Business

09:00, 03-Aug-2017

Model 3 demand, higher revenue propel Tesla shares higher

Tesla Inc reported Wednesday a doubled quarterly revenue and the electric car maker’s largest ever loss, but its shares rose after revealing more than 1,800 daily reservations for the Model 3 and predicting increased Model S deliveries in the second half of 2017.

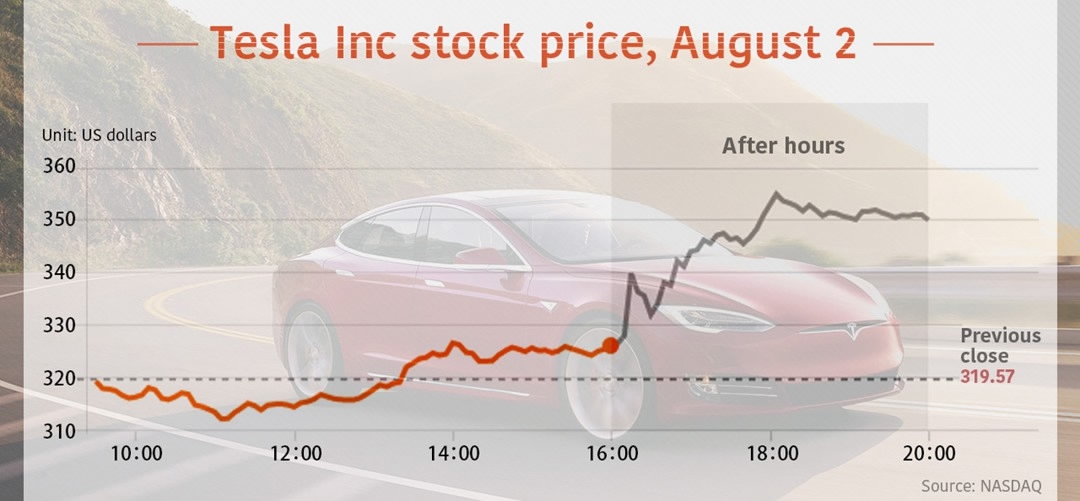

Shares rose as high as eight percent to 351.67 US dollars in late trade.

Despite a warning by Chief Executive Elon Musk last week that the Silicon Valley automaker would face six months of "manufacturing hell" in producing its first Model 3s, investors were enthusiastic over a remaining three billion dollars cash on hand at the end of the second quarter, as loss-making Tesla spent just shy of one million dollars on capital expenditures, less than expected.

Still, given the continued build-out of the Fremont factory and Tesla's Gigafactory battery plant in Nevada, the possibility of continued cash burn is high.

The electric car maker also has its eyes on other options for manufacturing. The company is “working with the Shanghai Municipal Government to explore the possibility of establishing a manufacturing facility in the region to serve the Chinese market,” Tesla China told CGTN Thursday via e-mail, noting that the plan would be more clearly defined for production in China by the end of the year.

“While we expect most of our production to remain in the US, we do need to establish local factories to ensure affordability for the markets they serve,” Tesla said. Meanwhile, Tesla plans to add 300 new superchargers in China, increasing the number in the country to 800, the company told CGTN.

The interior of the Tesla Model 3 sedan. /Reuters Photo

The interior of the Tesla Model 3 sedan. /Reuters Photo

Tesla said it plans two billion dollars in capital expenses in the second half of the year, which would erode its cash cushion to about one million dollars.

Musk, however, told analysts during a conference call that the company was considering debt to expand cash on hand, "but not thinking about a capital raise."

Chief Financial Officer Deepak Ahuja said Tesla's spending was at "historical highs," amounting to over 100 million dollars per week.

Model S demand was increasing, Tesla said, adding that Model S and X deliveries would rise in the second half of 2017.

Musk said investors should have "zero concern" that Tesla would fail to reach its production target of 10,000 vehicles each week by the end of 2018.

