, or 667,000 dollars per car sold last year. By comparison, GM's market capitalization is equivalent to 5,000 dollars per car it sold in 2016.

The Palo Alto, California company is rushing to launch its mass-market Model 3 sedan in the second half of 2017 and quickly ramp up its factory to reach a production target of 500,000 cars per year in 2018. Last year it sold 76,230, missing its target of at least 80,000 vehicles. By comparison, GM sold 10 million cars and Ford, 6.7 million.

With its stock down nearly 20 percent since 2013, GM has scaled back operations outside the United States while pushing to improve its profitability. It announced in March it would sell its European operations.

Mary Barra, chairman and chief executive officer of General Motors Co., at a news conference to announce the GM deal in Paris, France, on Monday, March 6, 2017. /VCG Photo

Reflecting Wall Street's worries, GM's stock trades at 6 times its expected earnings, the lowest multiple among companies in the S&P 500.

Proponents believe Tesla, which is not profitable, argue its stock price is justified based on long-term expectations for Tesla's growth.

They also point to opportunities from Tesla's acquisition last year of money-losing solar panel installer SolarCity and Tesla's Nevada battery cell plant aimed at driving down manufacturing costs.

Tesla's rich valuation has made it a target of short sellers, who so far in 2017 have suffered over 2 billion dollars in paper losses as the stock rallied.

Jeffrey Gundlach, who oversees over 105 billion dollars in assets at Los Angeles-based DoubleLine Capital, told Reuters last week: "As a car company alone, Tesla is crazy high valuation. As a battery company - one that expands and innovates substantially - maybe the valuation can work."

(Source: Reuters)