08:15, 20-May-2018

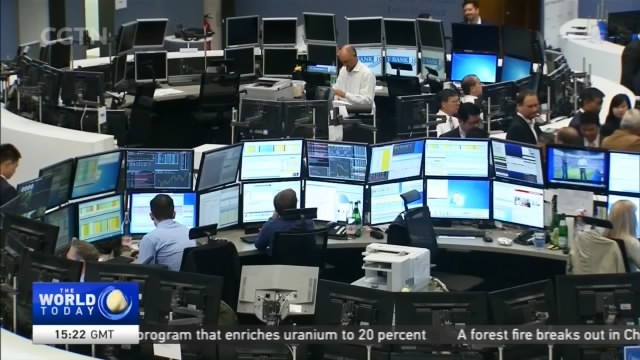

China Opening-Up: A-Share companies soon to be listed by MSCI

01:49

US index publisher MSCI says it will be including over 200 companies on its list of global companies. CGTN's Timothy Ulrich has more.

234, that's the number of Chinese A-share companies MSCI said will be put on its global and regional indexes on June 1st, following a review. The decision is exciting many business leaders.

WU JIAJUN MACQUARIE SECURITIES "Many foreign investors have been paying growing attention to A-shares through Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect."

Foreign investors have already started increasing their holdings of Chinese stocks ahead of the decision. Data shows that in April, 40 billion yuan of A-share stocks were traded using connect programs that link the Hong Kong, Shanghai, and Shenzhen stock markets.

BAI REN, EXECUTIVE DIRECTOR BOCI SECURITIES "This is a milestone in the opening up of China's capital markets. Global investors have to focus more on A-shares in the future."

The list consists mostly of blue-chip stocks, with the majority of companies in the financial, consumer and medical sectors. Being put on the list will expand China's financial market access to the world.

FAN WENZHONG INT'L DEPT., CHINA BANKING & INSURANCE REGULATORY COMMISSION "China banking and insurance regulatory commission will get rid of the limit of foreign capital shares in domestic banks and asset management companies. This year we will see more cases of foreign institutions investing and doing business in China."

China recently announced a series of liberalizing policies, including higher daily quotas for the stock connect programs, and allowing foreign brokers to hold a majority stake in securities joint ventures.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3