Business

18:32, 13-Sep-2017

Can Tencent, Alibaba deal see Chinese streaming take on Spotify?

Nicholas Moore

An agreement between rivals Tencent and Alibaba on sharing music licensing is being heralded as a major step forward for streaming in China, as record labels look to develop a market with huge potential.

The deal sees Tencent Music Entertainment Group sub-license its rights with major labels like Universal, Sony and Warner to Alibaba’s Ali Music, in exchange for access to some of Asia’s biggest labels like Rock Records, HIM International and Media Asia Entertainment Group.

This means Chinese music fans using services like Ali Music's Xiami or Tencent's QQ Music can access more artists without having to subscribe to multiple platforms.

The deal is expected to encourage more users to pay for subscriptions, with the music industry hoping Alibaba and Tencent’s collaboration can unlock the huge potential of streaming in China.

The deal comes amid speculation that QQ Music – believed to have as much as a 77 percent share of China’s streaming market – is gearing up for an IPO that Bloomberg reports could be worth as much as 10 billion US dollars. But is China’s streaming market big enough to compete with well-established names like Spotify, Apple Music and Tidal?

Spotify CEO Daniel Ek. /AFP Photo

Spotify CEO Daniel Ek. /AFP Photo

How many people in China stream music?

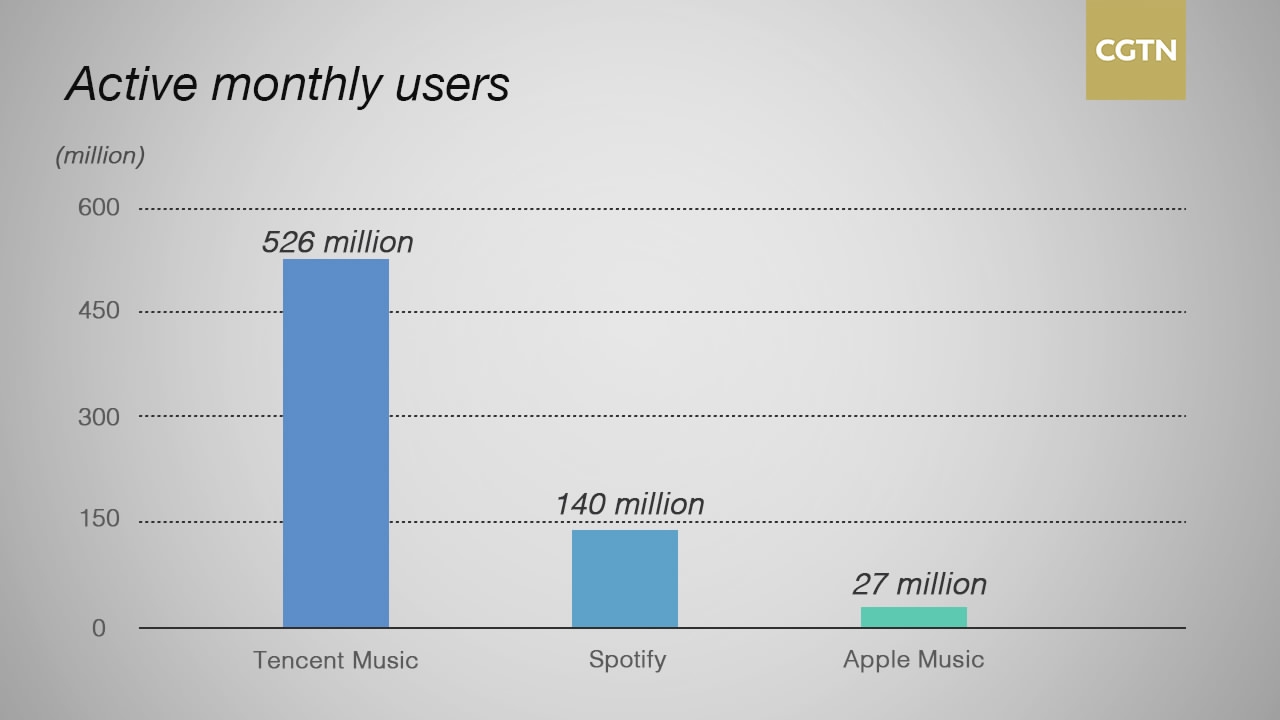

Questmobile and Jefferies report that as of June this year, the three platforms operated by Tencent – QQ Music, Kugou and Kuwo – had 526 million active monthly users. That’s much higher than Spotify, which reached 140 million active monthly users worldwide in June, and Apple Music’s 27 million subscribers.

