Politics

08:32, 04-Mar-2017

One year on: Assessing Premier Li Keqiang’s financial reform agenda

Updated

10:57, 28-Jun-2018

The announcement at last year's Fourth Plenary Session of the National People’s Congress (NPC) of a new local government debt management plan, a value-added tax reform, the Chinese currency's inclusion in the International Monetary Fund’s Special Drawing Rights, and the launch of the Shenzhen-Hong Kong Stock Connect offered hope of a new direction for China’s financial reform.

Premier Li Keqiang promised to clean up problems widely associated with ongoing state involvement in China’s financial system and to remove market-access barriers and investment restrictions. Here, we look at key documents from the Fourth Plenum - how reforms affect the way China’s economy works.

Xinhua Photo

Xinhua Photo

Defuse local government debt

As part of measures to resolve fiscal and financial risks and maintain economic safety and social stability, Premier Li told legislators that the central government would continue to pursue a more “proactive fiscal policy” and manage local government debt problems.

Li said Beijing would create a mechanism for local governments to secure financing through bond issuance and leave room for local authorities to up debt ceilings.

The government debt ratio was lower than those of other major economies and debt management measures were “necessary, feasible and safe,” the premier said.

China’s local government debt reached 16 trillion yuan (2.32 trillion US dollars) in 2015, according to Ministry of Finance data released in November, capping the rise of debt at 17.2 trillion yuan in 2016.

To ensure the debt problem was under control, the State Council rolled out contingency guidelines for managing local government debt problems in November. The guidelines, specifying for the first time four types of "debt risk events" and corresponding emergency responses, sent out "clearer warning signals" to local governments, who must think about how to pay back their debts before borrowing.

The worst kind, or "first degree" debt risk event, is exemplified by one of the five conditions, such as when a provincial government fails to make a bond principal and interest payment. Three other levels of debt risk events are based on less severe conditions, such as a lower percentage of bond payment defaults.

Biggest tax reform in 20 years

To create favorable conditions for modern service industries and small businesses, the central government pledged to cut tax for corporations. Premier Li outlined the country's biggest tax reform agenda for 2016 in more than two decades.

To reduce the burden on enterprises and encourage factories to upgrade and innovate, Li said value-added tax (VAT) would replace business tax in all sectors starting from May 1.

VCG Photo

VCG Photo

Putting all companies and industries under the same tax regime “will generate a massive tax cut for businesses and add incentives to the real economy,” said Jin Dongsheng, researcher at the State Administration of Taxation in Beijing.

The State Administration of Taxation predicted that the tax reform could save companies in the service sector a combined 500 billion yuan (72.5 billion US dollars) in tax payments a year.

Premier Li Keqiang told a VAT reform meeting with provincial leaders in Beijing in January that the overhaul fitted in with China’s mission to innovate and upgrade its economic structure.

“It can drive demand and create favorable conditions for modern service industries and small businesses,” Li said, according to a statement from the State Council.

“It provides powerful support to current economic growth and will also drive future growth.”

