Business

21:30, 07-Aug-2017

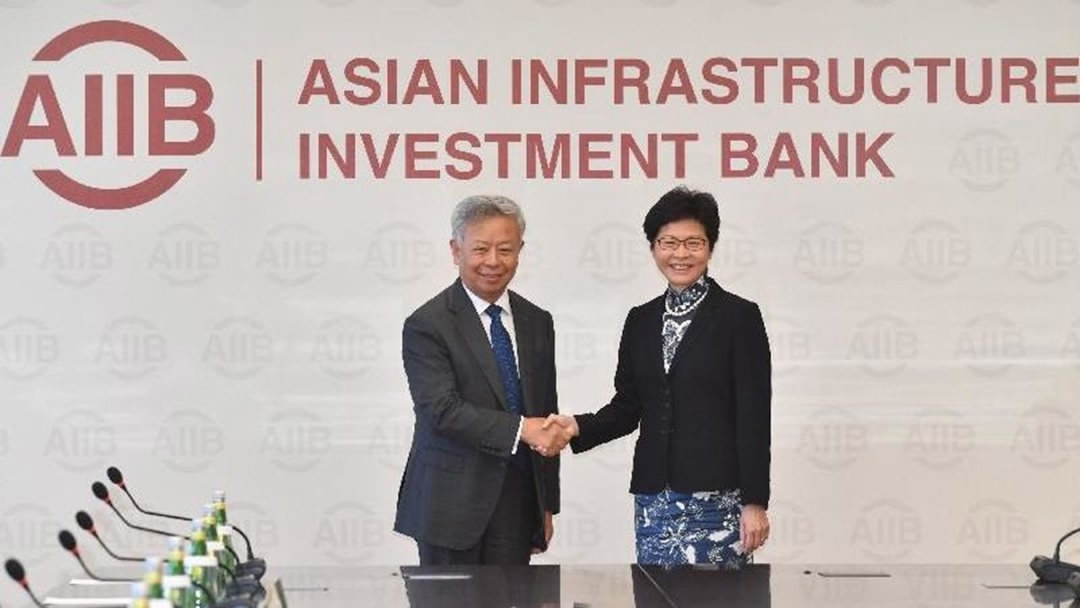

Chief Executive Carrie Lam seeks greater Hong Kong role in AIIB

Chief Executive Carrie Lam Cheng Yuet-ngor eagerly hopes for a bigger role for Hong Kong in the Asian Infrastructure Investment Bank (AIIB), in a sign of the city’s determination to consolidate its position as a world-renowned financial hub.

Lam said at a meeting with AIIB President Jin Liqun on Monday in Beijing that Hong Kong certainly looks forward to more active participation in the AIIB, which was founded by the Central Government.

“As you all know, Hong Kong is very proud of being an international financial center. And I hope that we can both benefit from AIIB’s major projects in future and also make a little bit of a contribution to this very important international initiative,” Lam said.

AIIB headquarters in Beijing /VCG Photo

AIIB headquarters in Beijing /VCG Photo

Jin said the bank also looked forward to exchanging ideas on bilateral collaboration with Hong Kong, and saw the city playing a bigger role in the institution.

Having wrapped up a three-day trip to Singapore and Thailand, Lam led a group of her top aides, including Financial Secretary Paul Chan Mo-po and other heads of policy bureaus, to Beijing on her first mainland visit, just more than a month into her term as chief executive.

The special administrative region joined the AIIB in June this year by pledging to pay 1.2 billion Hong Kong dollars (153.4 million US dollars) for a stake of less than 1 percent over the coming five years. The city has been known for its ambition, lobbying the AIIB to set up a regional office in the territory and its efforts are said to receive “positive response” from Beijing.

The Beijing-based multinational lender, formed in January last year with 57 founding members, now has more than 80 members and expects to take its total membership to 85 by year-end.

The bank, whose mandate is to promote infrastructure financing in Asia and beyond, has approved 17 projects with funding needs totaling 2.8 billion US dollars.

Banking on its 100 billion US dollars of capital base and prudent policies in risk management, the AIIB last month secured a triple-A rating from Fitch Ratings, after obtaining the same top-notch rating from Moody’s Investors Service at the end of June.

(Source: China Daily)

0km

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3