Business

20:30, 15-Mar-2018

Ringgit appreciation cheered on by Malaysians

CGTN's Rian Maelzer

It’s been three full years since Malaysia’s government implemented a new tax on goods and services, triggering three solid years of complaining by Malaysian consumers.

For many Malaysian merchants, the tax was a convenient excuse to raise prices, often higher than the six-percent levy.

Further kindling Malaysians’ dissatisfaction, the country’s currency, the ringgit, depreciated against the US dollar to levels not seen since the darkest days of the 1997-98 Asian financial crisis, pushing up the price of imported goods.

If Malaysians had cause for complaint, the millions of foreigners from poorer neighboring countries who work in the country felt the pain even more acutely.

CGTN Photo

CGTN Photo

“When I first came here, I used to be able to send home 27,000 Bangladeshi taka (about 330 US dollars) a month. It was enough to see to all my families’ needs without any problem. But now, even though I earn more, I can only send home about 17,000. Should I bother to stay?" pondered Md. Joshim Shoder, a Bangladeshi restaurant worker last year.

Economists point to several factors behind the fall: the low prices of commodities that Malaysia exports, especially oil, the US interest rate policy and the multi-billion dollar corruption scandal involving the state investment firm 1MDB.

Economists universally felt the ringgit was undervalued given the country’s economic fundamentals and strong growth of close to six percent.

Since the tail end of last year, though, the ringgit has rebounded sharply, rising as much as 13 percent against the US dollar as one of Asia’s best performing currencies.

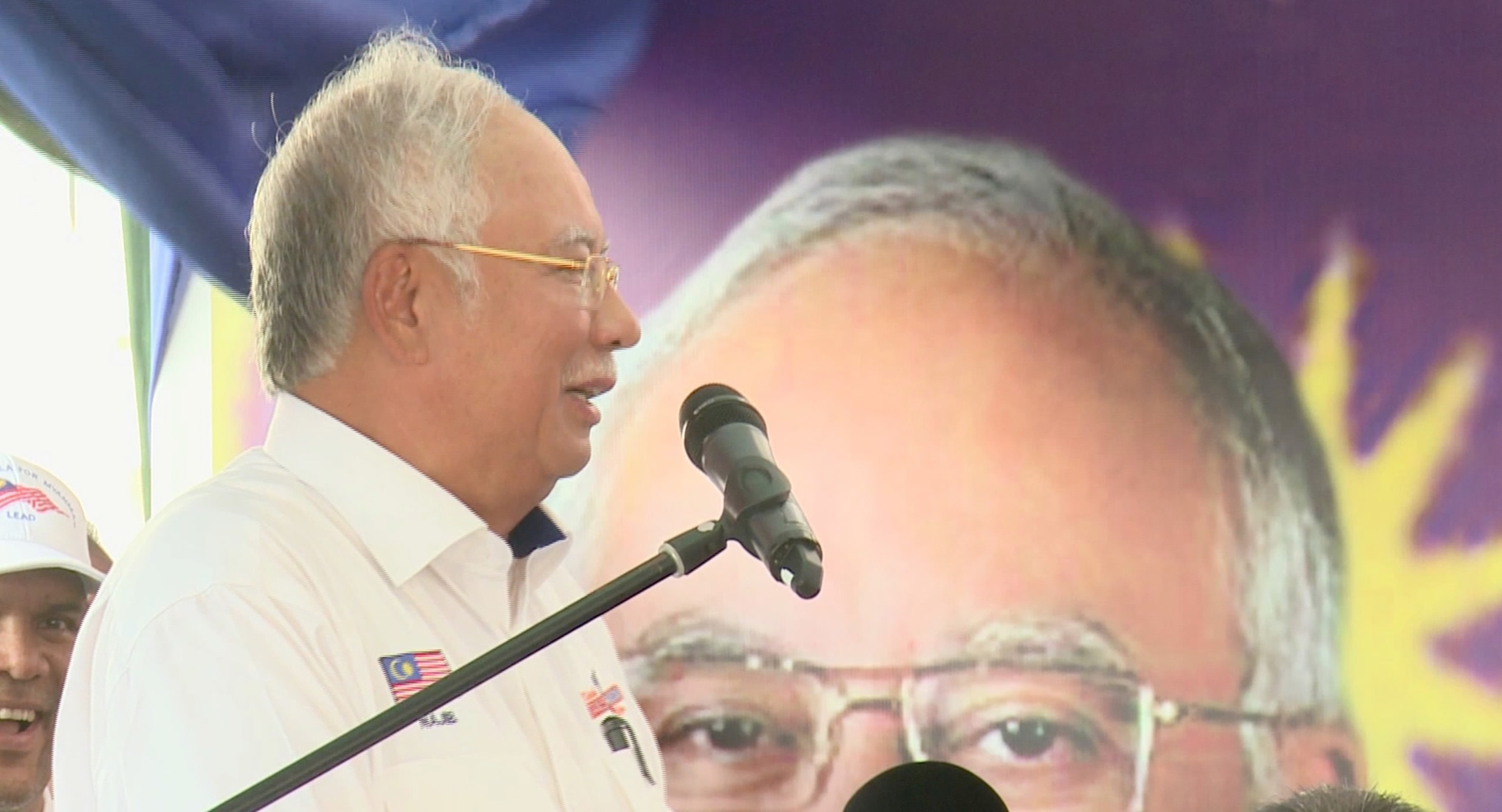

Malaysians will cheer the news. And so will the ruling Barisan Nasional alliance, with Prime Minister Najib Razak expected to call an election within weeks. It bolsters his arguments that the economy is on the right track, despite opposition claims that the country is on the verge of bankruptcy.

CGTN Photo

CGTN Photo

But Malaysia remains heavily reliant on exports and a strong ringgit is not great news for the country’s exporters such as its furniture makers, semiconductor industry and rubber glove manufacturers, whose sales are denominated in US dollars.

Malaysia produces more than 60 percent of the world’s natural latex and synthetic or nitrile gloves.

“Of course all exporters in Malaysia would enjoy a strong US dollar,” says Denis Low Jau Foo, president of the Malaysian Rubber Glove Manufacturers Association. “But this industry is run by entrepreneurs, and they are a very mature lot. They know how to anticipate that the US dollar is going up and down. We have seen all kinds of headwinds. To remain as number one in the world you have to be that anticipatory. You must read the situation well enough.”

The rubber glove industry also has a natural currency hedge. Half its costs are raw materials, and half its raw materials are imported and paid for in the now cheaper dollar.

It also has to be remembered that the weaker dollar is in fact a reflection of the US’s stronger economic performance, and a generally positive global outlook, which should translate into high sales for Malaysia’s exporters down the road.

And there are many businesses that will benefit from the stronger dollar.

“It's like a double-edged sword,” says Afzanizam Abdul Rashid, chief economist for Bank Islam Malaysia.

“If the ringgit continues to appreciate obviously importers will benefit because their import costs will be much lower especially those in automotive sectors or even food sectors. Companies with US dollar debts and the aviation sector, especially for the outbound tourism” also stand to gain.

Foreign workers will be hugely relieved as they see the value of the money they send home each month rise again.

Afzanizam and others believe the ringgit is still short of its fair value.

“If the market is convinced the rate hike in the US is going to be gradual, if the trade protectionist policies may not happen in a big way, and oil prices continue to stabilize slightly about 60 dollars (a barrel), I think there’s a hope that the ringgit could appreciate further”.

It’s a hope the government, Malaysian consumers and migrant workers will share.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3