Business

17:47, 14-Jul-2017

China’s fiscal revenues up in H1 with balanced structure

By CGTN’s Ming Tian

China's fiscal revenues saw a solid growth in the first six months of 2017, according to the country's Ministry of Finance. Officials said on Friday that the increase reflected "a healthy economic growth," but warned of a possible decline in the second half of the year.

VCG Photo

VCG Photo

Data from the Ministry of Finance show that the Chinese government spent more than 2.7 trillion yuan (0.4 trillion US dollars) in June, up 19.1 percent year-on-year and quickening from the 9.2-percent increase registered in May.

Revenue rose 8.9 percent on annual basis in June, after a 3.7-percent growth a month earlier.

The country's stable economy has brought out a firm increase in fiscal revenues with total income up 9.8 percent from a year ago. Tax revenues have accounted for more of the income compared to last year.

Tax percentage of fiscal revenues. /CGTN Photo

Tax percentage of fiscal revenues. /CGTN Photo

“Prices of factory goods, corporate profits, trade, and real estate sales have led to the increase in tax revenues. Meanwhile, various fee reduction programs have slashed the government income,” noted Lou Hong, Director-General of the Treasury Department of Ministry of Finance.

Lou also said the increase has a balanced structure, as the industrial sector has contributed more to added tax revenues than last year, quickly catching up with the service sector.

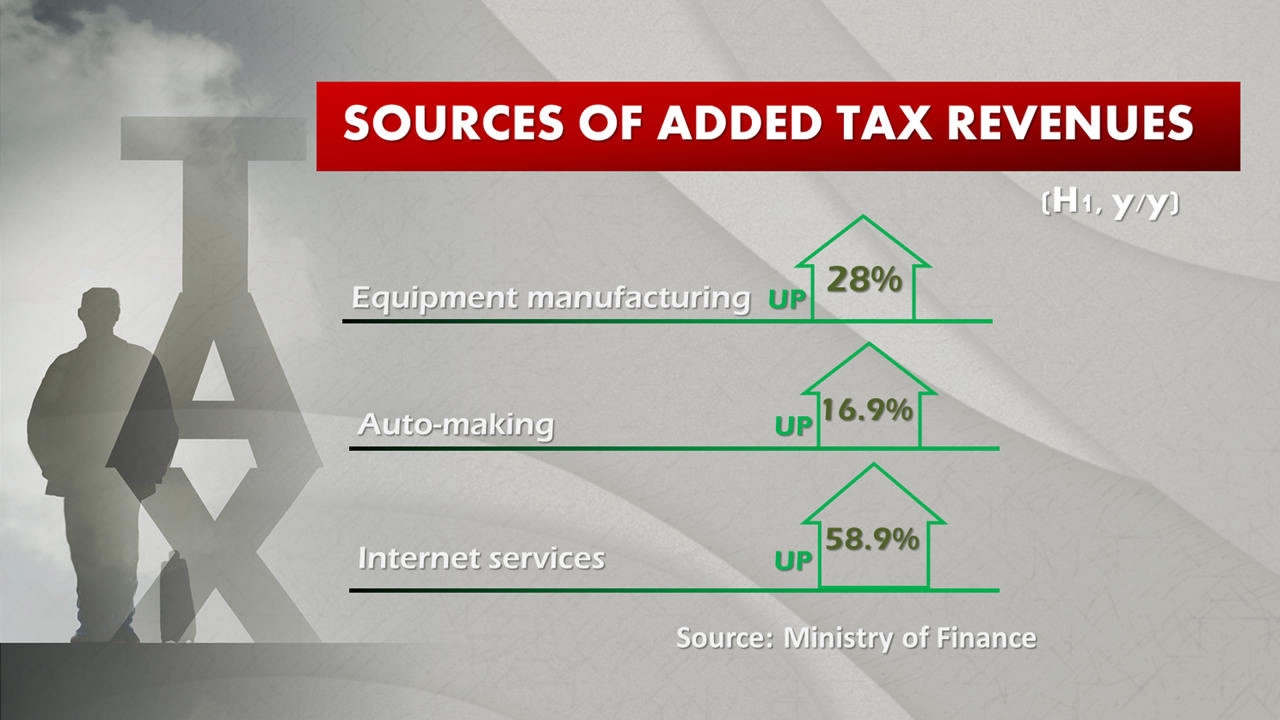

Meanwhile, high-end businesses have paid more in taxes. Taxes paid by equipment manufacturers, auto makers and telecom companies saw double-digit growth compared with the same period last year.

High-end businesses paid more in taxes in H1 2017. /CGTN Photo

High-end businesses paid more in taxes in H1 2017. /CGTN Photo

Government revenues are like the barometer of China’s economic health. While the figures are robust and stable during the first half year, there are multiple factors challenging further growth in the coming months.

"We will see stronger policies in tax cut and fee reduction, including the all-round value-added taxation program, and cleansing of unnecessary government fees. We also expect easing growth of producer price index, which would drag the growth rate lower. Plus, the curbing measures in the real estate sector will also impact fiscal revenues," Lou stressed.

Another notable trend is that China has issued fewer government bonds. Officials said there is not a pressing need for government bond restructuring, following waves of bond swap programs in the last couple of years. The authorities have slowed down the pace of bond issuance at the same time.

The Ministry of Finance also said it would keep guiding the pace of bond issuance, and further instructs local governments to issue bonds in the Shenzhen Stock exchange.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3