22:39, 17-Apr-2018

Wealth Management: China bans over-the-counter products

Brokerages and private equity firms in China can no longer sell over-the-counter wealth management products to individual investors. The new regulation that took effect on Tuesday aims to clean up the unregulated sector. Chen Tong takes a closer look.

Over the counter options, or OTC options, refer to wealth management contracts that are not signed on regulated trading platforms. Traders could provide individually negotiated products to investors according to their risk appetites. Experts believe the new regulation aims to hedge potential risks for individual investors.

FENG MEIYUN, GENERAL MANAGER SHANGHAI JINRONG INFO TECH "Many private fund companies use OTC options to attract individual investors to purchase their products, but these investors don't know much about the potential risks. So the new regulation aims to get these investors out of the market and let institutional investors come in. Still, I think the market will re-open in the future, but the investment threshold will be higher."

But the new regulation is expected to lower the interest rates for private fund products. The yield rates of these products actually saw a fall in the first quarter of the year. Data from financial service provider FOF power show that only 5 out of 17 large private fund players earned money in the first quarter -- with an average earnings ratio of only 0.55 percent. Market players say the suspension of OTC options is giving them some headaches for now.

YUAN LIJUAN, SALES DIRECTOR TOUZI.COM "The sales volume will be affected, and that's just something we have to go through. The new regulation will be good for both the financial market and investors."

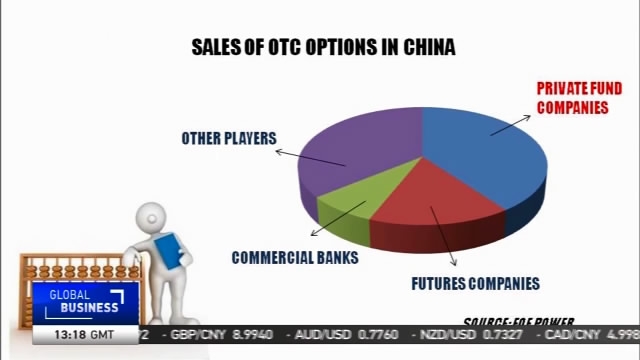

The sales of OTC options has seen explosive growth over the past year. As of the end of December 2017, the sales of OTC options by private fund companies accounted for 40 percent of all OTC sales, followed by futures companies and commercial banks.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3