Business

18:03, 10-May-2017

China’s Belt and Road Initiative might be a boon for Asian bond markets

By CGTN’s Martina Fuchs

The infrastructure investment drive has been touted as a success for Asian capital markets. But China’s "Belt and Road" will not only help boost the flow of physical goods across borders. It will also trigger more bond issuance and investment in the country, and beyond.

Banners are displayed along a street ahead of Belt and Road Forum for International Cooperation in Beijing, May 9, 2017. /VCG Photo

Banners are displayed along a street ahead of Belt and Road Forum for International Cooperation in Beijing, May 9, 2017. /VCG Photo

Leaders from 28 countries will attend the Belt and Road Forum in Beijing this coming Sunday and Monday, which aims to expand links between Asia, Africa and Europe underpinned by billions of dollars in infrastructure investment.

One of the world's leading banking figures, and the former chairman of the Industrial & Commercial Bank of China, is now heading up a fund aimed at promoting investment in Central and Eastern Europe (CEE) – all part of the Belt and Road.

"We can provide a broad range of financing services under the framework of the Belt and Road Initiative, such as providing loans. Besides, we can also offer open financing and commercially-focused services based on different needs and requirements," said Jiang Jianqing, chairman of the Sino-CEE Fund.

CGTN’s Martina Fuchs speaks to Sino-CEE Fund’s chairman Jiang Jianqing in Beijing. /CGTN Photo

CGTN’s Martina Fuchs speaks to Sino-CEE Fund’s chairman Jiang Jianqing in Beijing. /CGTN Photo

The New Development Bank is another actor that has spotted the opportunity. It plans to raise up to 500 million US dollars via rupee-denominated masala bonds in the second half, after it sold three billion in yuan-denominated green bonds on China's interbank market last year.

"For all the development banks in Asia, and especially for us, it offers massive opportunities. All of the five member countries of BRICS (Brazil, Russia, India, China and South Africa) are also members of the AIIB (Asian Infrastructure Investment Bank). And therefore there is a very close work relationship between our two institutions," said Leslie Maasdorp, VP and CFO of New Development Bank.

"Often people assume that there is a competitive dynamic between multilateral banks. But in reality we are all owned by governments, and secondly, there is a huge funding gap so there is sufficient space for all institutions to have a defined niche," he said.

What’s more, it could galvanize China’s financial reforms, and encourage policymakers to further open the country’s capital market to global investors.

"Apart from credit loans, we have a whole lot of other financing choices. For instance, debt financing is another valuable tool in infrastructure construction in mid- and east- Europe. The economic development among these countries will definitely benefit from such a variety of financing channels,” Jiang told CGTN.

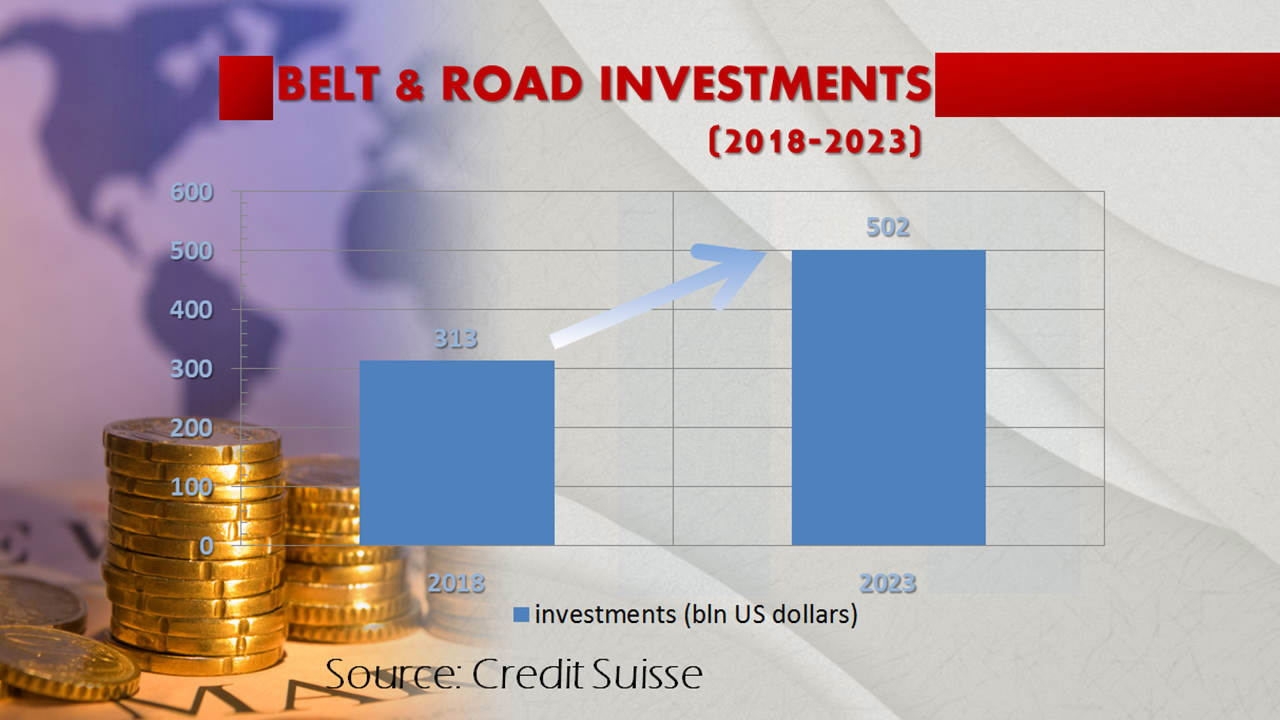

China could pour more than half a trillion dollars into its Belt and Road Initiative, Swiss banking giant Credit Suisse estimated last week. Part of this will come via a 40 billion US dollars Silk Road Fund, and the newly-launched 100 billion US dollars AIIB.

The investment expectation of Belt and Road from Credit Suisse. /CGTN Photo

The investment expectation of Belt and Road from Credit Suisse. /CGTN Photo

Most funds may flow into India, Russia, Indonesia, Iran, Egypt, the Philippines and Pakistan. This is good news. A more liquid and diverse bond market will help improve the allocation of capital, reduce the Chinese economy’s heavy reliance on bank lending, and expand financing options for private companies.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3