Business

20:41, 29-Jul-2017

Chip stocks show signs of slowing with more earnings on tap

High-flying semiconductor stocks may be poised for more losses in the coming weeks as a large swath of chip names reports quarterly results in a sector that may have run up too far for some investors.

Investors will parse earnings from 40 percent of the components in the PHLX semiconductor index .SOX over the next month, including Applied Materials, Nvidia and Marvell Technology.

The index is up more than 20 percent on the year, powered by gains of nearly 60 percent in names such as Nvidia and Lam Research, which has helped propel the S&P technology sector. SPLRCT higher as the best performing of the 11 major S&P sectors. Only five of the 30 names in the semiconductor index are in negative territory for the year.

Wall Street sign. /VCG Photo

Wall Street sign. /VCG Photo

Those gains were fueled by expectations of strong earnings and revenue for the quarter. Semiconductor and semiconductor equipment stocks are expected to see the highest growth within the tech sector, with year-over-year earnings growth of more than 40 percent, according to Thomson Reuters data.

"The semis are the heart and soul of the technology sector, particularly the large-cap technology sector, and they are really driving the theme that we saw really take shape in the second quarter," said Peter Kenny, senior market strategist at Global Markets Advisory Group in New York.

Initial stock movements in the wake of those that have already reported suggest some investors are ready to lighten up. The average 1-day stock performance has been a decline of 1.2 percent for semiconductor companies that reported earnings through Wednesday.

VCG Photo

VCG Photo

"A year ago I would say you have to be careful but now I’d say you have to be extremely careful," said Kim Forrest, senior equity research analyst at Fort Pitt Capital Group in Pittsburgh.

"The ones that have these exotic stories and high growth are probably frothy."

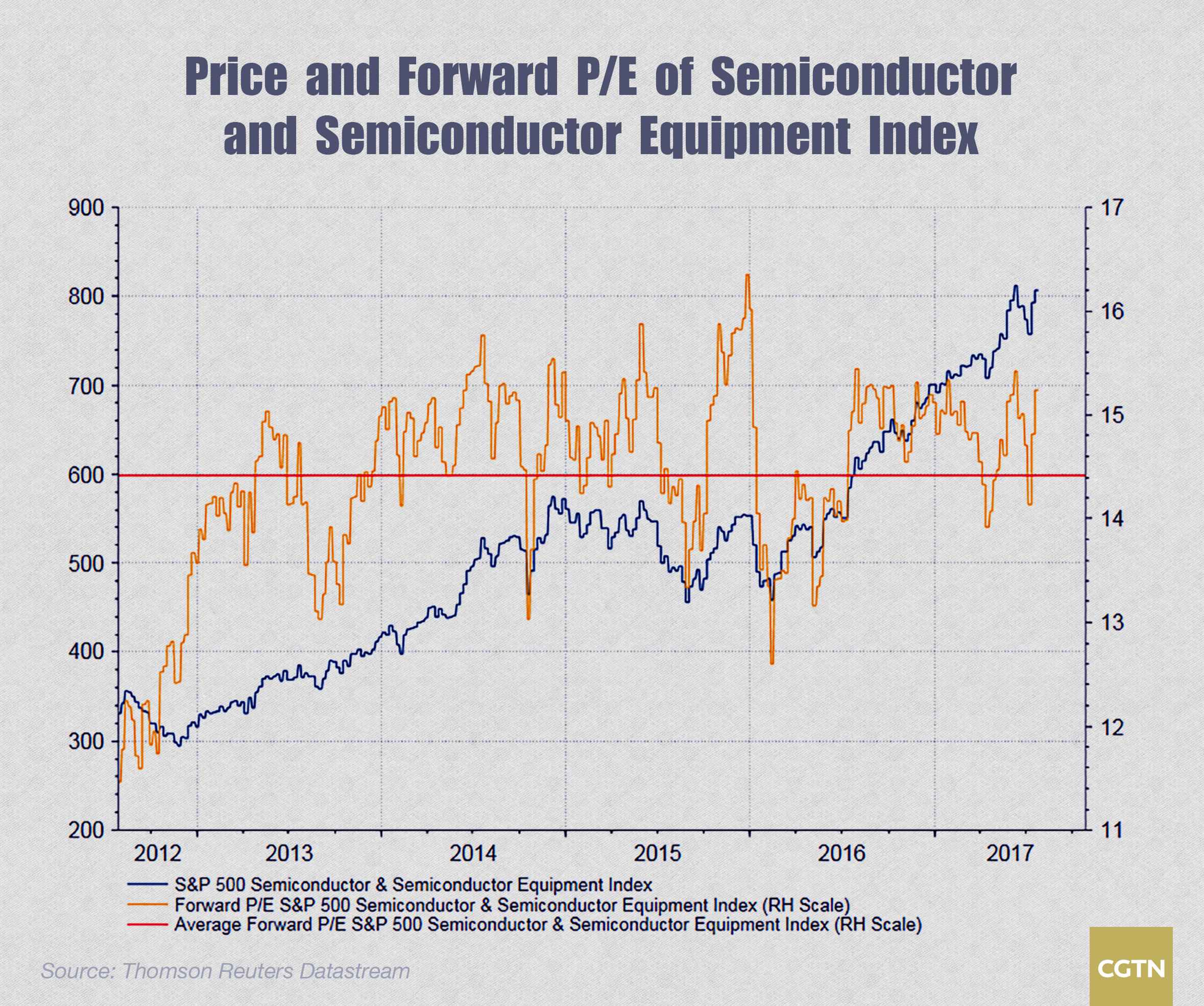

The forward price-to-earnings (P/E) ratio of the S&P 500 semiconductor and semiconductor equipment index .SPLRCSE stands at 15.2, above its five-year average of 14.4 but below the forward P/E of the broader S&P 500 .SPX of nearly 18.

CGTN Photo

CGTN Photo

In addition, the 14-day relative strength index reading for the PHLX Semiconductor index stands at 51.6, below the 70 level that indicate an overbought condition, which suggests the sector may still have room to run higher.

"The expectations are high in terms of growth rates: you keep raising the bar, raising the bar; even if you hit the number or get a penny over, it’s not good enough anymore," said Daniel Morgan, portfolio manager at Synovus Trust in Atlanta, Georgia.

"You are getting some mismatched trading related to earnings reports coming out; it creates some opportunities to be in some great names where the fundamental themes are still in place."

(Source: Reuters)

11002km

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3