Business

15:10, 20-Jul-2017

China's capital flow: stable as demand and supply balance out in H1

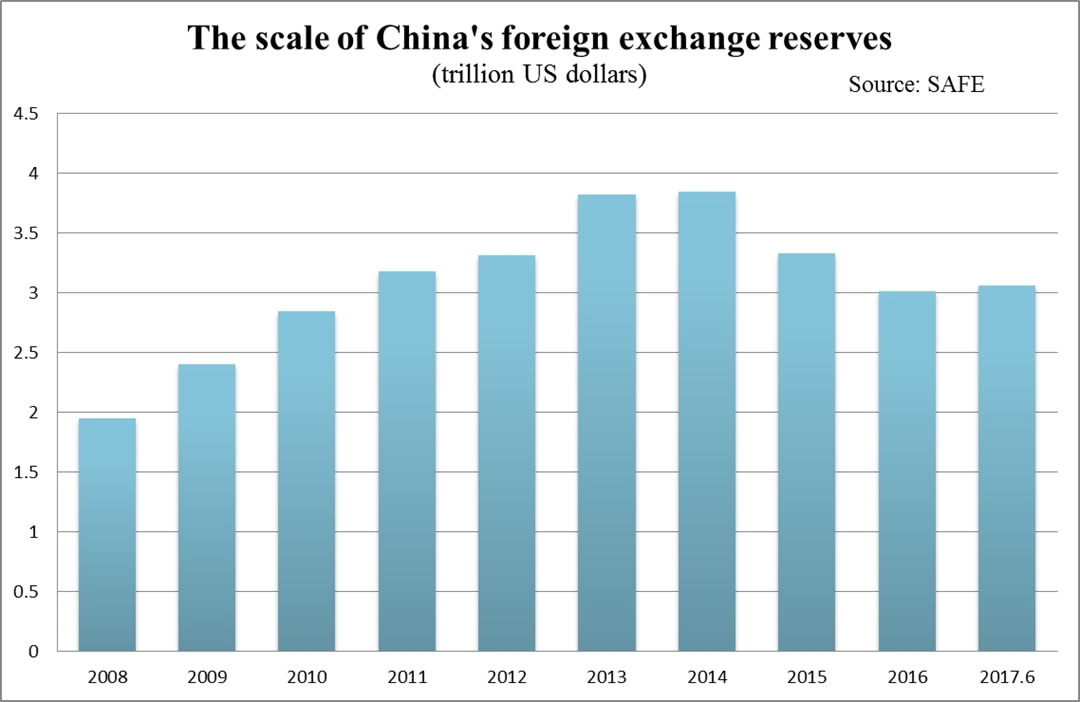

China's cross-border capital flow stabilized in the first half of this year, with the foreign exchange demand and supply in the market at its most balanced in three years, China's forex regulator said.

"The risk in significant capital outflows has notably reduced," said Wang Chunying, spokeswoman for the State Administration of Foreign Exchange (SAFE) at a press conference.

Both China's current account and capital and financial account have gained surplus in the first quarter this year, with current account surplus of 18.4 billion US dollars and capital and financial account surplus of 36.8 billion US dollars.

It is the first capital and financial account surplus after 11 consecutive months of deficit.

In the first half of 2017, Chinese commercial banks' net sale of foreign exchange plummeted by 46 percent. She pointed out China's forex demand and supply have almost balanced out since February.

The improvement in the national economy helped stabilize capital flow, said Wang. New information disclosure requirements have also effectively curbed illegitimate purchases.

"There is no doubt that the full-year economic growth target will be reached," she said. China expects its economic growth rate no less than 6.5 percent this year, and it grew by 6.9 percent in the first half of 2017, Wang said.

China's commercial banks sold a net 20.9 billion US dollars of foreign exchange in June, up slightly from May, Wang noted.

1km

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3