Business

21:28, 06-Apr-2018

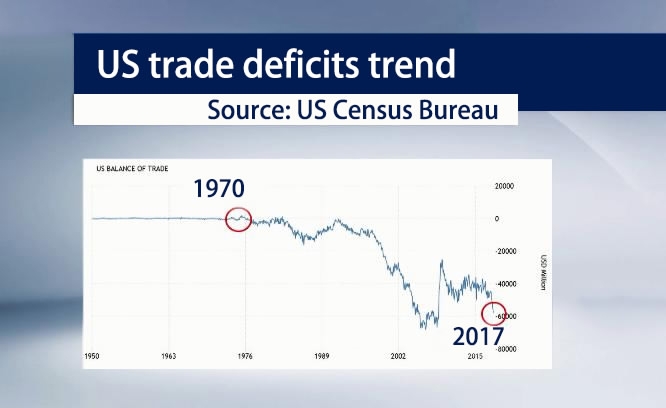

US trade deficits and savings rate are inversely correlated

CGTN

Trump loves to blame China and trade deals as the major source of the trade deficits. But the US makes its own bed, when the country has been living beyond its means for decades.

US household consumption expenditure in 1970 was 666 billion US dollars, and this figure had soared to 13.7 trillion US dollars by 2017, accounting for nearly 70 percent of GDP, according to figures from the World Bank and the Federal Reserve.

Although the US population accounts for only 4.4 percent of the world, it consumes 22 percent of the world's goods. On the one hand, more and more money is being spent; on the other hand, less and less money is saved. In the United States, household deposits accounted for 13 percent of GDP in 1970 and only 2.6 percent in 2017.

CGTN Photo

CGTN Photo

The trend of the US trade surplus also terminated in 1970, official data showed. Since then, the US has barely experienced a surplus, and the deficit has increased year by year until it reached 568 billion US dollars in 2017.

CGTN Photo

CGTN Photo

The quantitative study of Professor Stephen Roach at Yale University further revealed the inverse correlation between the national savings rate and the trade deficit.

CGTN Photo

CGTN Photo

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3