Business

12:07, 21-Dec-2017

Republicans banking that tax bill be hit among voters

By Roee Ruttenberg

After a rocky start and many closed door meetings, US Republicans have united on a sweeping plan to reform America's tax code. The Senate passed the package by a slim, party-line vote after midnight and the House of Representatives followed up with final approval later on Wednesday.

In passing the bill, Republicans are taking a big gamble that the American public will support it.

Several polls released in the days leading up to the vote showed that the majority of Americans opposed the legislation. The bill has been largely unpopular among Democrats, whose support Republican lawmakers and indeed the President weren't really counting on anyway. On the Republican side, conservatives, in general, support tax reform. But some were turned off by the bill's price tag, which according to the non-partisan Congressional Budget Office would add 1.5 trillion dollars to the federal deficit.

Lawmakers say the American people will quickly get behind the reforms once they see the savings in their paychecks. That could happen, they say, as soon as February.

"If we can't sell this to the American people we ought to go into another line of work," said Mitch McConnell, the Senate Majority leader. "I think there's an important accomplishment for the country that people will value and appreciate. But obviously it requires a continued discussion with the American people and we're all going to be doing that all through the year."

US President Donald Trump, surrounded by with Republican lawmakers, speaks during a ceremony celebrating the vote for the tax bill. /VCG Photo

US President Donald Trump, surrounded by with Republican lawmakers, speaks during a ceremony celebrating the vote for the tax bill. /VCG Photo

The bill will become law once President Donald Trump signs it.

Naturally, there are winners and losers. The Trump administration says American workers will benefit. It concedes that some will see their overall tax rate go down, others will see it go up. But without a doubt, the big cuts in this bill are for corporations. The corporate tax rate will go down from 35 percent to 21 percent. Republicans hope that will be good for business. They predict it will ultimately bring back American multinationals – and their tax revenues – that have gone abroad. Some argue that could have international consequences.

"My guess is that as American companies do better – being that the big companies that do most of the business here in the US are very global – they will actually invest a fair amount of that money around the world, not just in the US," said Max Wolff, chief economist at the Phoenix Group. "That being said, it gives the American corporations a bit of a home field advantage in the US against other companies. And we've seen the EU and others begin to talk about whether or not this particular process that was followed – hasty and very self-referential – might be a violation of certain WTO provisions."

They believe those gains will eventually trickle down to the rest of the economy. Top Democrats reject that approach, saying that it has failed before.

"There is no reason for a single middle-class family to pay more, while every single corporation pays less," said Charles Schumer, the Senate Minority leader, speaking on the chamber floor. "If you want to help the middle class, give them a real tax break. The rich get far more dollars back than the middle class. That is fact, irrefutable fact."

The vote in both the House and the Senate was split along party lines. Still, Republicans are claiming this as a win. And for President Trump, it's a significant win. He and Republicans have struggled to pass significant legislation this year. They fumbled on healthcare, they fumbled on immigration. The president really needed a congressional win in 2017, something he and Republicans can carry into next year as they campaign ahead of the midterm elections.

CGTN Photo

CGTN Photo

Democrats complained that they were shut out of the process. They say it was rushed through, and they're banking on a backlash.

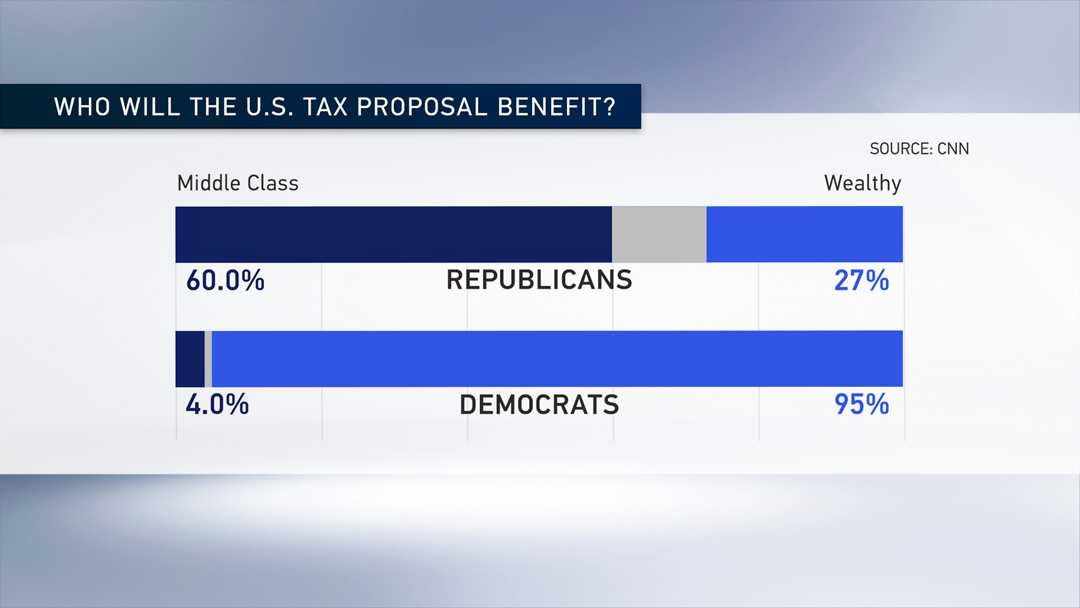

According to a CNN poll, 60 percent of Republicans said they believe the tax plan will benefit middle-income families over the wealthy. But 95 percent of Democrats say the exact opposite. Republicans seeking re-election next year will face tough questions if those families don't see the gains before they go and vote in November.

11158km

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3