CGTN Photo

CGTN Photo

So streaming in China must be worth billions?

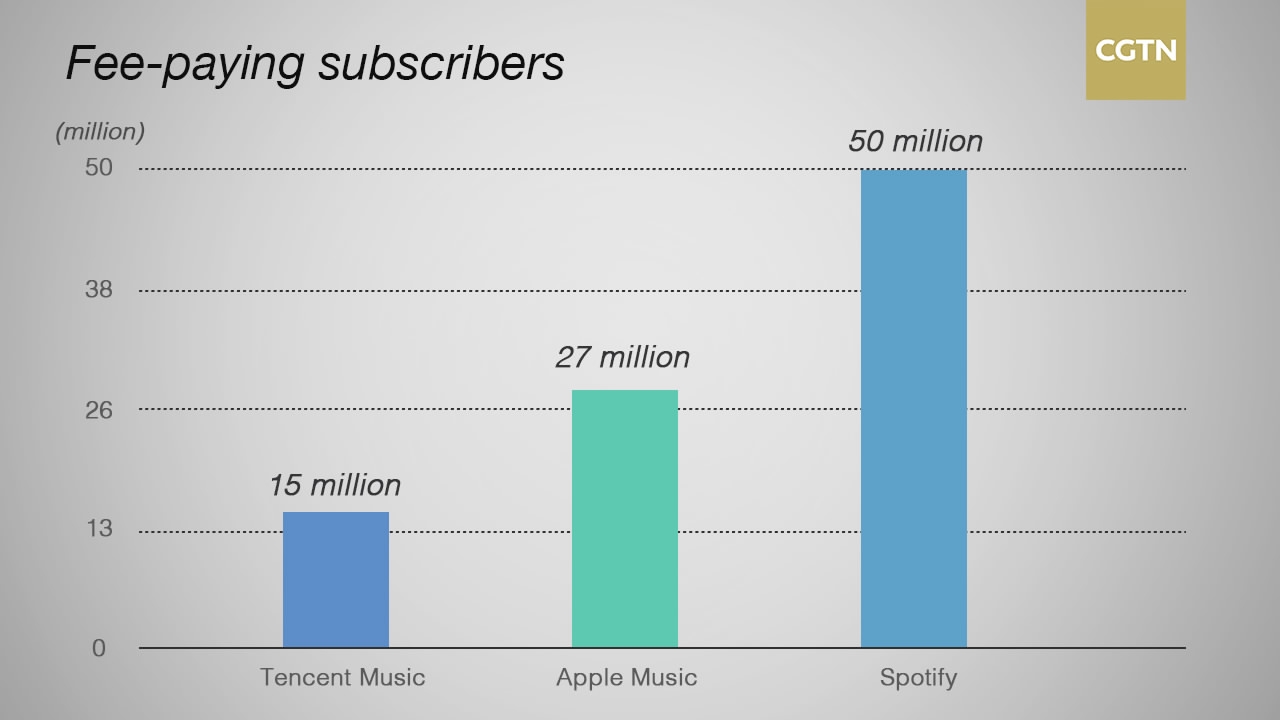

Tencent’s streaming platforms may have more than half a billion active users, but only 15 million of those are believed to be fee-paying subscribers, compared to 50 million for Spotify and all 27 million of Apple Music’s users.

CGTN Photo

CGTN Photo

Despite having 50 million users paying approximately 120 US dollars a year, Spotify is still making big losses. 85 percent of Spotify’s expenses go towards distribution and royalties, with the company reporting losses of 581 million US dollars so far this year.

