Editor’s note: In 2017, cross-border investment and trade found itself under attack from all sides as part of an anti-globalization movement. China itself has been caught up in this storm, after the US decided to put it under a trade investigation.

The European Union, while not as firebrand as the voices across the Atlantic, has also looked to strengthen its position ahead of a post-Brexit world which will no doubt leave both sides weakened.

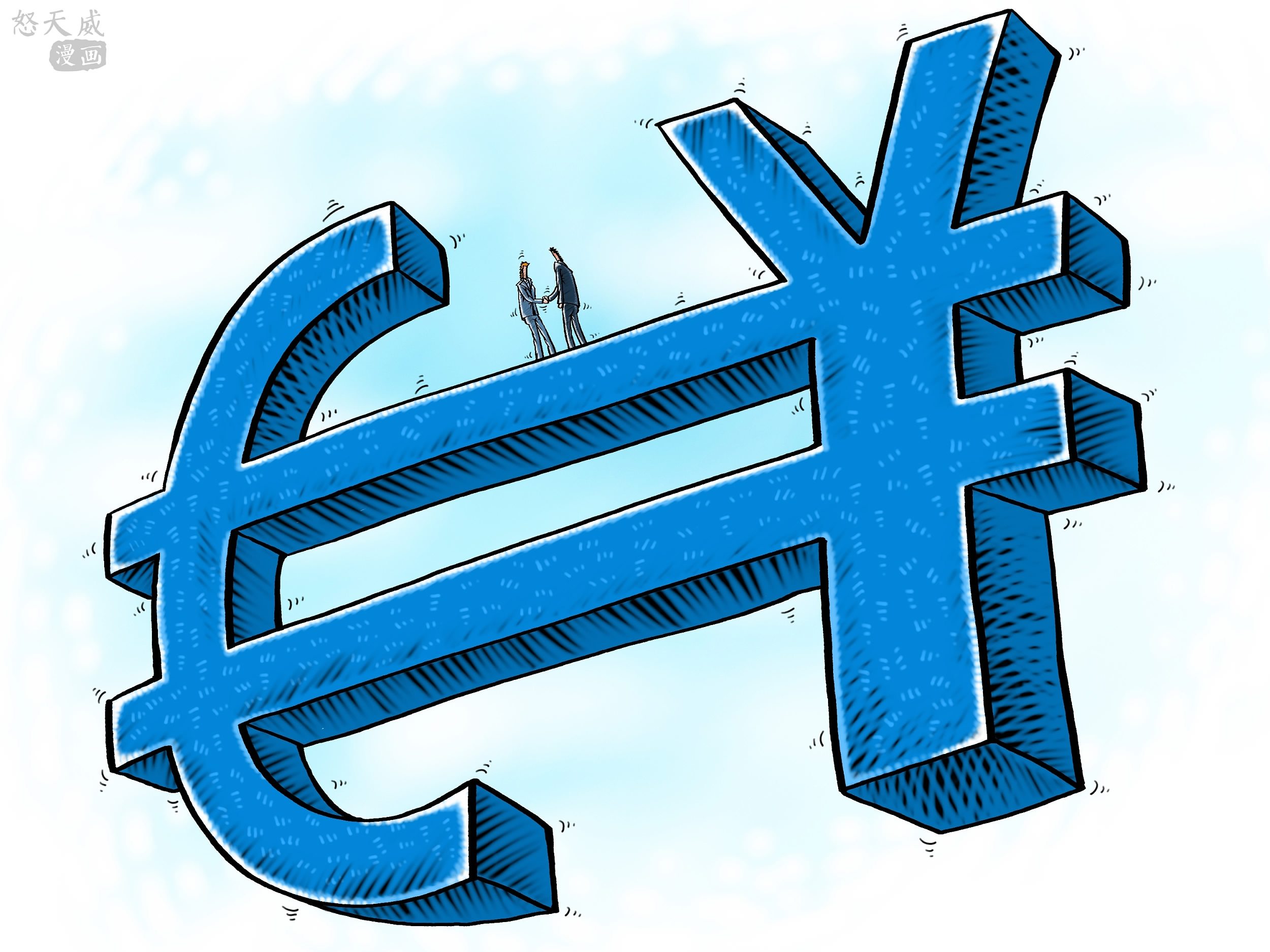

This should be a time for dialogue rather than dissent. The US may be determined to isolate itself from the world, leaving space for China and the European bloc to step up efforts to mend bruised relations in 2018, and to inject momentum into a vacuum voided by fears of a possible wave of populism.

