13:04, 09-Mar-2018

China's Financial Sector: New guidelines for asset management products

And last November, the financial sector saw the release of a package of tough regulations the People's Bank of China and other regulators.

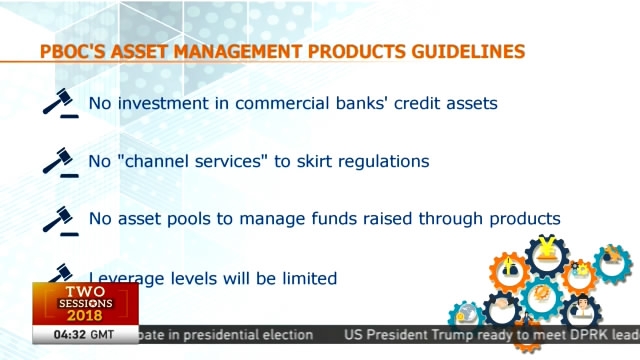

New guidelines concerning asset management products say that issuers won't be able to use asset management products to invest in commercial banks' credit assets or provide "channel services" for other institutions in order to skirt regulations. Financial institutions also won't be able to create asset pools to manage funds raised through asset management products.

Leverage levels will be limited to prevent any asset price bubbles. And highly-indebted companies can no longer invest in such products.

Among other things, financial institutions will have to set aside 10 percent of their management fee income as risk reserves. Regulators will provide a transitional period for asset management companies to comply with the new rules, which will take effect by the end of June 2019.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3