A Tesla Model 3 sedan. /Reuters Photo

A Tesla Model 3 sedan. /Reuters Photo

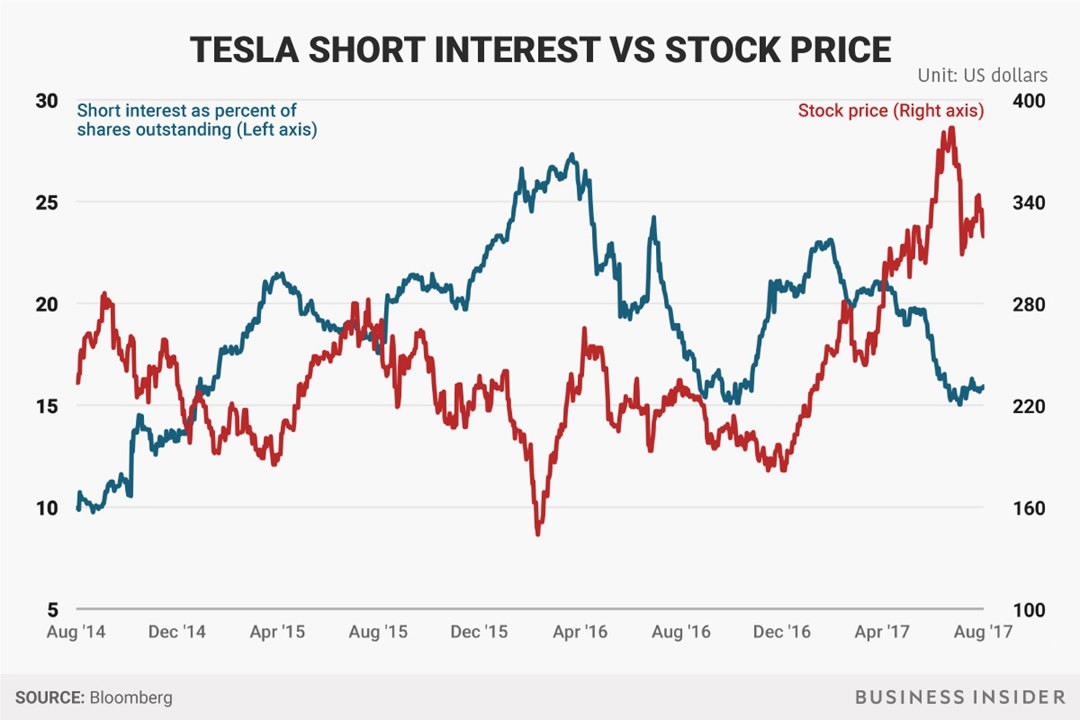

Bullish investors, who sent Tesla's share price up 77 percent from January to a June high of 386.99 dollars, are betting on Musk's strategy to transform the low-volume automaker into a clean energy transportation company offering electric semi-trailer trucks, rooftop solar energy systems and large-scale battery storage.

Model 3 Orders

Tesla's results came within a week of the long-anticipated Model 3 launch, where Musk revealed that first off the production line would be a 44,000 dollar version of the car with a 310-mile (500 km) range.

That is significantly higher than the 35,000 dollar price most customers were anticipating, before incentives. That base model will begin production in January.

Elon corrected a statement he made at the event that Tesla had booked over 500,000 net reservations for the Model 3, changing that to 455,000.

A Tesla Model S charges at a Tesla Supercharger station in Cabazon, California on May 18, 2016. /Reuters Photo

A Tesla Model S charges at a Tesla Supercharger station in Cabazon, California on May 18, 2016. /Reuters Photo

Tesla will begin delivering Model 3s to non-employees in the fourth quarter, it said.

As production improves, the non-GAAP Model 3 gross margin should be positive in the fourth quarter, Tesla said, eventually growing to 25 percent in 2018.

Revenue in the quarter rose to 2.79 billion dollars from 1.27 billion, beating analysts' average estimate of 2.51 billion dollars, according to Thomson Reuters I/B/E/S.

Excluding items, the company lost 1.33 dollars per share.

The company's net loss attributable to shareholders widened to 336.4 million dollars, from 293.2 million dollars a year earlier.

On a per share basis, net loss attributable to shareholders narrowed to 2.04 dollars from 2.09 dollars.

(Source: Reuters)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3