Business

13:14, 24-Oct-2017

Toshiba boss says sorry as shareholders blast $18-bn chip sale

CGTN

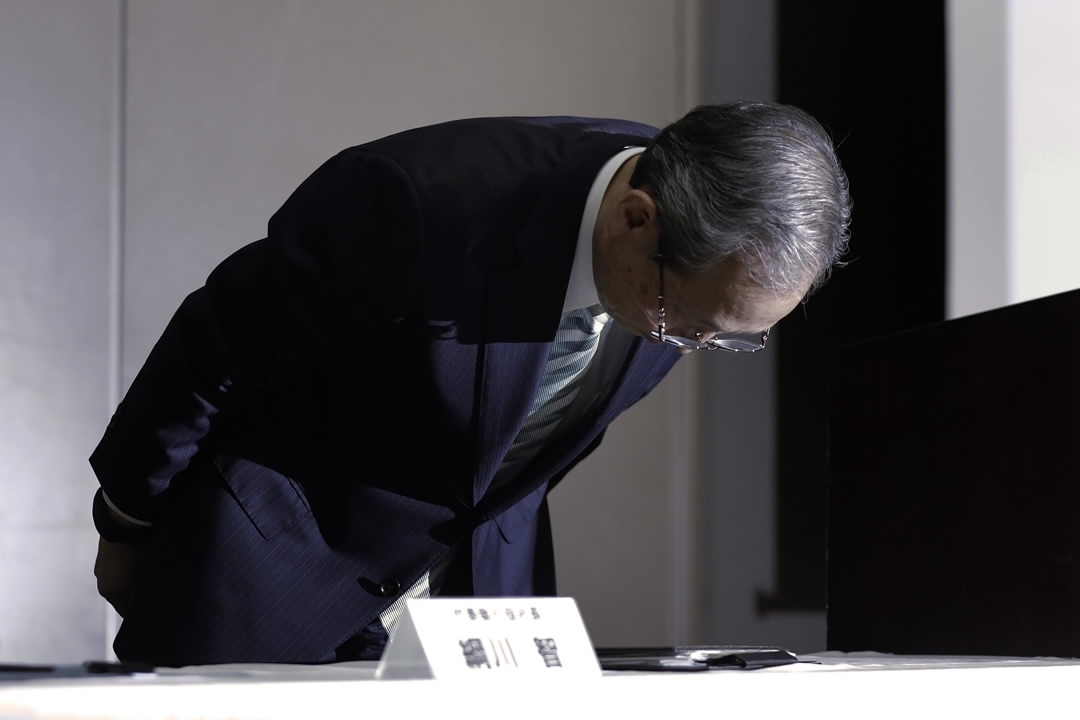

Toshiba’s president Tuesday apologized "sincerely" over the sale of its prized memory chip business worth 18 billion US dollars, as shareholders demanded answers over the deal seen as pivotal to the survival of one of Japan's best-known firms.

Bowing deeply at the start of what was expected to be a stormy shareholders’ meeting, Satoshi Tsunakawa said, "We sincerely apologize for causing problems and worry."

Satoshi Tsunakawa, president of Toshiba Corp., bows during a news conference in Tokyo, Japan on August 10, 2017. /VCG Photo

Satoshi Tsunakawa, president of Toshiba Corp., bows during a news conference in Tokyo, Japan on August 10, 2017. /VCG Photo

The meeting just outside Tokyo came after the company last month announced the sale to a consortium led by US investor Bain Capital -- which includes US tech giants Apple and Dell as well as South Korean chipmaker SK Hynix -- after months of wrangling.

Shareholders will vote later Tuesday on the deal which is crucial for the cash-strapped company to plug massive losses at its US nuclear division, Westinghouse Electric.

Tsunakawa pledged to finish the sale by the end of March 2018 and stressed, "We will continue to have honest management, and improve our internal governance."

The chip unit brought in around a quarter of Toshiba's total annual revenue and is the crown jewel in a vast range of businesses ranging from home appliances to nuclear reactors.

Toshiba narrowly averted a delisting this year, but it still faces the humiliating prospect of being yanked from Japan’s premier stock exchange if the sale does not raise enough money.

'Clear answers'

Japanese electronics giant Toshiba's logo is displayed at the Toshiba headquarters in Tokyo on May 15, 2017. /VCG Photo

Japanese electronics giant Toshiba's logo is displayed at the Toshiba headquarters in Tokyo on May 15, 2017. /VCG Photo

Toshiba stock is down about 25 percent since the Westinghouse losses came to light in late December at the world’s number-two chipmaker behind Samsung.

And some investors had doubts about whether things would change at Toshiba, which was recovering from a 2015 accounting scandal when the huge US losses were made public.

"Executives never give us clear answers at these meetings," complained Ken Futoo, a 57-year-old former Toshiba employee turned real estate agent.

"They just do what big shareholders and the banks tell them to do. I regret that they have to sell the chip division. It's really bad but there was no choice if the banks told them to sell it."

He warned Toshiba could find itself in trouble again, despite the much-needed cash injection.

"What’s at issue is the company’s governance," Futoo said.

The Japanese industrial giant is trying to recover from the disastrous acquisition of Westinghouse, which racked up billions of dollars in losses before being placed in bankruptcy protection.

Those losses came to light as the group was still reeling from revelations that top Toshiba executives had pressured underlings to cover up weak results for years after the 2008 global financial meltdown.

The twin crises were a major embarrassment for a cornerstone of Japan Inc, which traces its history back as far as 1875 when Toshiba started life as a telegraph factory in what is now Tokyo's Ginza shopping district.

"I came to listen to the president to find out why Toshiba, which used to be a great company, is now in this trouble," said Nobuko Kaneko, a 60-year-old teacher.

"There are many bright people I know, including friends, who worked for the company," said the teacher.

Source(s): Reuters

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3