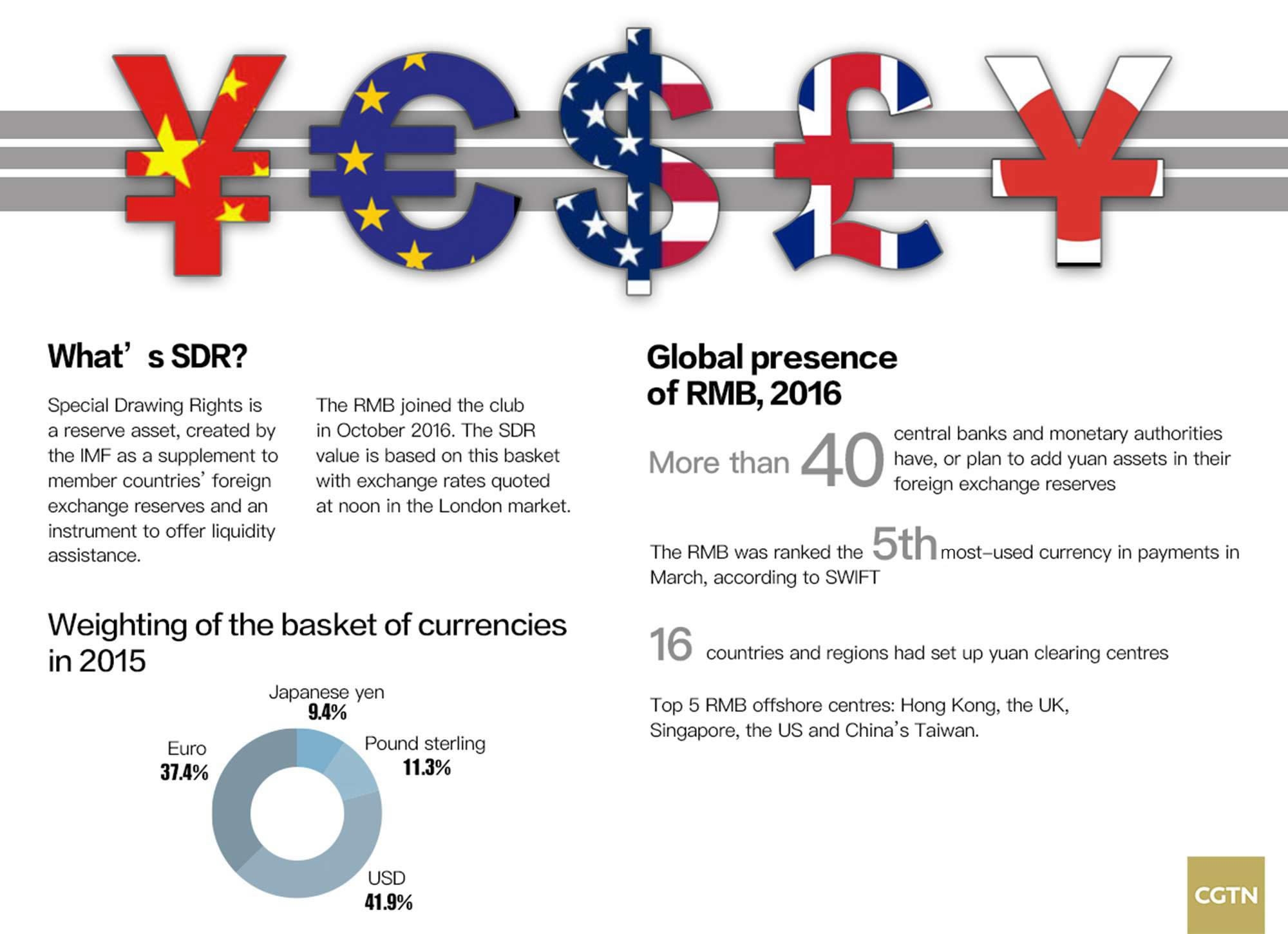

The rise of the RMB

As part of China’s approach to pursue “prudent” monetary policy, Li stressed the importance of offshore use of the renminbi (RMB) and the internationalization of the use of the currency. To do that, he called for the improvement of a market-based currency exchange mechanism.

In October, the RMB officially joined the IMF’s basket of global reserve currencies, marking a milestone in China’s push to internationalize its currency.

CGTN Photo

CGTN Photo

It made China the first developing country to join the Special Drawing Rights (SDR) basket, which comprises the US dollar, euro, pound sterling and Japanese yen.

Although its inclusion in the SDR is largely symbolic for China and will not lead to a rapid rise in demand for the yuan because the total value of SDRs used as reserves pales in comparison to that of US dollars, the IMF said the effort to include the RMB in the SDR would be an irreversible push toward financial liberalization, and would bring the RMB exchange rate “quite close to a float” in two to three years.

Admission of the currency into the SDR basket will help build confidence in the long-term nature of the trend of wider international RMB usage, encourage more central banks to hold the RMB as their foreign exchange reserve and by extension increase the availability and demand for yuan-dominated assets.

According to SWIFT Watch, London became the world’s second-largest RMB offshore trading center in March 2016, accounting for 6.3 percent of all offshore transactions using the Chinese currency, following Hong Kong, which processed 72.5 percent of all RMB payments.

Shenzhen-Hong Kong Stock Connect

China’s stock market management was another major part in Li’s annual report. Speaking of the stock market rout in 2015, the premier said the central government responded proactively and safeguarded economic and financial security.

As planned, in December, China launched the Shenzhen-Hong Kong Stock Connect program, connecting its second exchange in Shenzhen, with the bourse in Hong Kong. It gave foreign investors access to many mainland tech shares.

One year on, these reforms will help improve China’s financial institutions and stabilize the market. Even if the plans from the Fourth Plenum have not yet been fully implemented, China’s economy and finance sector will still operate stably with broad state involvement in key decisions.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3