Europe has long been a preferred destination for Chinese outbound investment. Over the past few years, an outbound spending spree led by both state-run and private Chinese enterprises has more often than not targeted Europe. Today, China’s ”One Belt, One Road” initiative (OBOR) has added new impetus to outbound investment, and directed massive capital outflows towards football clubs, infrastructure assets as well as high-tech firms in Europe. According to the Rhodium Group, 2016 saw Chinese companies invest 35 billion euros (41 billion US dollars) in the EU, a 77 percent increase from 2015.

Initially, Chinese investment was largely welcomed by the EU. The financial crisis left Europe with an estimated investment gap of 330 billion euros (391 billion US dollars). Chinese investment not only helped stabilize the economies of some peripheral Eurozone countries, but also strengthened market confidence in the integrity of the EU.

Geography is no longer the most thorny problem. A map shows the railway route linking eastern China to western Europe. VCG Photo

Geography is no longer the most thorny problem. A map shows the railway route linking eastern China to western Europe. VCG Photo

However, suspicions from Brussels have started to grow, as the figure of Chinese investment rises exponentially. Several EU member states have raised concerns about increasing Chinese investment since last year. In response, European Commission President Jean-Claude Juncker announced in September that a “new EU framework for investment screening” will be created.

The concerns of the EU are two-fold: first, EU officials found that more Chinese investment was gradually targeting European manufacturers of advanced technology, sparking concerns that European firms will lose technical advantages to Chinese competitors.

Adding to their concerns is the fact that many Chinese buyers are state-owned-enterprises (SOEs). They suspect that the Chinese government could be providing certain subsidies or financial support for high-tech sector mergers and acquisitions (M&As), putting other bidders from Europe and the rest of the world at a disadvantage.

Meanwhile, certain EU member countries have increasingly voiced concerns that closer trade and investment ties with China could make it more difficult for all 28 EU members to adopt the same stance on many China-related or global issues. The issue recently came to light after China recently held a successful dialogue with Central and Eastern European countries under the “16+1” mechanism. Certain voices in Brussels are suggesting that China is using this strategy to “divide” the EU.

The concern over China looking to divide the bloc is both prejudiced and unnecessary. Looking at the content of the so called “16+1” dialogue, there is no evidence that China had any intention of maintaining special relationships with these countries beyond the purpose of deepening bilateral trade and investment. The EU should realize that its member countries vary tremendously in terms of geography, culture and economic development.

As such, it is difficult for China to find and apply a universal model for develops its trade and investment ties with such a large bloc of countries. Indeed, even towards those 16 Central and Eastern European countries, China has to take different approaches to accommodate their specific demands to develop bilateral economic ties. It will be much more fruitful for the EU not to allow such unfounded political noise to harm bilateral economic relations with China.

To a certain extent, China can sympathize with the EU over its concerns about investment in its high-tech industries, but this should not be exaggerated. As the largest developing economy in the world, China has a large SOE sector. Misunderstandings could arise concerning the scale of the SOE sector, in terms of state subsidies and financial support.

Indeed, China’s government has been painstakingly pushing forward structural reforms to make the market play a determinant role in resource allocation. Over the past few years, there have been cases of defaults within the Chinese SOE sector. That being said, EU concerns about the sources of Chinese investment will gradually be eased as the SOE reform process deepens.

Looking ahead, there are some ways in which the bilateral trade and investment relationship between China and the EU can be redefined in the long run.

Firstly, it is true that reciprocity is an important principle for maintaining a healthy balance for bilateral economic relations. In this respect, China can do more to increase access for EU investors to its domestic sector. Beijing is showing a greater-than-ever willingness to open up to external investment, and at the same time, both sides should bear in mind that a forward-looking attitude is indispensable to bilateral ties.

That being said, the stock of EU investment in China is five times more than Chinese investment in the EU. As long as China’s economy continues to catch up with developed countries, its outbound investment is set to increase.

Secondly, with the new EU investment screening mechanism set to be established, the process should refrain from targeting any specific country and ensure a level playing field for all. More importantly, 15 EU member countries already have their own individual investment screening mechanisms in place. The EU should better coordinate between the new mechanism and existing processes for the sake of efficiency.

Last but not least, it is important for both China and the EU to accelerate negotiations on the Bilateral Investment Treaty (BIT), which was launched in 2013. The best way to avoid investment disputes is to sign a treaty that regulates the behaviour of both sides.

For 2018, the BIT negotiation progress between China and the EU has a good chance of completion ahead of similar talks between the US and China. However, here is no reason for complacency before the final deal is signed.

About the author: Xia Le is chief economist for Asia at BBVA Research.

Edited by Nick Moore and Dean Yang