Chinese cities have become cheaper to live in, while half of the world's 10 most expensive cities are in Asia, according to a survey from the Economist Intelligence Unit (EIU) released on Tuesday.

"The fall in Chinese cities down the ranking is to be expected given weakening demand growth and the decline in the value of the yuan over the last year or so," said Jon Copestake, editor of the survey.

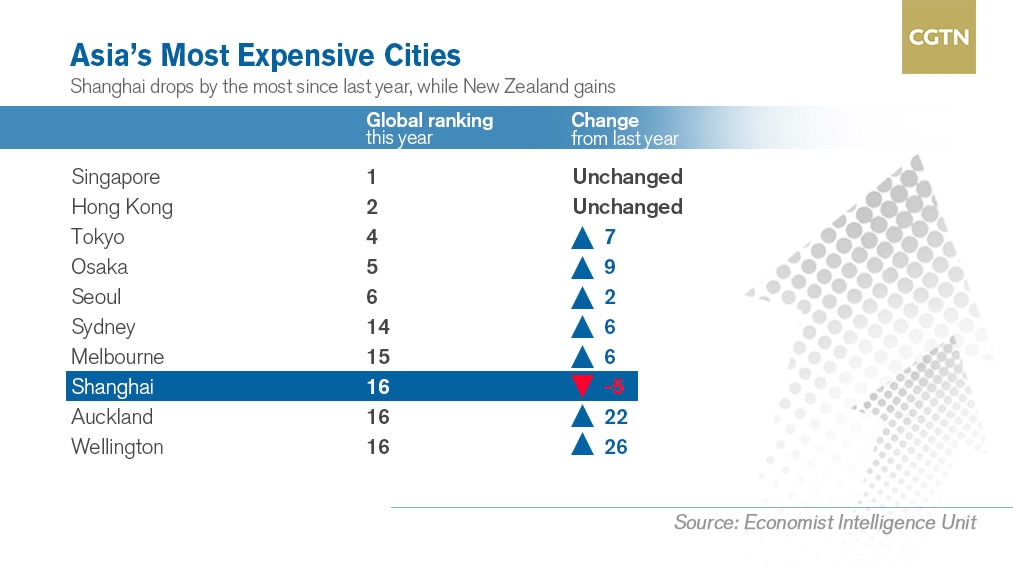

Shanghai firmly defended its top spot from a year ago in Chinese Mainland, though its ranking worldwide fell by five places to the 16th. Beijing’s global ranking dropped by 16 places to the 47th.

Singapore topped the ranking for the 4th consecutive year, and was joined by Hong Kong in the second place.

Tokyo returned to the top 10 in 2017 as Asia’s representation expanded. The Japanese capital, which was the world’s most expensive city until 2012, moved seven places up the ranking due to a sustained recovery of the Japanese yen.

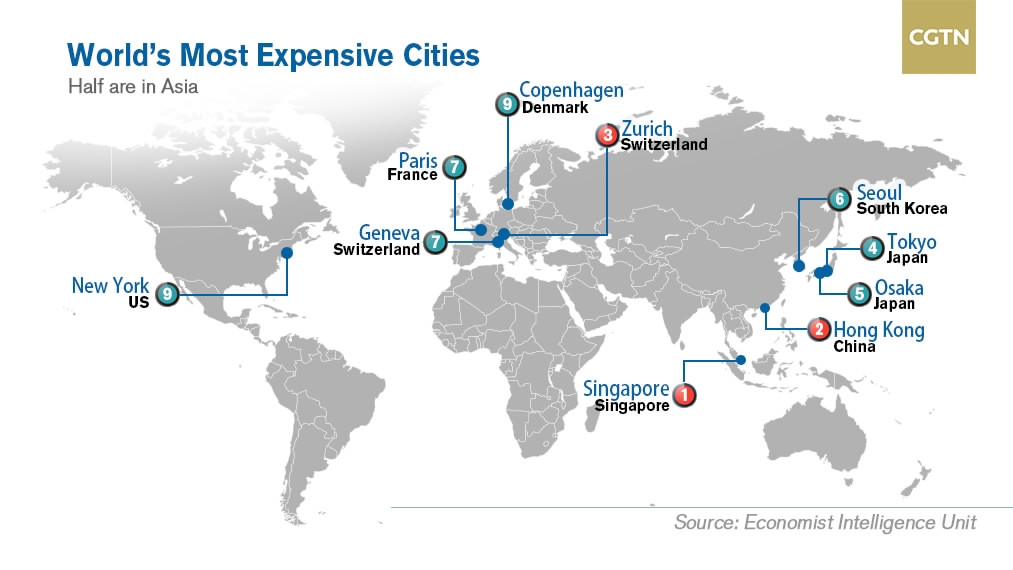

Asian cities made up five of the six most expensive cities globally.

Europe had four cities in the top 10, with Geneva, Paris and Copenhagen joining Zurich.

The French capital was the only euro zone city among the top 10, remaining “structurally extremely expensive to live in, with only alcohol and tobacco offering value for money compared with other European cities,” the EIU said.

While Asia is home to some of the world’s most expensive metropolises, it is also site of some of the cheapest cities, particularly South Asian cities like Bangalore, Chennai, Mumbai, New Delhi of India and Karachi of Pakistan, but the EIU report noted many of these places had "well-documented economic, political, security and infrastructural challenges."

This year, Almaty, Kazakhstan’s business center, and Lagos in Nigeria were ranked the world’s cheapest.

EIU ranked the world's major cities by comparing more than 400 individual prices across 160 products and services including food, drink, clothing, household supplies and personal care items among others.

Globally, the report notes, this year could see fallout from various political and economic shocks take deeper effect.

In the UK, the British government recently set the date to begin Brexit negotiations with the European Union. Following last year's referendum vote, the British pound tumbled sharply and is expected to decline further and remain volatile throughout the negotiations.

"There'll be moments of 'this seems like a good deal' and there'll be moments of 'this looks like a bad deal.' So I think the pound is going to be quite volatile so that's going to have an impact on the cost of tradable goods in the UK," said Simon Baptist, regional director for Asia at the EIU.

Copyright © 2017