17:06, 25-Oct-2018

China Income Taxation: Authorities introduce itemized deductions for personal income tax

Updated

16:24, 28-Oct-2018

03:01

China's tax authority has drafted a list of itemized deductions to further cut individual income tax for millions. Now authorities are seeking public opinion on the matter till November 4th. Taking effect next January, the proposed measures are expected to ease tax burdens for China's low to mid income earners. CGTN's Wang Mengzhen reports.

For the first time ever, itemized deductions of this kind are part of China's income tax legislation.

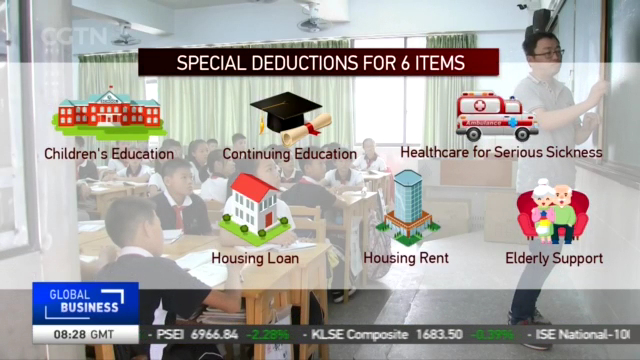

Respectively, the six items cover expenses in education for children, continuing education, healthcare for serious illness, housing loans, housing rent and support for the elderly.

Take children's education as an example, about 12,000 yuan or over 1,700 U.S. dollars can be deducted each year from the parents' taxable income.

WAMG MENGZHEN BEIJING "For taxpayers, their top concern is of course how much of their income tax can be cut via the proposed deduction measures."

Vita Wang, a father of two, is a white-collar worker living in Beijing. He says monthly income for he and his wife could increase some 1,000 yuan in total, once the deduction measures come into play next year.

VITA WANG, PROJECT MANAGER BEIJING "Our older girl is now in elementary school, and we are paying a large amount on our housing loan. Meanwhile, my wife and I need to support our parents' medical treatment. So after all these deductions, we could use the extra money to at least register an extra-curriculum class for our children."

Experts say about 80 percent of all income taxpayers nationwide will benefit from the itemized deductions, especially the middle class and lower-income groups.

PROFESSOR ZHU QING RENMIN UNIVERSITY OF CHINA "In the past, we used the standardized income tax in all cases. Now the customized measures can better help ease burdens for families facing different situations. At the same time, each family is responsible for providing real information when applying for the deductions."

And it comes just after China launched new income tax rates and raised its tax baseline from 3,500 yuan to 5,000 yuan per month in October.

PROFESSOR LI XUHONG BEIJING NATIONAL ACCOUNTING INSTITUTE "Personal income tax cuts play a key role in driving China's consumption, thus boosting the economy. On the other hand, such deductions are more for social purposes as these items involve the pillars of people's livelihood-- education, housing, healthcare and the aging population."

This is among larger-scale tax cuts happening across the country to push forward a proactive fiscal policy. As experts predicted, more reform measures, especially for the value-added tax, are in the pipeline. WMZ, CGTN, BEIJING.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3