Business

18:39, 02-Jan-2017

Online art funds take on color with Chinese investors - Part 1 of CGTN's 'Brush Hour' series

Updated

10:29, 28-Jun-2018

CGTN business correspondent Martina Fuchs explores how China’s prospering art market and the world of investments can be a perfect match.

Online art funds, which are privately offered investment funds managed by a professional manager or advisory firms, are flourishing in China.

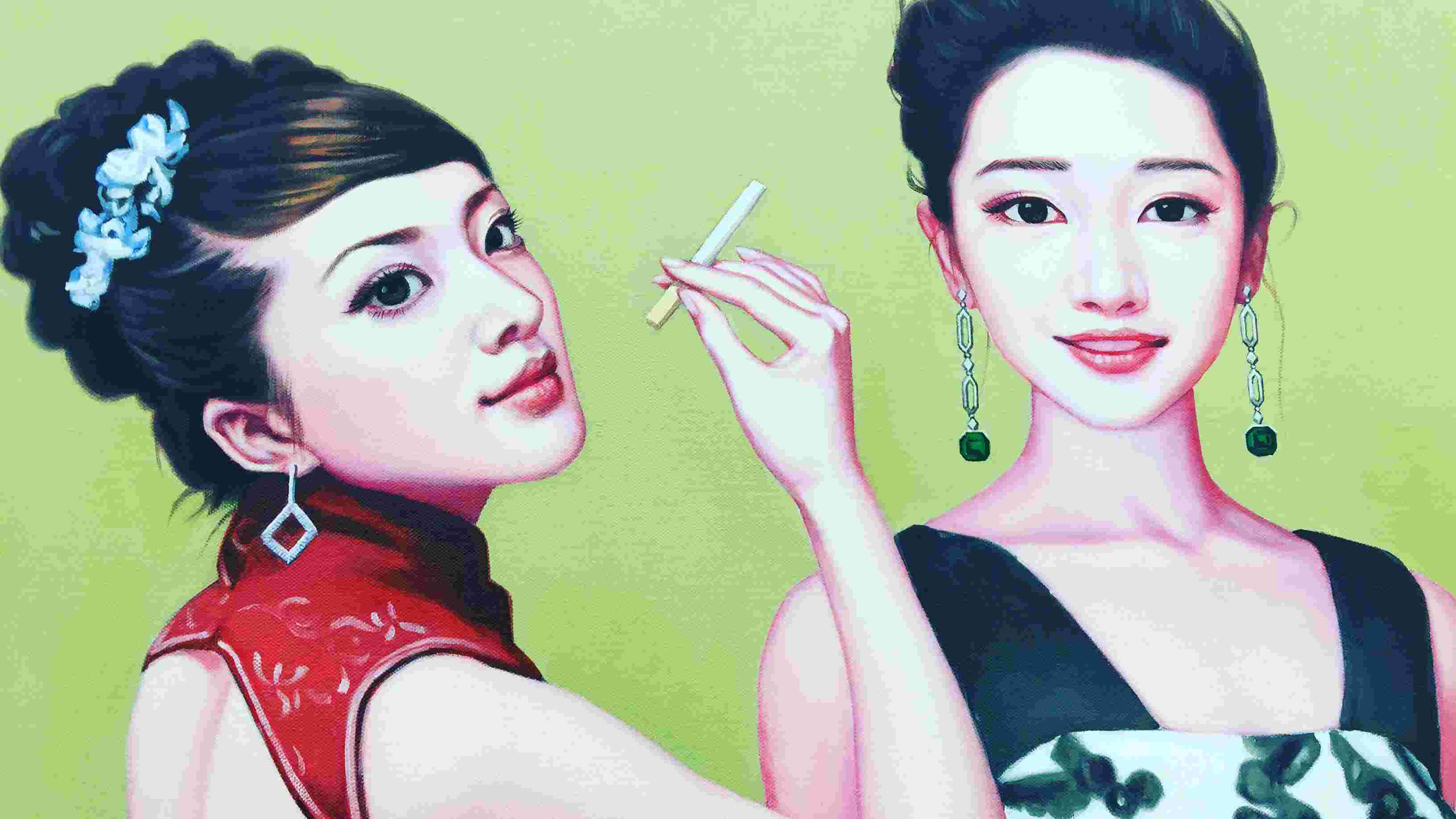

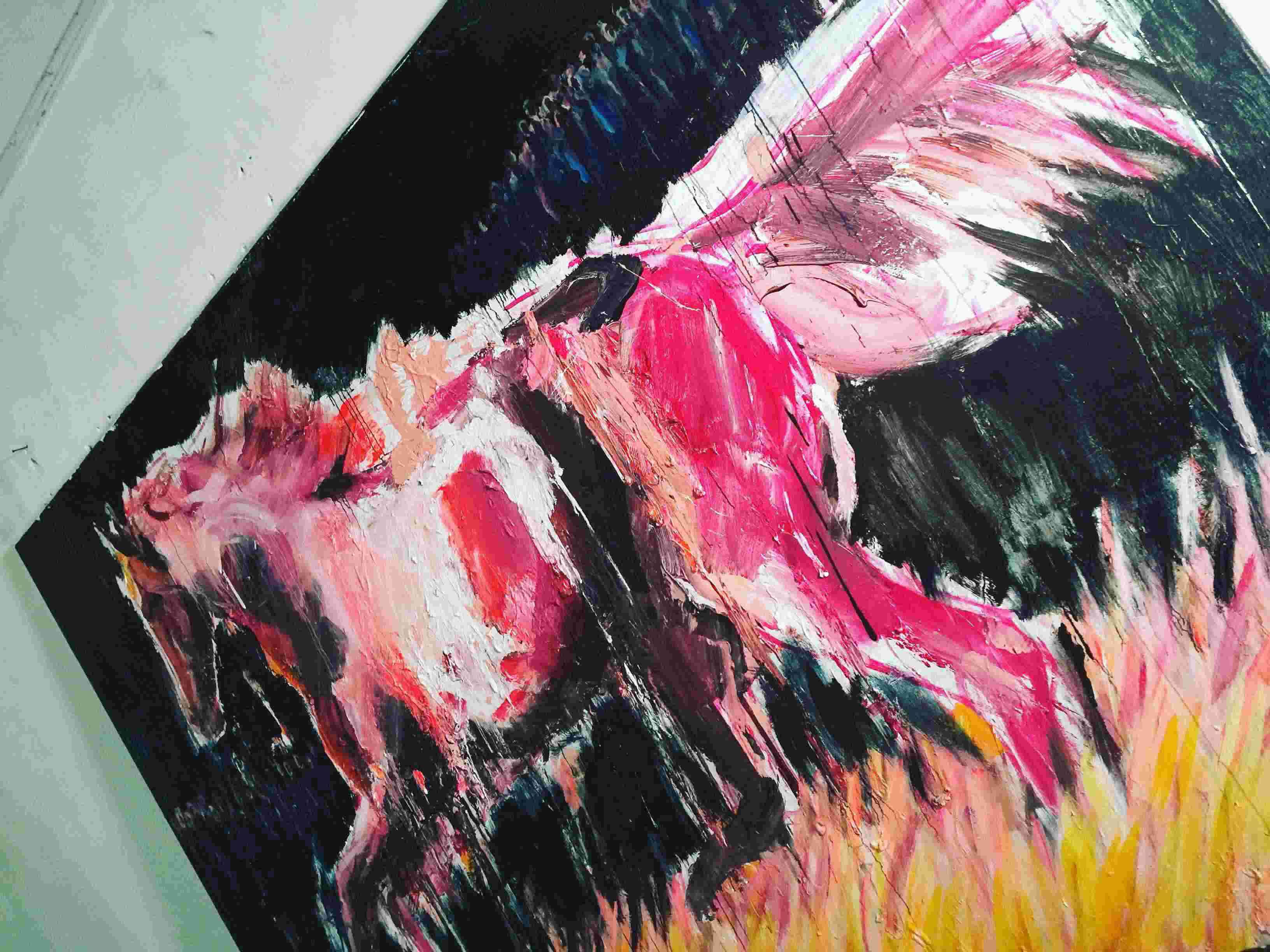

Work by Chinese artist Cui Guotai

Work by Chinese artist Cui Guotai

They seek to deliver returns through the appreciation and ultimate sale of their underlying assets, which includes paintings, sculpture, photography, video or print.

If you can’t quite afford a Matisse, Monet, Picasso or Rembrandt, you might want to consider investing in such a fund to borrow an artwork by a maestro and hang it in your office or home.

(courtesy of Hihey.com)

(courtesy of Hihey.com)

Art investment funds have fared well in poor economic climates and the art markets in general, and often manage to outperform the stock market in times of recession.

According to Deloitte and ArtTactic, globally there were 54 art investment funds in operation in 2015, of which 34 were Chinese and 20 from the US or Europe. The overall art fund market in 2015 is conservatively estimated at $1.20 billion, with China taking up $652 million of the business.