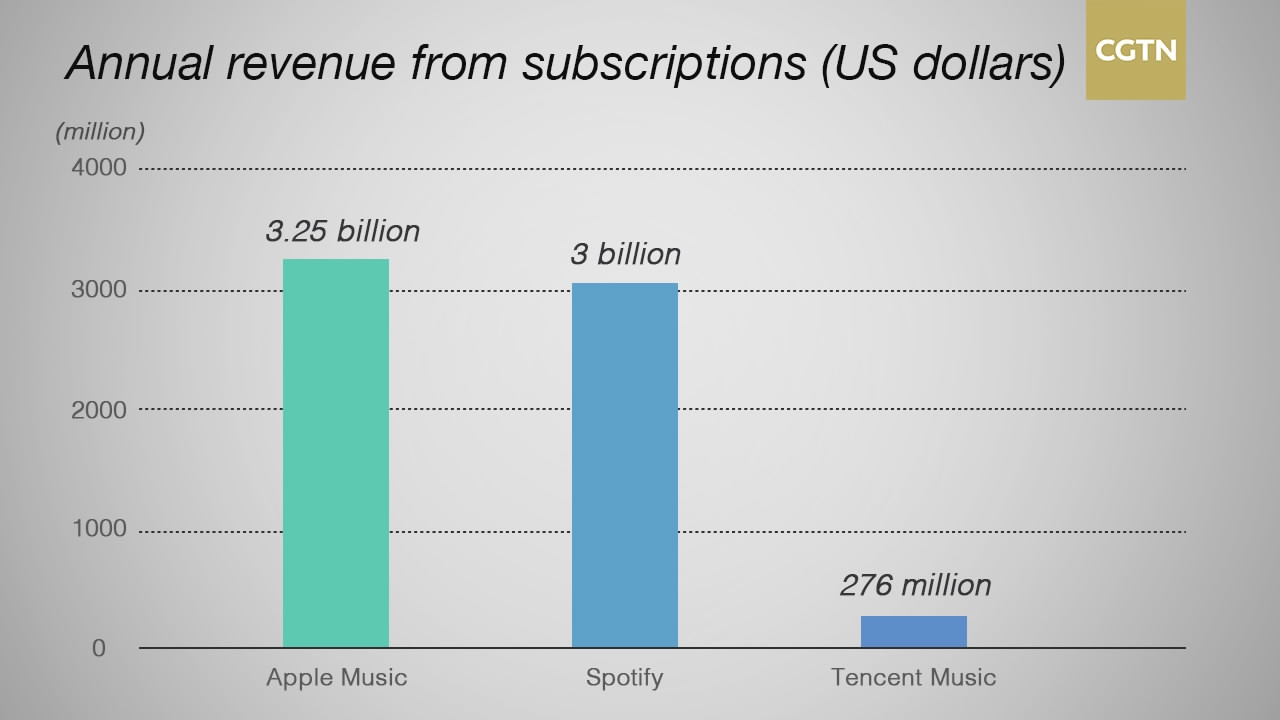

Apple Music charges similar subscription fees, and spends around 58 percent of its estimated 3.25 billion US dollar revenue on royalties.

QQ Music’s annual spend on royalties is unknown, but its subscription packages are significantly cheaper than Spotify or Apple Music, with the current annual fee for the “Green Diamond” VIP package only 120 yuan (18.40 US dollars) per year.

Even if all 15 million subscribers pay that amount, revenues of 276 million US dollars barely compare to the 3.064 billion US dollars raked in by loss-making Spotify in 2016.

CGTN Photo

CGTN Photo

But surely it’s all about potential?

Yes, potential is the keyword for China’s streaming industry, and the main reason why Tencent has been able to sign groundbreaking deals with Universal Music Group, Sony Music and Warner Music – the music world's "big three" are keen to gain a foothold in China.

China’s music industry grew 20 percent between 2015 and 2016 to become the 12th biggest in the world according to the International Federation of the Phonographic Industry (IFPI), and streaming platforms like those operated by Tencent and Alibaba are seen as key to fighting illegal downloads in the country.

However, Chinese consumers will need to undergo a major shift if the music industry wants to make money in the country. While the movie industry has grown to such an extent that 2016 saw China spend 45.3 billion yuan (6.9 billion US dollars) at the box office, research by Jefferies estimates that the paid music market in China will be worth just under three billion yuan (459 million US dollars) in 2017.

An exclusively digital album by Chinese star Jay Chou sold 170,000 copies in its first month in 2016. Compare that to Lemonade by Beyonce, which saw streams of 115.2 million in its first week of release last year on Tidal. /AFP Photo

An exclusively digital album by Chinese star Jay Chou sold 170,000 copies in its first month in 2016. Compare that to Lemonade by Beyonce, which saw streams of 115.2 million in its first week of release last year on Tidal. /AFP Photo

The IFPI found in 2015 that per capita annual spend on music in China was only 0.10 US dollars, suggesting that Tencent and Alibaba have a tough fight on their hands if they want to convince more users to pay for music in the country, especially if Tencent wants to convince investors that QQ Music really is worth 10 billion US dollars.

While details of Tencent’s deals with Universal and other major labels are unclear, artists and other industry workers will expect to be paid royalties on a par with Spotify and Apple Music.

That means the pressure is on for China to transform into a market happy to pay for music – otherwise major labels will look elsewhere, and take the music industry's top talent away with them.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3