Business

08:23, 24-Nov-2017

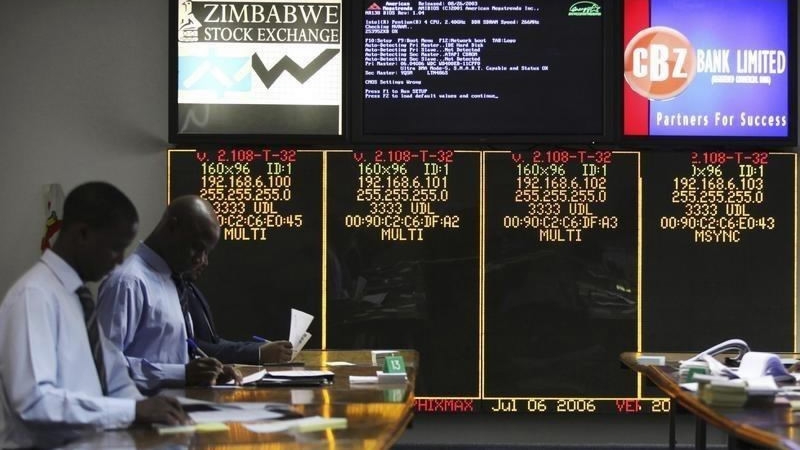

Zimbabwe bourse loses $6 billion shedding 40 percent value after military takeover

CGTN

Zimbabwe’s stock market has shed 6 billion US dollars while its main index has slumped 40 percent since last Wednesday when the military seized power leading to the fall of Robert Mugabe, stock exchange data showed on Thursday.

The main industrial index was at 315.12 points compared with 527.27 points on Wednesday last week when the military announced its takeover and put former president Mugabe under house arrest. On Thursday the index fell 4.4 percent.

The Zimbabwe Stock Exchange had been on a rapid rise in the last two months, driven by investors seeking a safe haven for their investment amid fears of a return to hyperinflation in an economy suffering acute shortages of foreign exchange.

But analysts said the market had entered a period of correction on investor optimism of a change in economic policy in a post-Mugabe era.

Market capitalization was 9 billion US dollars, down from 15 billion US dollars last week, bourse data showed.

On the currency front, black market rates for buying cash dollars softened further on Thursday.

Buying 100 US dollars using electronic transfer cost 150 US dollars, down from 180 dollars last week. Some black market traders said they were not buying dollars at all, anticipating further softening of rates.

Zimbabwe adopted the US dollar in 2009, along with Britain’s pound and the South African rand, to tame inflation that topped out at 500 billion percent.

“The market is adjusting back to reality,” an analyst at a Harare-based asset management company said.

“The gains that we had seen were being fueled by an outlook of a return to hyperinflation, continued isolation of Zimbabwe by international lenders as well as a depressed economic outlook.”

Source(s): Reuters

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3