Work by Chinese artist Cui Guotai

Work by Chinese artist Cui Guotai

But they can carry a high price tag. London's The Fine Art Fund Group, the largest player in the market, with more than $500 million in assets under contract, requires a minimum investment of $500,000 to $1 million.

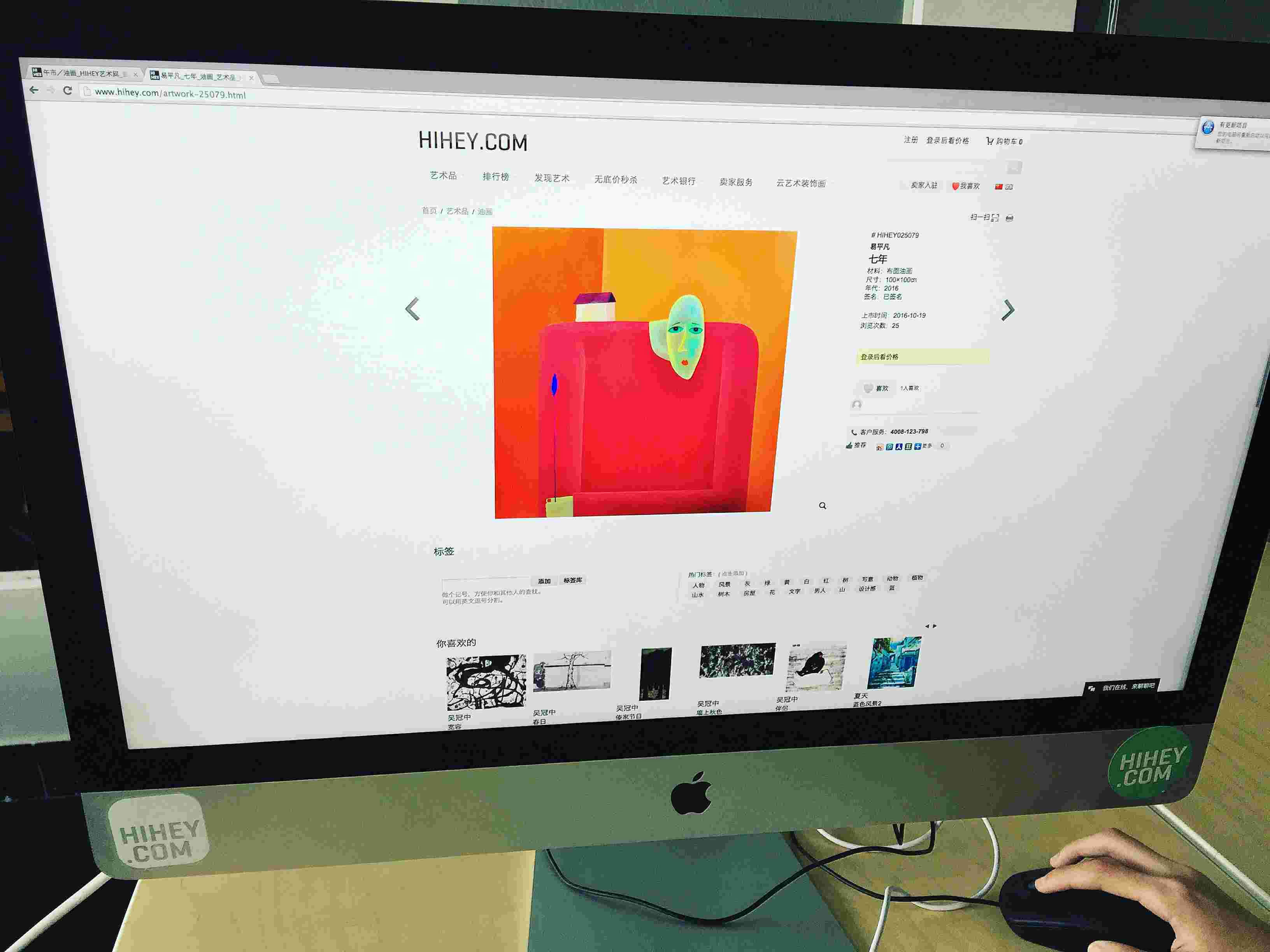

Putting a price on art

Putting a price on art

In China, the investment fund activity has increasingly come under the radar of government scrutiny, which imposed new art market regulation in January 2016, aiming at standardizing the domestic art market, better artwork operations and commercial exhibitions, and regulate trading behavior. It stipulates that selling artwork via online trading platforms is also subject to these new rules.

This article is part of 'Brush Hour" Air time: Jan. 2-6, 1600 BJT (0800 GMT) and 2115 BJT (1515 GMT)

Show: Global Business on China Global Television Network (CGTN)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3