Business

11:53, 26-Jan-2018

Sources: China's Kuaishou in $1 billion Tencent-led funding round, eyes IPO

CGTN

Chinese live-video streaming start-up Kuaishou, backed by Tencent, is nearing the close of a 1-billion-dollar funding round led by the tech giant and plans to list as soon as this year, people familiar with the matter said.

The latest funding round values Kuaishou at about 18 billion US dollars and has attracted venture capital firm Sequoia Capital China, among other investors, the people said. It is expected to close in the coming weeks, they said.

The fundraising comes as Kuaishou is considering an initial public offering (IPO) as soon as the second half of this year, according to one of the people. It prefers to list in Hong Kong, the person said, adding the IPO plan has not been finalized.

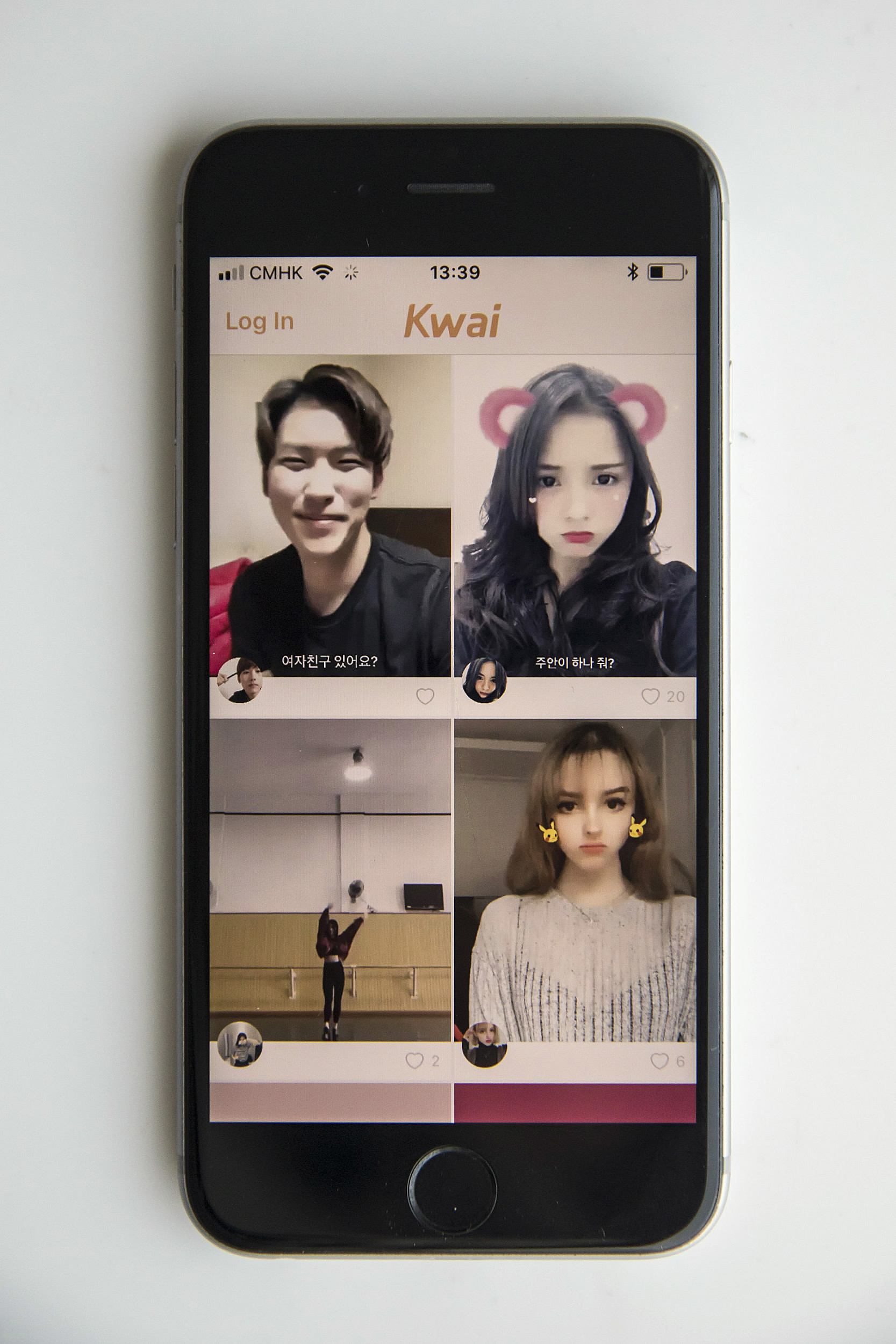

Beijing Kwai Technology Co.'s app Kuaishou, or Kwai, is arranged for a photograph on a smartphone in Hong Kong, China, on Tuesday, Jan. 16, 2018. /VCG Photo

Beijing Kwai Technology Co.'s app Kuaishou, or Kwai, is arranged for a photograph on a smartphone in Hong Kong, China, on Tuesday, Jan. 16, 2018. /VCG Photo

Seven-year-old Kuaishou, meaning “fast hand” in Chinese, is boosting its firepower as live streaming in China has seen rapid growth, attracting a rush of investment led by tech heavyweights Tencent, Alibaba Group Holding and Baidu Inc. The tech firms expect live streaming to boost their existing offerings in e-commerce, social networking and gaming.

The live streaming sector, which barely existed in China three years ago, produced revenues of more than 30 billion yuan (4.74 billion US dollars) in 2016. According to an estimate by investment bank China Renaissance Securities, it is set to more than triple that by 2020. That puts it on track to overtake cinema box office receipts in a few years’ time.

Kuaishou was China’s most popular short video streaming application with over 20 percent market share, according to a December report by Chinese data provider Jiguang. It currently has more than 100 million monthly active users and plans to more than triple the number in 2018, said one of the people.

The start-up also looks to expand its footprint in overseas markets, which account for less than 5 percent of its business, in particular in Southeast Asia, said another person. The majority of the proceeds raised will be used to finance its future outbound investment and deals, the person said.

Kuaishou’s likely preference for Hong Kong as a destination for any IPO comes after recent technology listings in the region have fared well, boosting its appeal as a venue for such floats.

The region’s exchange operator also plans to publish new listing rules for companies with dual-class shares as early as in June, a powerful attraction for technology companies to list in the region.

Source(s): Reuters

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3