09:22, 05-Aug-2018

Cashless Coffee: Chinese chain uses tech to give established brands a run for their money

Updated

08:42, 08-Aug-2018

04:24

China is at the forefront of consumer technology. Already, it has 11 times more mobile payment users than the United States. And one consumer tech company is leveraging the craze for cashless payments to capture China's growing coffee market. Can technology and coffee be brought together in what's traditionally a nation of tea drinkers? CGTN's Wei Lynn Tang explores how Luckin Coffee is trying to achieve just that.

Over 500 outlets sprouting across cities in China in just 5 months. A testament, perhaps, to this new coffee brand's drive to capture the country's still under-penetrated coffee market.

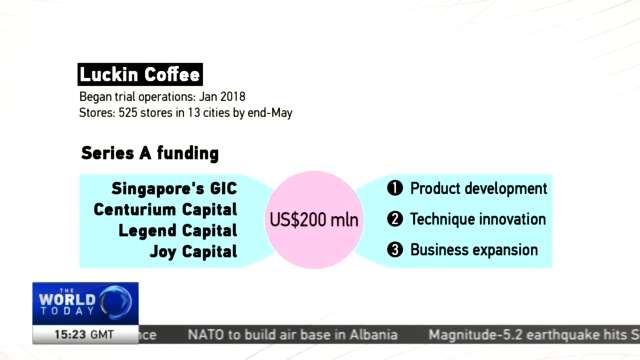

Luckin Coffee secured 200 million US dollars in its Series A funding in the middle of July. Among its investors is Singapore's sovereign wealth fund GIC. This reportedly puts Luckin's valuation at 1 billion dollars -- unicorn status.

Luckin claims it sold 5 million cups in its first four months. What's the buzz?

I went on the app myself and gave it a go. It's pretty straightforward: you select either the pick-up or delivery option, choose your beverage -- that's an iced latte with no sugar for me -- and you make payment all through the app. No cash allowed --even if you sit in its cafes. And there, a message informing me my order has been received with another updating me that my coffee is on its way.

WEI LYNN TANG BEIJING "Not bad. 15 minutes. And it looks like my iced latte is still in one piece. You know, I have experienced the fast delivery of food, household appliances, and almost anything you can think of here in China; but coffee delivery, I must say, is something new."

Technology to position coffee as a go-to beverage. Is China ready for this?

JEFFREY TOWSON, PROFESSOR OF INVESTMENT GUANGHUA SCHOOL OF MANAGEMENT, PEKING UNIVERSITY "Does that retail coffee experience make sense for the mass market as opposed to a more luxury product which is what Starbucks is – their pricing, price of a Starbucks coffee in China Beijing is the same as New York. Even though the GDP capita is one sixth. So does it make sense to bring it to the mass market or is this always a niche market. This is more like a venture capital play, we're gonna build big, we're gonna win big or not do too well."

In May, Luckin wrote an open letter, accusing Starbucks of monopolistic behavior. Starbucks called it a publicity stunt. But Professor Towson says it's not about winning.

JEFFREY TOWSON, PROFESSOR OF INVESTMENT GUANGHUA SCHOOL OF MANAGEMENT, PEKING UNIVERSITY "The market is so big potentially that if they get any degree of traction in the mass market retail coffee, they will be big and win big without touching Starbucks. Now however Chinese consumers are notoriously fickle in any industry just about you see market shares swing every year. It would not surprise me at all if we see 10 or 20 percent of Starbucks volume shift."

Indeed, scale is key in the retail business, as experts say location often trumps brand.

BRUNO LANNES PARTNER, BAIN & COMPANY "So I think as long as you have this local presence, then you can have loyal consumers, and so the game for many of those retail chains is really to increase the number of stores because then they can increase the possibility of creating loyal consumers."

COFFEE DRINKER "Because there are so many options now, I will consider what's more convenient for me. With Luckin, for example, I can first order it on the app when I am in the car, pick it up from the shop, then go. But with Starbucks, I have to physically queue to buy."

Queues or not, Starbucks still has a big following. After all, it's been in China for 19 years.

COFFEE DRINKER "I've seen people drink Luckin Coffee but I didn't have it because I really prefer Starbucks."

Of Luckin's 525 outlets, 231 are takeaway kitchens. The company expects this ratio to come down to 15 percent in the future, as it says brick-and-mortar stores are the way forward.

It remains to be seen if Luckin's new retail model for coffee will work in China. But one thing consumers can look forward to is more options and convenience. Wei Lynn Tang, CGTN, Beijing.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3